The last few days have been volatile, but there are some things that are value right now, regardless of any short-term market moves. Large airline stocks would be a good example. They have been hit hard in recent months as the delta variant of Covid has delayed the recovery of international travel, but if there is one thing a 2-year chart for a major stock index makes clear, it is that human and economic resilience can beat even a pandemic, and that we will bounce back.

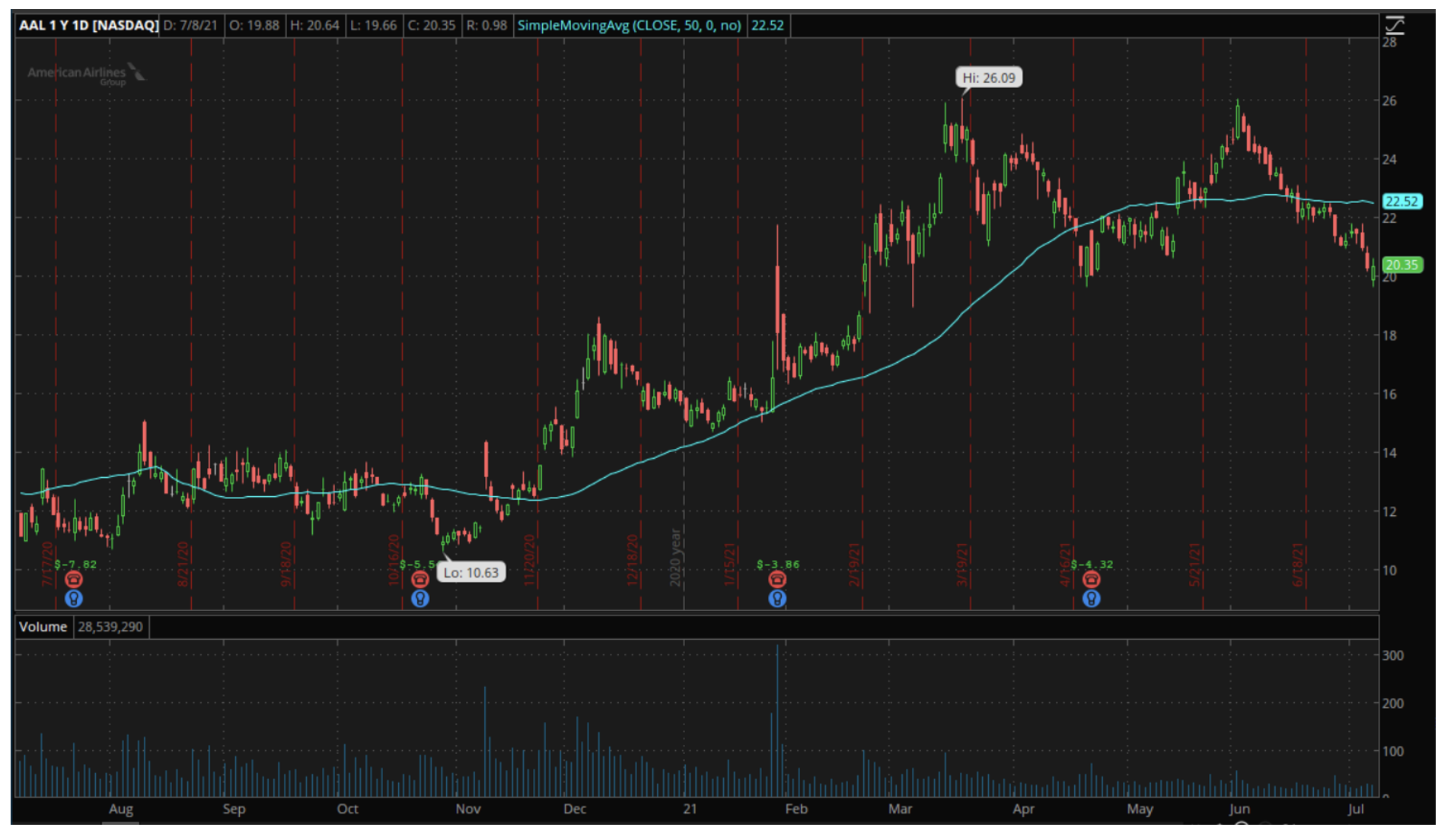

The long-term case for stocks like American Airlines (AAL) and Delta (DAL) is therefore clear, but there is also a short-term argument for owning them, which I should point out, I do. I am long AAL right now and will probably add to that position over the next couple of weeks before the company’s earnings release on July 22. The reason for that is a combination of anecdotal evidence and simple logic.

Last weekend, I took my first post-covid commercial flight. It was a holiday weekend, so I was not surprised that the flight was full, but I was surprised to be told in a conversation with a flight attendant that that is an increasingly common thing. The numbers suggest it shouldn’t be, as domestic passenger volume, while it has recovered strongly, is still down around 26% from pre-covid levels, with the number of flights down only around 21%. Those data, however, are for a couple of months ago. Things have been moving faster since then, with more people flying on fewer flights, and with airlines combining flights to maximize loads.

As a result, there is reason to believe that not only will earnings for last quarter be better than anticipated, but also that they will show a skew towards the end of the quarter that results in a relatively positive outlook. That should be enough to give stocks like AAL and DAL a boost that provides a higher launch point for the gains that will come when international travel begins to recover.

Of course, it isn’t quite that simple; there are risks and potential pitfalls. The delta variant could prove to be the disease that confounds human ingenuity and science, I suppose, but that hasn’t happened yet in human existence and if it does, what stocks you own will be the least of your worries.

Then there are more practical risks. There is a pilot shortage among airlines right now that will necessitate some expenditure to rectify, and if passenger numbers don’t recover quickly enough, that will create some cash flow problems that may lead to another capital raise. Those risks, however, are well known and pretty much priced in at this point. AAL, for example, has a forward P/E of only around 7, way below average, but they have enough cash on hand to survive about a year and a half of losses at last quarter’s rate. Assuming that negative cash flow declines, which the evidence indicates will happen, that will be more than enough and AAL at around $20 will prove to be incredibly cheap.

Ultimately, though, this is a play on the fact that markets tend to overreact to headlines, just as people do. The delta variant proves that viruses can be unpredictable and hard to defeat, but the fact that humankind has been living with and progressing despite various strains of the flu and other viruses for centuries shows that even if we have to live with this one to some extent, the global economy will continue to expand and airlines will, before too long, be profitable again.

Do you want more of Martin? If you are familiar with Martin’s work, you will know that he brings a unique perspective to markets and actionable ideas based on that perspective. In addition to writing here, Martin also writes a free weekly newsletter with in-depth analysis and trade ideas focused on just one long-time underperforming sector that is bouncing fast. To find out more and sign up for the free newsletter, just click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.