Coca-Cola (NYSE: KO) has been losing market share globally in the nonalcoholic ready-to-drink industry since the onset of the COVID-19 pandemic. As governments worldwide instituted lockdown measures and placed restrictions on businesses in response to the outbreak, restaurants, theme parks, sports stadiums, and movie theaters closed down. Unfortunately, those were also the places where people consumed soft beverages, including those made by Coca-Cola.

To make matters worse, the Atlanta-based beverage company actually commands a large market share -- larger than those of rivals PepsiCo (NASDAQ: PEP) and KeurigDrPepper (NASDAQ: KDP) -- at these outdoor venues, which meant a substantive loss in demand for the ubiquitous brand.

Fortunately, the global vaccination campaign against the coronavirus has been effective with COVID-19 infections trending down in regions having higher vaccination rates. With close to 2 billion doses already administered worldwide, there's still progress to be made, however there seems to be light visible at the end of the tunnel. Restrictions against in-person activities are being lowered and businesses are reopening, and this is good news for Coca-Cola.

As the world recovers from COVID-19, the soft drink maker should regain its market share.

Coca-Cola lost market share during the pandemic. Image source: Getty Images.

Can I get you a drink?

In the company's most recent earnings report that includes results till April 2, it reported losing market share. Here's what management noted on the matter in the earnings press release:

The company lost value share in total nonalcoholic ready-to-drink (NARTD) beverages as an underlying share gain in both at-home and away-from-home channels was more than offset by negative channel mix due to continued pressure in away-from-home channels, where the company has a strong share position.

In other words, people were consuming beverages at home more often, and Coca-Cola's competitive position is not as strong in that market as it is when people consume beverages outdoors. That's mainly due to its exclusivity agreements with several venue operators.

Coca-Cola has spent years building a strong portfolio of venues that offer its products exclusively and hence has a larger market share in the away-from-home market. As a result, when people leave their homes and consume beverages, there's a higher probability those beverages will be Coke products. So as COVID and starts going restaurants, theme parks, sports stadiums, and movie theaters more often, it will consume more Coca-Cola products.

Coca-Cola is poised to gain market share as economies reopen. Image source: Getty Images.

Investor takeaway

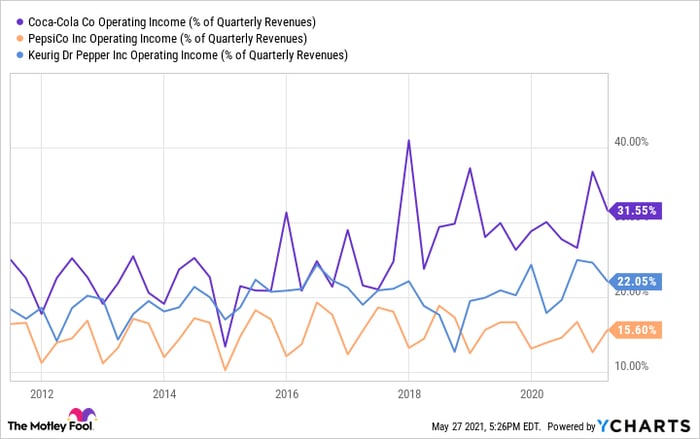

Importantly, beverages consumed outdoors are pricier. For example, a soda at a theme park can easily cost you $5 for a 20-ounce bottle while the same costs you less than $1 at the grocery store. That generates higher profits for providers like Coca-Cola. That's partly what's allowed Coca-Cola to maintain higher operating profit margins than competitors (see chart).

Data Source: YCharts

Coca-Cola's stock is trading at a reasonable forward-price-to-earnings-ratio of 25. It could be a good time for investors to consider adding Coca-Cola to their portfolios. The company will benefit as folks start going out more often. And its dominant position in the away-from-home market means it can maintain or raise prices without a significant risk of losing customers to competitors.

Investing in Coca-Cola will not triple your money in a year, but it can provide steady returns for the long run.

10 stocks we like better than Coca-Cola

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Coca-Cola wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of May 11, 2021

Parkev Tatevosian owns shares of Coca-Cola. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.