- Many believe that deflation is imminent despite continuing infusions of mass amounts of money. This may be correct.

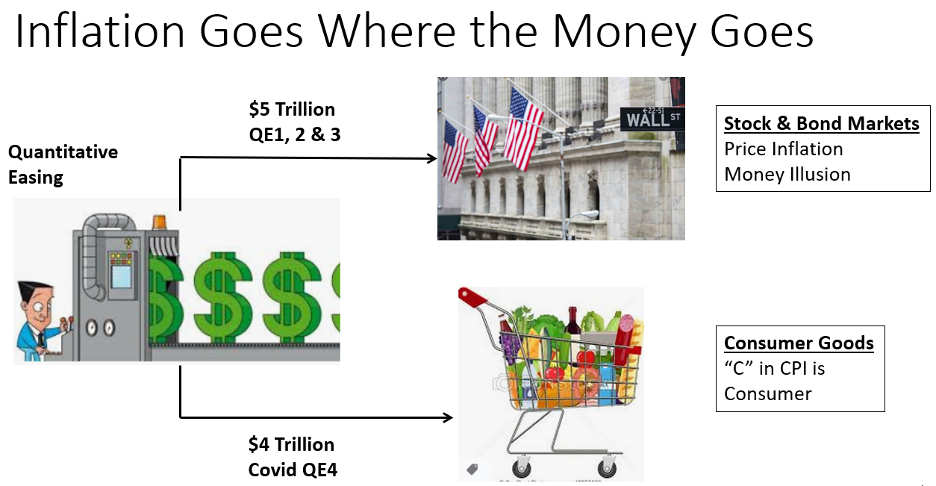

- We have had, and will continue to have, inflating stock and bond market bubbles fed by Quantitative Easing (QE). It’s a new kind of inflation

- We will also have old fashioned inflation driving up grocery and gas prices, increasing the CPI. This could take a year or two.

Despite the trillions in stimulus money being poured into the US economy, there has been no inflation. In fact many believe we are on a path to deflation, as explained in these articles:

- Ways to Prepare for Deflation | Personal Finance | US News

- Deflation, not inflation, is the main risk now - Investors' Corner

- On the road to deflation? | The Hill

- Japanification: Is Global Deflation Ahead? – Commercial Observer

Similarly, several articles explain that inflation has been subdued by a lack of velocity:

- What Does Money Velocity Tell Us about Low Inflation in the US - St. Louis Fed

- Will Record Low Velocity of Money Create Deflation or Stagflation? - Pinnacle Digest

- Money Growth, Money Velocity, and Inflation - thisMatter.com

- No, Higher Velocity Will Not Necessarily Mean Higher Inflation - Pragmatic Capitalism

In the following, we share our belief that serious inflation lies in our future, but we will probably see a little deflation first.

Deflation soon

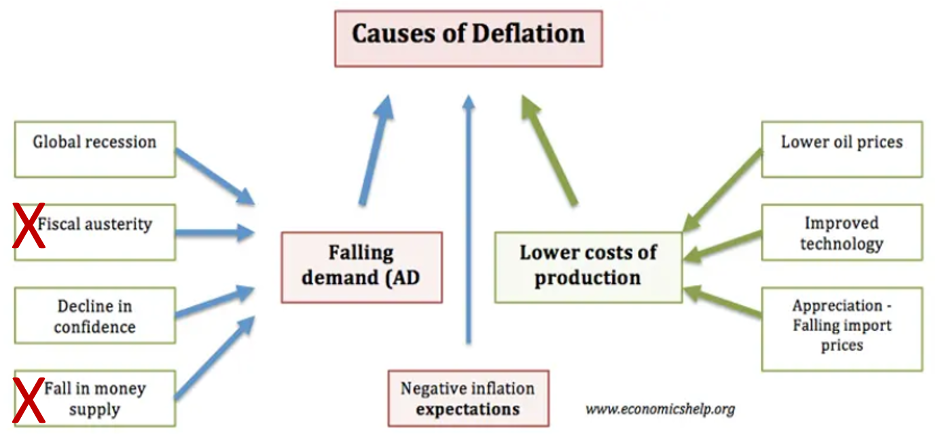

As shown in the following exhibit, decreases in the prices of goods and services, AKA deflation, can arise for several reasons:

As you can see, all but two causes – austerity and decrease in the money supply – are currently in play, so deflation is a real possibility. But we see several of these causes diminishing through time, giving way to inflationary forces:

- As the pandemic moves into the rearview mirror, the Global Recession will end, and Consumer Confidence will return.

- When this happens, Negative Inflation Expectations will morph into Positive Inflation Expectations

- Oil prices are not likely to remain low.

- Trade wars can reverse falling import prices

No one knows how long this transition from deflation to inflation will take, but we believe it will be less than two years. We also believe that we have had and will continue to have a special kind of insidious inflation.

Continuing inflation

We have had inflation since 2009, but it has not been in consumer prices. Rather the prices of stocks and bonds have been seriously inflated. Yes, the miracle of the 2010 decade is nothing other than stock and bond balloons filling up with $5 trillion in Quantitative Easing (QE) money. Explanations for the flatness in CPI correctly identify the absence of velocity in purchasing consumer goods and services but totally miss the real inflation. That will change with the latest round of pandemic-related stimulus.

New inflation

Much of the $3 trillion that the Fed has dropped from helicopters in Covid relief will be used to purchase groceries. Some of it will pay housing costs like mortgages and rents, and these payments will also find their way into the economy rather than the capital markets. The following picture explains why asset price inflation will continue and will be joined by consumer price inflation (CPI).

What to do

Asset price inflation will remain in stock and bond market bubbles until the Fed takes it out, which might be an awfully long time from now. In the fourth quarter of 2018 the Fed began a modest unprinting of QE money and the stock market reacted violently with a 15% decline, so now we know what deflating asset bubbles looks like. Investors can take heed and sell their stocks and bonds on any Fed announcements about reversing QE because the last one out the door will not have lights to turn off. (I expect to get a lot of comments on this statement.)

As for consumer price inflation, investors can protect themselves with inflation protected securities like Treasury Inflation-Protected Securities (TIPS), commodities, precious metals, and other “real” assets. Anecdotes abound of wealthy people hoarding physical gold; they might know something.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.