If you've never heard of Nu Holdings (NYSE: NU), this could be your chance to buy into a growth superstar at a discount. While the company does face some challenges over the next three years, there's more than enough opportunity to make up for it. If you're willing to buy and hold, this could become a stellar investment.

Don't expect history to repeat itself

Nu is the perfect example of a fintech company. It's undoubtedly in the financial sector, as it makes money by offering financial services like credit and debit cards, insurance products, and even cryptocurrency trading. But it's also undoubtedly a technology company, offering all of these services directly to customers digitally.

Like most financial companies, Nu's potential addressable market is huge. Its customer base is essentially anyone who uses money. Because Nu is also a technology company, it can grow far faster than most traditional financial businesses. For example, when it first launched its cryptocurrency trading platform, it registered more than 1 million new users in its first month. That makes sense because the company already has more than 100 million users, and getting these users to try another financial product only requires a new smartphone notification to be pushed.

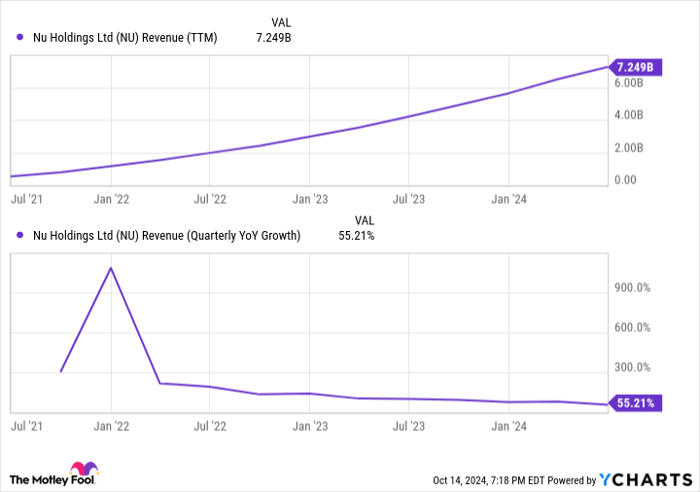

Due to the successful nature of its fintech business model, Nu has been able to grow sales tremendously since going public in 2021. Even though sales growth remains above 50% year over year, don't expect these high growth rates to last forever. The company operates exclusively in Latin America, and it has already entered the three countries -- Brazil, Colombia, and Mexico -- with the largest populations and highest GDP per capita rates. Nu has also performed so well that its penetration in these markets is already quite high. In Brazil, for example, more than half of all adults are now Nu customers.

In the future, don't expect Nu's sales growth to match its impressive history. However, there's good news: The company doesn't need to repeat history to be a compelling investment opportunity right now.

NU Revenue (TTM) data by YCharts.

Shares are incredibly cheap right now

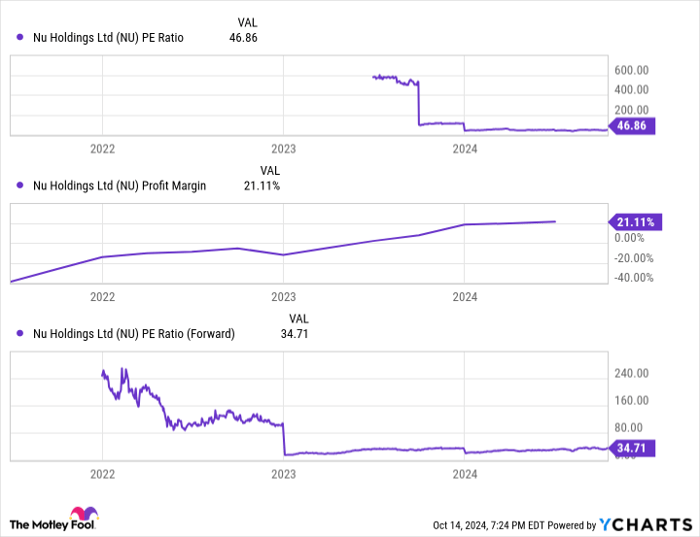

Last year, Nu became profitable for the first time. Now that it has scaled the business, expect profit growth to continue. Over the next five years, Wall Street analysts expect profits to grow by more than 50% per year. If that comes to pass, the company's premium 47 times earnings valuation should come down quickly. Based on next year's earnings, for instance, shares trade at just 35 times forward earnings. In another few years, today's valuation could ultimately look quite cheap.

NU PE Ratio data by YCharts.

Nu has the technology and reputation in place to continue its exciting growth journey over the next three years. And even if sales growth rates fall below historical norms, earnings growth rates will become the main driver of this story. Last quarter, the company generated a return on invested capital above 20% -- not bad for a business that only recently turned profitable.

Over the next few years, expect Nu to continue growing market share in its existing countries of operations, with a potential new addition or two should management deem the opportunity worth the investment. But the story with Nu right now is scaling profits -- something it already has an impressive track record of despite the limited timeframe. If you buy today, you're essentially betting that the current 47 times earnings valuation will soon look like a bargain. That's a reasonable bet, but it'll require patience to pull off.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.