What happened

Fitness and health drink maker Celsius Holdings (NASDAQ: CELH) reported first-quarter 2021 results today that showed volume and sales growth has continued to accelerate. Investors cheered the report, sending shares up 14.5% as of 3 p.m. EDT.

So what

The Florida-based maker of drinks used by athletes and fitness buffs reported revenue in the first quarter jumped 78% over the year-ago quarter, led by sales growth in North America. Net income edged up 7% compared to the prior year period. The results follow a strong 2020, where full-year revenue grew 74% year over year, and it was announced the company would join the S&P SmallCap 600 index.

Image source: Getty Images.

Now what

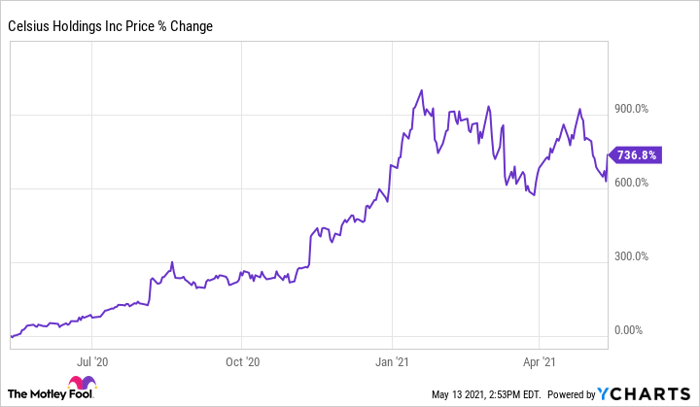

Sales in the company's U.S. home market more than doubled in the first quarter, making up almost 80% of total revenue. The growth Celsius has shown in the past year hasn't gone unnoticed by investors. Shares have soared more than 700% in the last 12 months.

Celsius said domestic growth was mostly driven by sales in traditional retail channels as it has expanded its list of retail and distribution partners. But the company also reported 33% sales growth in fitness channels, despite pandemic-related impacts that have reduced the use of gyms and fitness centers.

Growth stocks are typically priced with high valuations and Celsius is no exception, with a forward price-to-earnings ratio of over 400. But for those with a long time horizon, the company has proven its products have a good following.

10 stocks we like better than Celsius Holdings, Inc.

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Celsius Holdings, Inc. wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of May 11, 2021

Howard Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.