I am sure that in many ways, dealing rooms now are different places than they were when I made a living in them years ago. I would imagine they are quieter, with less open outcry trading and an almost total dependence on computers. Some things, however, will always persist in a trading environment, and one of them is a trader’s love for a position with no downside. Providing you don’t mind possibly tying up some capital for a while, that can be achieved by buying Apple (AAPL) in front of earnings next week.

Of course, I am not saying that Apple will definitely report spectacular results, beat expectations handily and post a huge, immediate gain on Wednesday. Words like “definitely” have very little use in trading, and none at all in prognosticating. However, both history and current conditions do suggest that a beat by the tech and manufacturing giant is far more likely than a miss.

For starters, Apple has beaten expectations in each of the last four quarters. Not big beats, but consistent beats, which is the normal state of affairs for a large company covered by a lot of analysts. You might expect that the more coverage there is of a company, the more diverse the views would be as to what the future holds, but that is rarely the case. Instead, it seems that Wall Street has a herd mentality in these situations, with a fairly tight, conservative, and very stable consensus view of the upcoming quarter’s results. When you add to that the fact that over 70% of companies beat EPS estimates on average every quarter, the chances of a beat in that situation are very good.

That is especially true right now. The overall mood has been gloomy for a while, with Covid-19 resurgent not just here in the U.S., but around the world. Even China, the first to get hit but also one of the first to seemingly get the virus under control, is back to using lockdowns to control outbreaks, which is being blamed for selling in this morning’s early action. As we have already seen, though, lockdowns aren’t an insurmountable impediment to Apple’s business. People in isolation turn to their phones and computers and Apple benefits from that, even if their physical stores are closed.

All well and good, but why say that buying AAPL can be a trade with no downside?

Well, for a trader to come to that conclusion, something about the position has to be changed. Usually in a dealing room, it is the actual direction of the trade.

Let's create an example.

Let’s say you are looking at support for a stock at the price of 20. The stock is on the way down and looks like it is going to test that level. When it drops to 40, you join in the selling, with a view to buying twice as much just above the support level, at 25. When you buy at 25, you also set a stop loss level at 15.

If you get to 25, you have a 15-point profit and a new position, with your worst-case scenario being a cut of the new position at or around 15 for a 10-point loss should the support not hold. You would potentially make money on the way down on your initial position, and on the way back up when you reversed. Your worst-case is a small profit overall. Your upside potential is therefore large, but your downside, if you get the initial move down right, is less than zero. (Of course, if you get the initial move wrong, you will lose a small amount, but that is just normal trading risk).

Ok, back to Apple.

What would be changed is not the direction of the trade, but its timeline.

If Apple misses expectations on Wednesday or issues pessimistic guidance, or says something else perceived as negative, your initial trade wouldn’t have worked out. The stock could react by heading lower, but then it just becomes a matter of waiting, and probably not that long.

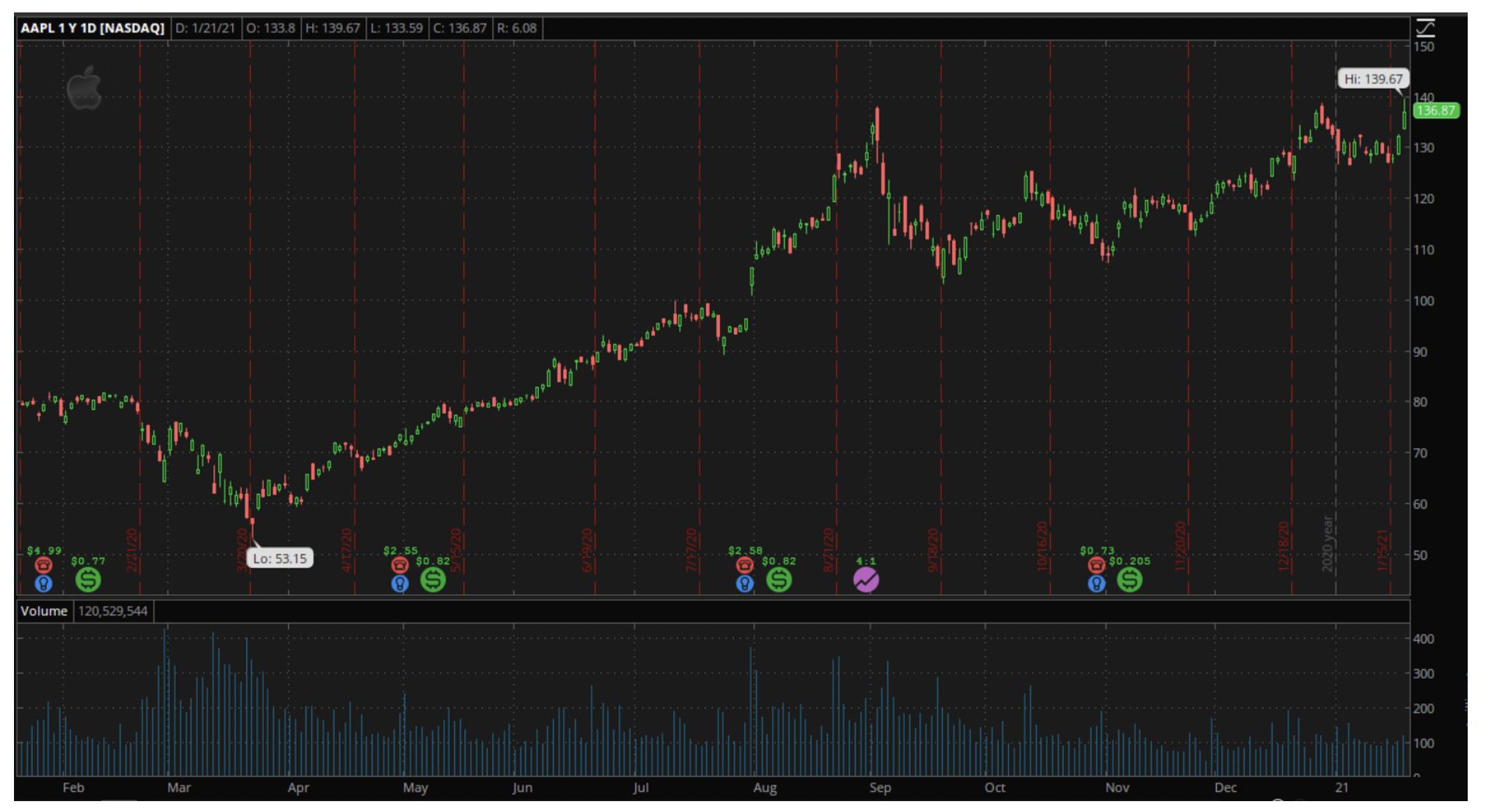

Last quarter, for example, lack of guidance was seen as a big negative, and AAPL lost around five percent over the next couple of days. That was regained within another two trading days though, and the stock is now more than 25% above its level before the “bad” earnings. Not too shabby.

As I have said before, Apple is one of the most successful companies in the world, if not the most successful. That doesn’t change with quarterly fluctuations, so buying the stock going into earnings gives you multiple ways of winning. AAPL could post big gains between now and Wednesday in anticipation of a beat, giving you room to offset even disappointing results. Or they could issue a positive report, causing a jump in the stock. Or, if all else fails, short-term losses are likely to be regained when the stock bounces back, as it always has to this point.

That sounds to me like a win-win-win trade, and that is the kind of trade I like.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.