What happened

Shares of AMC Entertainment Holdings (NYSE: AMC) fell hard in early trading on Monday because financial services company Credit Suisse downgraded the stock and sees significant downside due to the ongoing COVID-19 pandemic. As of 11:45 a.m. EDT today, the stock was up just under 1%, but it had been down 10% earlier in the session.

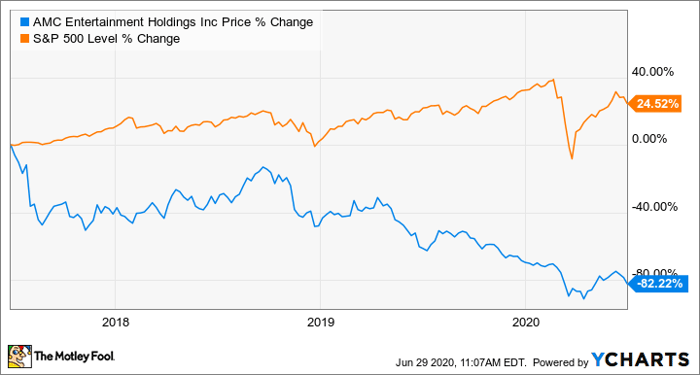

It's a continuation of a painful journey for AMC shareholders. Over the last three years, shares have lost more than 80% of their value, severely underperforming the market during that time.

So what

AMC has around 600 movie theaters in the U.S., all of which are closed because of the coronavirus. That's obviously been devastating for revenue. But the company is slated to reopen 450 locations on July 15, and the remaining theaters shortly thereafter.

COVID-19 closed movie theaters, so moving past that event should be a good thing. But Credit Suisse is looking at rising coronavirus cases in the U.S. as reason to be concerned. The risk is twofold. First, the coronavirus could spark fresh physical-distancing restrictions, and nonessential businesses (like movie theaters) could close. And second, if studios fear low attendance at theaters, movie releases may get delayed.

For its part, AMC was pushing to reopen before the release of what would be two blockbuster films under normal circumstances. Disney's Mulan was slated to drop July 24, while AT&T's WarnerMedia was set to release its film Tenet on July 31.

Now what

The releases for Mulan and Tenet have been delayed again, now to August. Therefore, Credit Suisse's point is well taken. It does appear the risk to movie theater stocks is rising. No business can indefinitely operate without income.

Without a clear end in sight for the coronavirus, investors should consider the risk to any business that depends on consumers getting out and about to spend discretionary income.

10 stocks we like better than AMC Entertainment Holdings

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and AMC Entertainment Holdings wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of June 2, 2020

Jon Quast has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Walt Disney and recommends the following options: long January 2021 $60 calls on Walt Disney and short July 2020 $115 calls on Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.