SoundHound AI (NASDAQ: SOUN) has simply taken off in the past couple of years. Shares of the voice artificial intelligence (AI) solutions provider shot up a phenomenal 1,940% during this period thanks to the growing AI craze, an investment in the company by Nvidia, and solid results from the company in recent quarters.

So, if you bought just $100 worth of SoundHound AI stock two years ago, your investment would now be worth an impressive $2,000. The stock witnessed wild swings during this period, though it won't be surprising to see SoundHound sustaining its impressive run over the next couple of years as well.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Let's take a closer look at SoundHound's catalysts and determine if this fast-growing AI company could be primed for more upside over the next two years.

SoundHound AI is gaining credibility on Wall Street

SoundHound AI is a small company with a market cap of $7.5 billion as of this writing. Additionally, the company's financials tell us that it is currently in the early phases of its growth. For instance, SoundHound AI is on track to deliver revenue of $82 million to $85 million in 2024. The midpoint of the guidance would translate to an 82% year-over-year increase in SoundHound's top line, better than the 47% revenue growth that the company delivered last year.

This acceleration in growth that SoundHound is on track to deliver in 2024 clearly indicates that the company's voice AI solutions are gaining traction in the market. That's also evident from SoundHound's impressive customer base, which includes multiple restaurants and automakers. The company is adding new customers to its portfolio while also expanding its relationships with existing customers.

It is also looking to move into additional verticals to make the most of the fast-growing adoption of voice AI technology, driven by the recent acquisition of enterprise conversational AI solutions provider Amelia that will expand its presence in markets such as insurance, healthcare, retail, and financial services. These are probably the reasons why certain Wall Street analysts are turning bullish on SoundHound.

Dan Ives of Wedbush Securities raised his price target on SoundHound to $22 from $10 earlier this month, pointing out that it is an underappreciated AI stock that could win big in the long run thanks to the growing integration of voice AI solutions across multiple industries. Similarly, investment banking firm H.C. Wainwright raised its price target on SoundHound from $8 to $26, stating that its scalable platform should drive solid enough growth in the long run to help the stock justify its rich valuation.

These positive endorsements rubbed off positively on SoundHound's stock this month, with shares of the company up a remarkable 128% in December. However, there is one factor that may keep new investors from buying the stock -- the valuation. The stock's red-hot surge has brought its price-to-sales ratio to a whopping 93. That's extremely expensive when we consider that the S&P 500 index has a sales multiple of 3.11.

Outstanding growth could help this AI stock jump higher

SoundHound AI will have to keep delivering eye-popping growth quarter after quarter so that it can justify its rich valuation. The good part is that the company seems to have a solid enough pipeline that could help it generate robust long-term growth. Its cumulative subscriptions and bookings backlog doubled year over year in the third quarter of 2024.

This metric is a mix of SoundHound's committed customer contracts and the potential revenue that it expects to achieve from its current customers over a five-year period. SoundHound's cumulative subscriptions and bookings backlog stood at $723 million in the second quarter of 2024, with the metric doubling on a year-over-year basis. The company didnt reporta number for the third quarter as it is adjusting the metric to reflect the acquisition of Amelia, but it did point out on theearnings callthat the number doubled from the year-ago period.

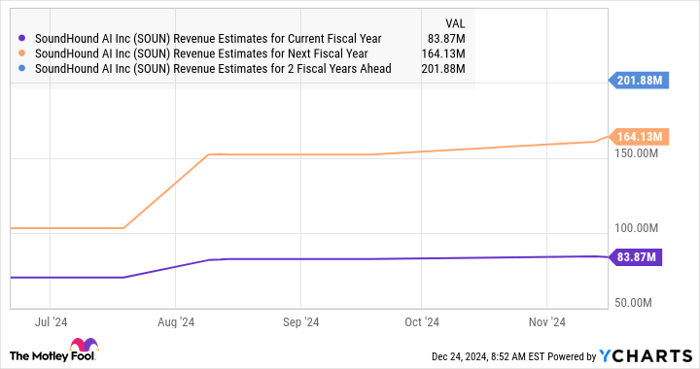

Even if SoundHound's backlog stood at $700 million at the end of the third quarter, it would be strong enough to help drive outstanding growth over the next couple of years. The company is expecting its top line to jump to $165 million in 2025 at the midpoint, which would be almost double this year's level and points toward further acceleration in its growth.

Meanwhile, analysts are expecting SoundHound's annual revenue to cross $200 million in 2026.

SOUN Revenue Estimates for Current Fiscal Year data by YCharts

Don't be surprised to see SoundHound exceeding that mark in 2026 as its estimated backlog of $700 million is big enough to help it deliver stronger growth than what analysts are expecting. If that's indeed the case, it won't be surprising to see SoundHound stock head higher over the next couple of years as well.

But investors who haven't bought this stock and are looking to jump onto the SoundHound bandwagon shouldn't miss the fact that it is expensively valued right now and would be prone to volatility. There are cheaper options to capitalize on the AI boom.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $859,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 23, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.