When Performance Matters: Nasdaq-100 vs. S&P 500, Fourth Quarter '20

The Nasdaq-100 and S&P 500 are two of the most popular equity indexes in the U.S. The Nasdaq-100 is heavily allocated towards top performing industries such as Technology, Consumer Services, and Health Care, which have helped the Nasdaq-100 outperform the S&P 500 by a wide margin between December 31, 2007 and December 31, 2020. Below is a comparison of annual total returns -- which reinvest dividends -- between each index. The Nasdaq-100 TR Index has outperformed 11 out of the 13 years in our study.

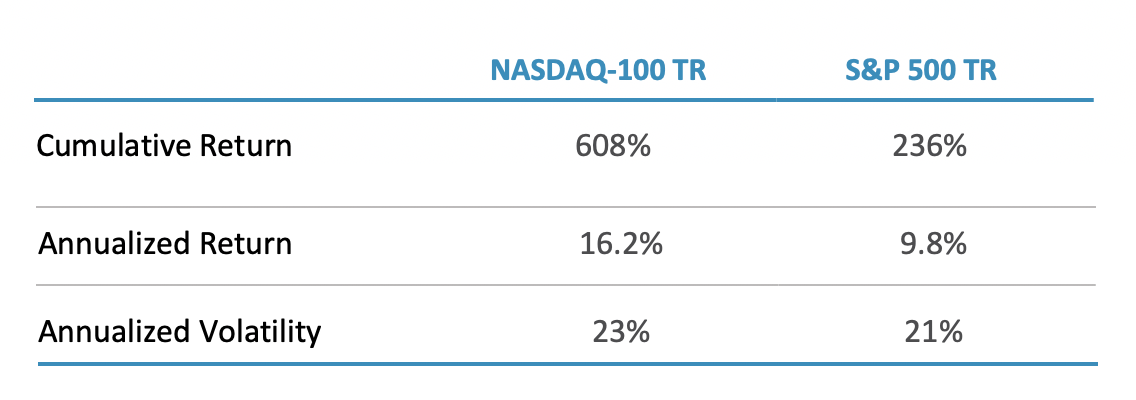

Historic Performance

The table and the charts above display historical performance figures for both the Nasdaq-100 TR and the S&P 500 TR between December 31, 2007 and December 31, 2020. Despite recent overall market volatility, the Nasdaq-100 TR Index has maintained cumulative total returns of approximately 2.5 times that of the S&P 500 TR Index.

Rolling Volatility (One Year)

One year rolling volatility (calculated by taking the standard deviation of daily returns, annualized) was 94% correlated between December 31, 2007 and December 31, 2020, when comparing the two indexes. Given the large exposure the Nasdaq-100 has towards Technology, the ability for the Nasdaq-100 to closely track the volatility of the S&P 500 is rather impressive.

Current Industry Weights

We can see important differences between the Nasdaq-100 and the S&P 500 as of December 31, 2020. As mentioned previously, the largest allocations to both Technology and Consumer Services helped propel the Nasdaq-100 Index to multiple records throughout the year, including a new all-time high to close out 2020.

The Nasdaq-100 finished the year with a gain of 48.9%, more than 30% of outperformance relative to the

S&P 500's gain of 18.4%. Its outperformance was also consistent throughout all 4 quarters. In the most recent quarter, it was up 13.1% vs. 12.1% for the S&P 500.

This most recent outperformance mirrors what occurred in the last major market downturn in 4Q’18. For 2018 as a whole, the Nasdaq-100 outperformed the S&P 500 by more than 4% and maintained its streak of positive annual total returns dating back to 2009.

Conclusion

The Nasdaq-100 and S&P 500 are two of the most popular equity indexes in the US. We provided performance and volatility analysis for almost 12 years. The Nasdaq-100 is heavily allocated towards top performing industries such as Technology, Consumer Services, and Health Care. The growth of companies in these industries has continued to be strong. Given the way technology is influencing the world and making companies more efficient, this trend is more than likely to continue going forward.

Sources: Nasdaq Indexes, Bloomberg

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq,

Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2021. Nasdaq, Inc. All Rights Reserved. 0090-Q21

In This Story

NDX SPXOther Topics

Indexes Smart InvestingContact Us

Nasdaq 100 Index