By Grant Engelbart, CFA, CAIA – Senior Portfolio Manager, Brinker Capital Investments

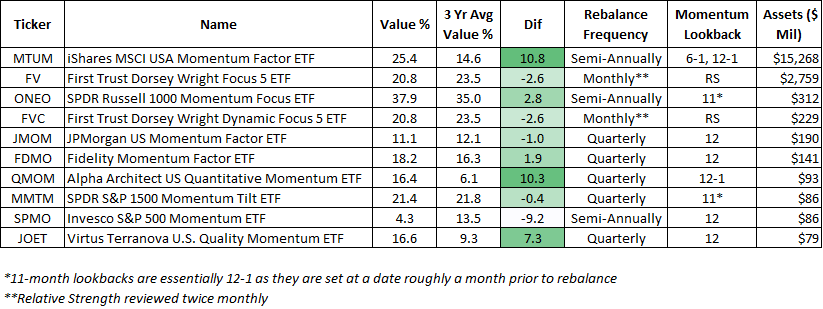

There has been no shortage of ink spilled over the recent rebalance of momentum ETF strategies, and the shift towards the strong performance of value stocks. This is a somewhat unique occurrence, as traditionally value and momentum are negatively correlated (at least their excess returns). Beyond quantitative jargon, this makes conceptual sense. Beaten down stocks that are “cheap” likely aren’t going to be the same stocks as those that continue to perform well. However – believe it or not – those cheap value stocks may reverse course and outperform, and may do so quickly. Most standard academic momentum measures over a 12-month lookback period (often excluding the most recent month) to find outperformers. However, this has been adapted to the ETF wrapper in a number of ways, including the addition of a 6-month lookback period, risk-adjusted returns, risk-adjusting the entire portfolio’s weighting, sector neutrality, including earnings momentum, etc. We are seeing ETFs with a 6-month lookback or more frequent rebalance periods catching the recent strength in value stocks and adjusting accordingly.

[wce_code id=192]

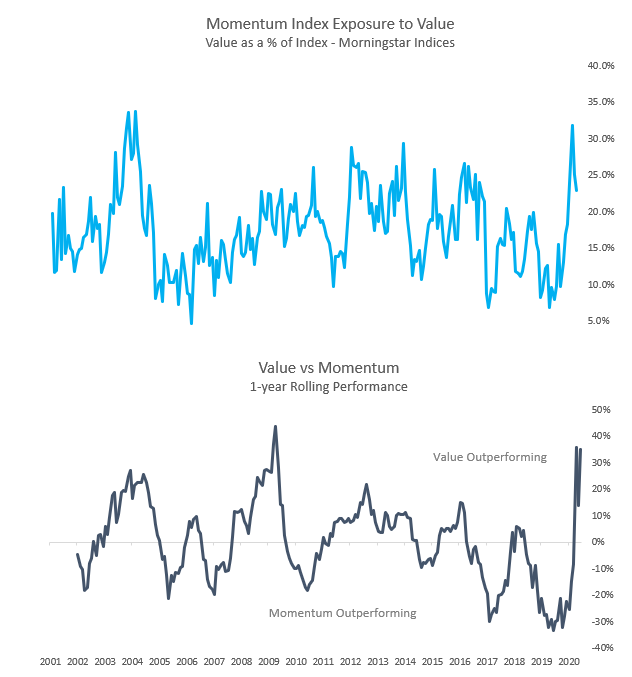

Below, you can see the change over time in the percentage of stocks in the momentum index that are classified as value, and the relationship to performance of value and momentum stocks. As you would expect, there is a slight lead time of value outperforming, which then increases the amount of value securities in the momentum indices as reconstitution occurs. Today, we sit at nearly the highest level of value stocks in this particular momentum index since after the tech bubble.

[caption id="attachment_426585" align="aligncenter" width="632"] Sources: Brinker Capital Investments, Morningstar, as of 5/31/21[/caption]

Sources: Brinker Capital Investments, Morningstar, as of 5/31/21[/caption]

Interestingly, the allocation to value stocks in momentum indices doesn’t last as long as one would think. I believe that in a lot of cases, it depends on measurement. Many of the “value” stocks that have been outperforming for a period of time may have simply graduated into “core” or “blend” stocks, or in grander cases become “growth” stocks (looking at you Gamestop!) This migration acts as a natural rebalancer, and keeps the value and momentum excess return correlation low-to-negative.

What happens after value stocks become a larger percentage of the momentum index, like they are today? The majority of the time, say when value hovers between 10-25% of the momentum index, there is very little relationship between the level of value and forward returns. However, at more extreme levels – when value is less than 10% or more than 25% of the momentum index, we tend to see performance persist. This is displayed graphically below. When value is less than 10% of the momentum index, value tends to continue to underperform momentum stocks on a 3-month, 6-month, and 1-year basis. Historically, momentum tends to outperform over those same time frames to the tune of 65-80% of the time. However, when value stocks exceed a quarter of the momentum index – like they do today – value tends to outperform over the 3-, 6-, and 12-month time frames, and has done so with a success rate of 60-75%.

[caption id="attachment_426587" align="aligncenter" width="1516"] Sources: Morningstar, Brinker Capital, returns from 1/1/2002 to 5/31/2021[/caption]

Sources: Morningstar, Brinker Capital, returns from 1/1/2002 to 5/31/2021[/caption]

If we look at the current ETF universe today, several momentum-specific ETFs have elevated levels of value stocks relative to their history (I used 3-years as it was close to a common inception, but results are absolutely and directionally similar back to inception of each ETF). Not all products have at or above average levels of value, at least not yet. Invesco S&P 500 Momentum rebalances in March and September with a 12-month lookback, so not all of the value strength has been captured yet. This path-dependency of inclusion for various stocks based on momentum index rebalancing periods is probably not all that important to those with diversified factor portfolios, as they would theoretically be participating in value as well. Value cycles also tend to be long-lived, so there is time to adapt. But those who time factors or factor exposure should be aware of the changing dynamics in the momentum factor as it pertains to value.

The combination of value and momentum will continue to be a strong combination. However, paying careful attention to the construction of each of those factors – whether inside ETFs or otherwise – is as important as the interaction between them.

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.

This information is prepared for general information only. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. The graphs and charts contained in this work are for informational purposes only. No graph or chart should be regarded as a guide to investing.

Compliance Code: 2085-BCI-7/22/2021

Read more on ETFtrends.com.The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.