When Performance Matters: Nasdaq-100 vs. S&P 500 Fourth Quarter '19

Editor’s Note: An updated version of this story can be found here: When Performance Matters: Nasdaq-100 vs. S&P 500 Second Quarter ’20

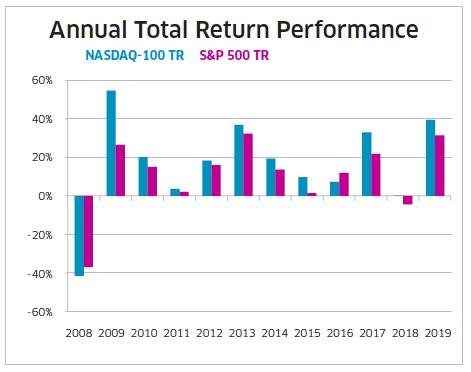

The Nasdaq-100 and S&P 500 are two of the most popular equity indexes in the US. The Nasdaq-100 is heavily allocated towards top performing industries such as Technology, Consumer Services, and Health Care, which have helped the Nasdaq-100 outperform the S&P 500 by a wide margin between Dec. 31, 2007 and Dec. 31, 2019. Below is a comparison of annual total returns - which reinvest dividends - between each index. The Nasdaq-100 TR Index has outperformed 10 out of the 12 years in our study.

Historic Performance

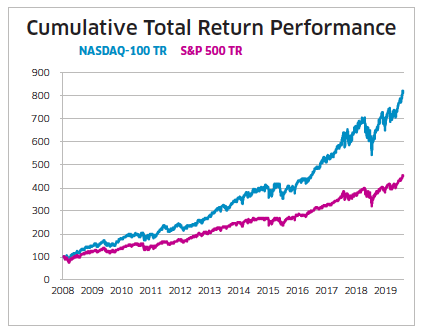

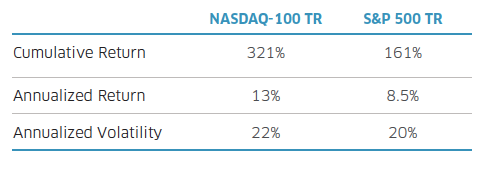

The table below and the charts above display historical performance figures for both the Nasdaq-100 TR and the S&P 500 TR between Dec. 31, 2007 and Dec. 31, 2019. The Nasdaq-100 TR Index displayed more than double the cumulative total return, on just slightly higher volatility.

Rolling Volatility (One Year)

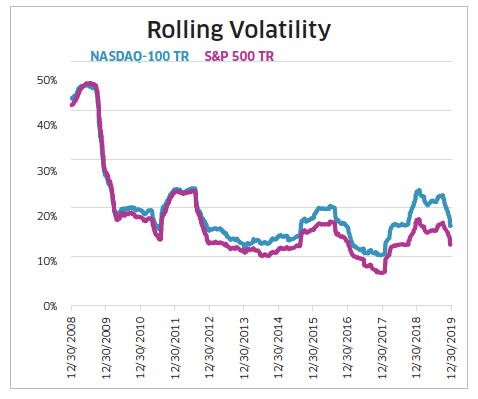

One year rolling volatility (calculated by taking the standard deviation of daily returns, annualized) was 93% correlated between Dec. 31, 2007 and Dec. 31, 2019, when comparing the two indexes. Given the large exposure the Nasdaq-100 has towards Technology, the ability for the Nasdaq-100 to closely track the volatility of the S&P 500 is rather impressive.

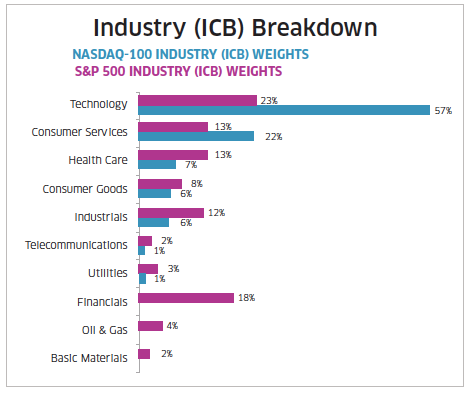

Current Industry Weights

We can see important differences between the Nasdaq-100 and the S&P 500 as of Dec. 31, 2019. As mentioned previously, the largest allocations in the Nasdaq-100 are geared towards Technology (57%), Consumer Services (23%), and Health Care (7%). The large allocations to both Technology and Consumer Services have helped propel the Nasdaq-100 Index to a new all-time high in Q4 of 2019.

Despite the sharp drop in the market from October to Dec. 2018, the Nasdaq-100 still outperformed S&P 500 by 4% in 2018 and by 3% in the first 3 quarters of 2019 from a total return standpoint.

Conclusion

The Nasdaq-100 and S&P 500 are two of the most popular equity indexes in the US. We provided performance and volatility analysis for almost 12 years. The Nasdaq-100 is heavily allocated towards top performing industries such as Technology, Consumer Services, and Health Care. The growth of companies in these industries has continued to be strong. Given the way technology is influencing the world and making companies more efficient, this trend is more than likely to continue going forward.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

Contact Us

Nasdaq 100 Index