Toast (NYSE: TOST) is a restaurant technology company with products for processing payments, taking orders, and more. And one year from now, Toast stock is likely to be trading higher than it is today.

Revenue is growing at more than 20% annually, and management is demonstrating that it knows how to run a profitable business. Those two things are encouraging enough, but there's one more thing that makes me even more optimistic about the long-term prospects of this company.

Don't overlook this adoption trend with Toast

In the second quarter, around 8,000 new restaurant locations started using Toast's technology. Admittedly, the second quarter is usually a strong one for the company, but this was a record amount of net new locations. And it answers a major question that shareholders had.

In 2023, Toast launched a new fee that outraged customers, leading management to quickly reverse the decision. But there are other restaurant technology companies out there, and shareholders were left wondering whether Toast had misstepped and alienated users from its platform.

Given the record number of net new locations in Q2, it appears Toast didn't suffer too much reputational damage. That being the case, there's good reason to believe its growth rate could accelerate.

When Toast reaches 20% market share in a specific market, management calls this a flywheel market. It seems its existing customers become brand evangelists in those flywheel areas. Simply put, the company has noted stronger adoption rates, lower expenses, and consequently, higher profits, in flywheel markets.

In 2021, Toast had 20% or greater market share in only 5% of U.S. markets. In 2023, that jumped to 31% of U.S. markets. And it continues to climb in 2024, according to management.

The company only has 13% market share in the U.S. as a whole, but more and more markets are reaching a tipping point where taking more share gets easier.

Thinking about this from a big-picture perspective, Toast appears to be on a path to claiming a huge percentage of the overall restaurant space in the U.S., meaning the business could have many years of growth ahead of it.

More than just growth

For some time, I've been a believer in Toast's growth potential. I was a doubter when it came to its bottom line, but this company is proving me wrong in real time.

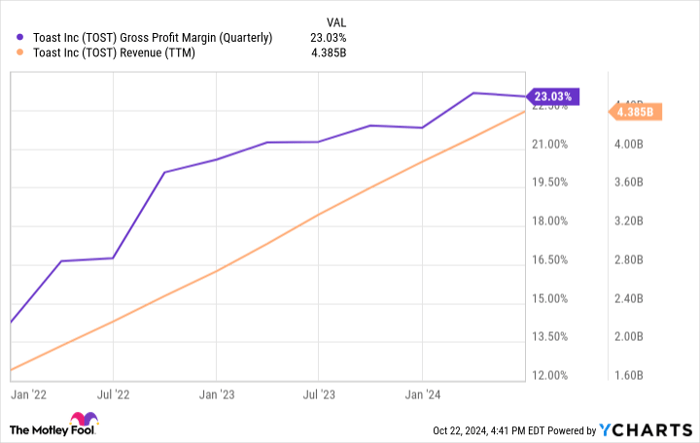

Toast provides hardware devices to customers at a gross loss, and payment processing is low margin. By contrast, its software subscription products are high margin. That's great, but it takes time for the software profits to get big enough to offset the losses elsewhere in the business. However, as this chart shows, Toast's gross profit margin is jumping higher recently as revenue soars.

Data by YCharts.

Further boosting operational efficiency is the aforementioned flywheel effect that helps Toast save on sales and marketing expenses.

So, on one hand, the improvement with Toast's profitability is a natural byproduct of its growth, and on the other hand, management is making other moves to help the bottom line as well. General and administrative (corporate) expenses were down a whopping 22% year over year in Q2.

With revenue growing, margins rising, and management exercising discipline, Toast just reported its first quarterly operating profit as a publicly-traded company. Its Q2 operating income of $5 million may be modest, but it's a step in the right direction.

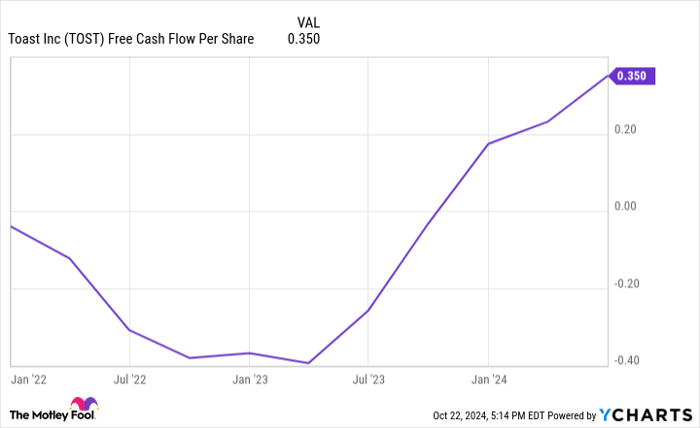

Toast's free cash flow per share is also climbing higher at an impressive rate as you can see below.

Data by YCharts.

Looking toward 2025 and beyond

With Toast, investors are presented with a profitable growth opportunity that could very well pick up more steam in the coming year. And looking at the stock, it trades at a reasonable valuation of less than 4 times sales. That sets shares up nicely for gains as business momentum gets going.

For those looking to buy Toast stock today, it may have upside potential over the next year, but there's something to keep in mind: It may take longer than a year to play out.

Research company Boston Consulting Group published a long-term study in 2006 that found that a company's valuation moved a stock price more than anything over a single year. But over three years, growth was the biggest factor for sending a stock higher.

Valuation is in large part driven by investor sentiment, and any number of things can impact sentiment both positively and negatively, making predictions difficult. Therefore, Toast stock might not rise over the next year if investor sentiment drops its valuation lower.

Fortunately, the valuation is already reasonable in this case. If growth continues over the next three or more years, patient Toast shareholders should be rewarded.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,154!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,777!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $406,992!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 21, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Toast. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.