The artisan's online marketplace named Etsy (NASDAQ: ETSY) is not a market darling these days. Its stock price is down 17% over the last year and 82% from the all-time highs of 2021. Etsy lost its key card to the S&P 500 (SNPINDEX: ^GSPC) club last month after a four-year tenure. Many Etsy bears think the stock can keep falling, too -- short interest in the stock has risen from 12% to 17% in the last year.

Are the bears on the right track, or is Etsy set up for a full recovery from this low point? Let's take a look.

Etsy's financial challenges

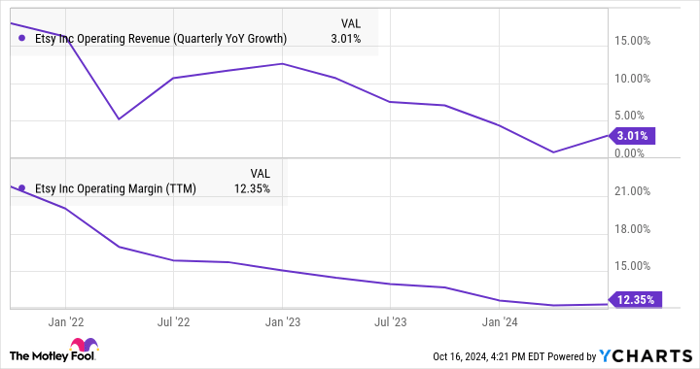

Etsy's critics worry about slowing sales growth and narrower operating margins. They're not wrong. The company has indeed experienced negative financial trends over the last two years:

ETSY Operating Revenue (Quarterly YoY Growth) data by YCharts

At the same time, Etsy's top line never stopped growing and the company keeps generating robust cash profits. Also, I'm encouraged by the fact that every financial chart that matters has shown improvement in the last two quarters.

How Etsy is turning the tide

So Etsy's management has work to do, but there are already signs of progress. Some of the recent improvement comes from forces outside Etsy's control, such as a stronger economy that makes consumers more likely to go shopping. On top of that large-scale rebound, Etsy is doing its part to deliver better numbers.

For example, Etsy is adjusting its business model. The company used to optimize its apps, web sites, marketing, and operations to drive the largest possible gross merchandise sales (GMS). In 2024, the company's focus shifted to a better customer experience. Etsy's marketing message is all about gifts at the moment, and that focal point should only grow sharper as the holiday season draws closer. With features like gift lists, holiday reminders, and personalized video messages, transactions marked as gifts outperformed Etsy's standard catalog in the second quarter.

The marketing strategy is based on years of direct customer data, supported by modern artificial intelligence (AI) analytics. And it's not all about pushing the proven best-sellers to every shopper. A more obscure item could be just what this buyer wanted, and Etsy is diversifying its product discovery experience.

"What we're going to end up with now dramatic improvements in the diversity of items we're showing on Etsy, the diversity of sellers we're showing on Etsy," CEO Josh Silverman said on the latest earnings call. "It's going to drive a lot more people to say, 'Wow, there's a lot more stuff for sale than I realized. There's more categories of items for sale than I realized,' and they're going to come back more often. And that's what I'm really excited about."

Moreover, Etsy offers generative AI tools to help shoppers find the right product. Then, another large language model (LLM) helps them craft a greeting card. As strange as it may sound to pair computer algorithms with handcrafted goods, generative AI tools are a great fit for Etsy's operations.

Etsy's road ahead

So where does Etsy stand today, and where will the stock go from here?

The GMS volume should continue to trend down, as Etsy now wants to inspire return trips rather than maxing out the sales-ticket total in every trip. If all goes well, this strategy shift should boost profit margins in the long run. The stalled sales growth could also bounce back soon enough as people get over the inflation-driven crisis and go shopping on a larger scale. Again, Etsy can't really control that trend to a significant degree. But the rebound is happening anyway, and this company will benefit from it.

Meanwhile, Etsy's stock is hanging out in Wall Street's bargain bin. The shares could boost their price to sales (2.2) and price to earnings (24) ratios by 50% and still look affordable next to e-commerce peers like Amazon and MercadoLibre.

I like what I see here. Come back in three years, and I think you'll find the company thriving in a healthier economy. In a perfect world, consumer confidence would spring back before the 2024 holiday shopping season, but Etsy should be OK if the recovery takes a bit longer, too. The holiday seasons in 2025 and 2026 can make up for a lost rebound opportunity this year, after all -- and investing is a marathon anyhow.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,121!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,917!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,844!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Anders Bylund has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Etsy, and MercadoLibre. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.