A lot has changed for Rivian (NASDAQ: RIVN) over the last five years. And there could be even more change to come over the next five years. Right now could be an incredible time to invest in this up-and-coming electric vehicle (EV) maker. Here are two major events to expect in the near future.

This major catalyst could happen very soon

It's no secret that manufacturing cars is a capital intensive business. It takes billions of dollars to design a vehicle, build the factory, produce the vehicles, and then market, sell, and ship them to consumers. Then there are warranty claims.

It also takes time. Tesla literally took decades to go from zero to the small handful of models it sells today. And there were times during the journey that it almost went bankrupt. When scaling up the production of its Model 3, for example, Musk said that the company was about a month away from bankruptcy.

So far, Rivian has avoided the capital trap that has forced countless automakers -- both electric and conventional -- into bankruptcy, and ultimately into irrelevancy. It launched its R1S and R1T models to great fanfare, earning Consumer Reports' highest customer satisfaction rating of any automaker.

And it has earned the backing of major investors including Amazon. But Rivian's time is still limited. It's losing around $33,000 for every vehicle it sells. And that's while it tries to spend billions of dollars on manufacturing capacity for new models aimed at the mass market.

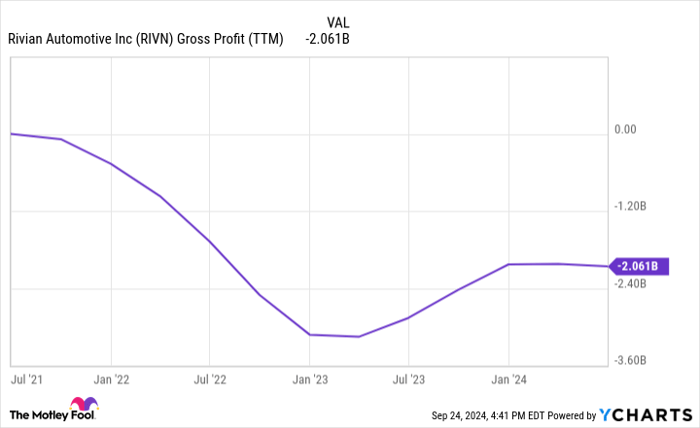

The challenge of finite capital and mounting losses has surely kept a lid on Rivian's valuation. But those fears could ease significantly in the next quarter or two. In a recent shareholder letter, management said to expect "a modest gross profit" by the end of the year. That would represent a step change in the company's financial position.

Even if the timeline is stretched another few months, achieving positive gross profits should have a sizable impact on the share price, especially given that the company has generated a $2 billion gross loss over the last 12 months.

RIVN gross profit (TTM); data by YCharts. TTM = trailing 12 months.

Expect big things when this milestone is reached

If Rivian achieves positive gross profits soon, its capital situation should improve dramatically. That's huge news for its largest potential catalyst over the next five years: the introduction of mass-market models.

Earlier this year, executive unveiled three new models: the R2, R3, and R3X. All three are expected to start at under $50,000. Just like the Model 3 and Model Y did for Tesla, these mass-market vehicles have the potential to increase Rivian's sales base by an order of magnitude.

The company still has around $6 billion in cash on its balance sheet, plus an $827 million incentive package from the State of Illinois to help ramp up its factory. Nonetheless, Rivian will likely need to tap debt and equity markets again to get these models on the road.

If it can get the R2, R3, and R3X to market, expect big things. The introduction of mass-market vehicles has made Tesla the company it is today. But this will require patience. The R2 isn't expected to be delivered until 2026 at the earliest, with the R3 and R3X hitting the road months later -- if not years later.

The biggest catalysts for Rivian over the next few years are clear. The company needs to achieve positive gross profit margins to help clear up concerns over financing. Then it needs to get its lower-cost models to market.

And if it can achieve all this without too much stock dilution, it's hard not to like Rivian's stock, which currently trades at a market capitalization around $12 billion.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.