NVIDIA Corporation’s NVDA leadership in the data center computing market, fueled by significant investment in artificial intelligence (AI) infrastructure, provides a strong long-term advantage.

Yet, rival Advanced Micro Devices, Inc. AMD closely trails NVIDIA and could potentially close the gap with a next-generation innovation. In this context, let’s explore the better investment choice –

Reasons to Be Bullish on NVIDIA & AMD

DeepSeek’s claim that it can build large language models (LLM) at only $5.6 million disrupted the AI landscape. After all, it would only be a fraction of the amount that the top U.S. tech firms spend on computing power to manufacture their AI models.

DeepSeek’s cost-effective LLM development claim impacted NVIDIA, whose graphic processing units (GPUs) are crucial for the AI infrastructure buildout in the tech space. However, this won’t significantly affect NVIDIA as lower costs will drive more use of computing power, a boon for the magnificent-7 stock. Furthermore, NVIDIA has ample resources to shift to more cost-friendly products, enriching the AI ecosystem.

Despite DeepSeek’s low-cost model, the likes of Meta Platforms, Inc. META and Microsoft Corporation MSFT are spending billions on AI infrastructure, highlighting NVIDIA’s strong growth potential. NVIDIA’s cutting-edge Blackwell chips are gaining popularity among major tech players, boosting growth. These chips offer a quicker AI interface and better energy efficiency (read more: Buy NVIDIA Stock, DeepSeek's Threat is Exaggerated).

AMD, meanwhile, has immensely benefited from its strategy to focus more on the data center business and help clients implement AI. Last year was transformative for AMD, with annual data center revenues almost doubling due to increased adoption of its EPYC processor.

In the current year, AMD’s outlook is promising with its recent acquisitions of Silo AI and ZT Systems, which will help customers develop AI systems. Lest we forget, AMD is a front-runner in PC central processing units with a strong moat due to its know-how and x86 architecture license.

Why NVIDIA Is a Better Buy Than AMD Now

Both NVIDIA and AMD stocks show promising growth, but if you have to choose anyone, it has to be NVIDIA, hands down. This is because the industry has widely adopted NVIDIA’s CUDA software platform over AMD’s ROCm software platform. The CUDA X has given NVIDIA a strong competitive advantage, while the company’s dominant position in the expanding GPU space has created a wide moat.

Moreover, developers are likely to stick with CUDA due to the cumbersome infrastructure transitions, keeping AMD behind NVIDIA in the data center race for now. Talking about data center revenues, AMD’s $3.9 billion in the fourth quarter of 2024 pales next to NVIDIA’s $30.8 billion in the fiscal third quarter ending on Oct. 27. NVIDIA is set to report its fiscal fourth-quarter results on Feb. 26.

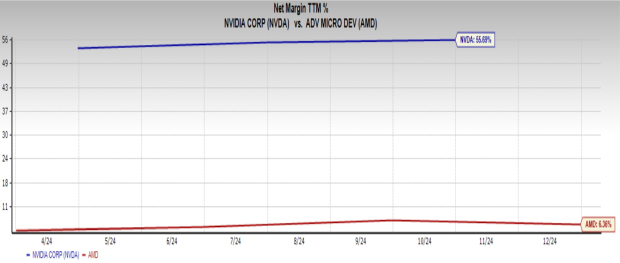

NVIDIA, anyhow, generates profits more efficiently than AMD. NVIDIA’s net profit margin of 55.7% is higher compared to AMD’s 6.4%, showing a high margin.

Image Source: Zacks Investment Research

NVIDIA, thus, rightfully has a Zacks Rank #2 (Buy). AMD carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpAdvanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.