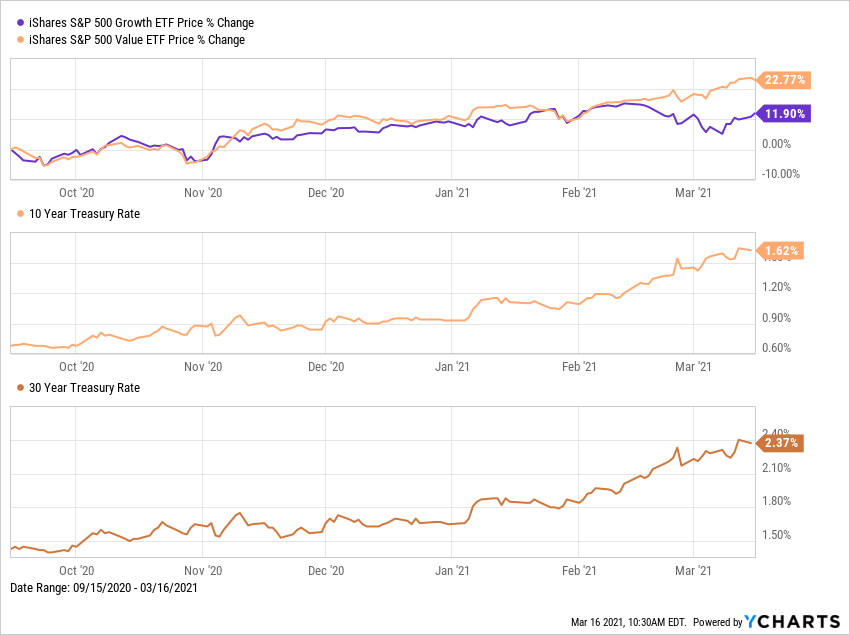

The value vs. growth stocks debate is never-ending, but recent advances from value companies are signaling a significant tide change. From the March downturn through the end of 2020, growth stocks delivered a 1.5x greater return than their value counterparts. In 2021, the tables have turned—value stocks are pulling away to lead the market while the growth sector is nearly flat year-to-date.

March 2021 also marks the first time in months where daily volume in the S&P 500 Value ETF (IVE) was higher than that of IVW, its growth counterpart, indicating interest is shifting into value stocks and related funds.

This change in market leadership has brought an age-old debate back to the forefront: value or growth stocks?

Value and growth have each outperformed the other over certain time periods—the chart below shows the rolling three-year total return for the Russell 1000 Growth and Russell 1000 Value indices since the early 1980’s, with value and growth regularly trading the lead. The lower panel illustrates the spread between the two, with a value above zero representing growth outperformance.

It’s easy to get carried away when one sector significantly outpaces the other, but when deciding between value and growth investing, it’s important to consider cyclicality, as well as your personal investment objectives and time horizon. To help in your decision making, we’ve outlined below the most important characteristics of each approach, how value and growth compare in terms of performance, and several ways YCharts helps uncover the best strategy for you and your clients.

Value and Growth Defined

Value investors try to identify companies with solid fundamentals which they believe are undervalued by the market. Growth investors look for companies that demonstrate rapid revenue growth but have yet to reach scale or their full growth potential. It’s difficult to say which approach is superior because market conditions fluctuate, as do sector returns.

The key characteristics of value stocks and funds are:

Undervalued compared to their peers: Value stocks trade at lower valuations than other companies in their sector or industry. When share prices fall but a company’s underlying fundamentals remain strong, value stocks become “affordable” in the short-term, and hopefully lead to long-term gains.

Lower P/E Ratios than the broad market: Even beyond a company’s closest competitors, value stocks are generally lower-priced than the broader market in terms of price-to-earnings (P/E) ratio, especially compared to growth stocks.

Less growth but reliable income streams: Usually larger and more established businesses, earnings of value stocks grow at modest but consistent clips. Because of their sizes, many companies opt to pay significant amounts of earnings directly to shareholders in the form of dividends, rather than reinvest them back into the business.

Less volatile than the broad market: Because value stocks are priced more conservatively, share prices often move less than the market average, and expectations are lower when companies report earnings. But the trade-off to price stability may be a longer holding period until pay out, so value stocks are well-suited for long-term investors.

The key characteristics of growth stocks and funds are:

Track record of earnings and revenue growth: Growth stocks are typically less mature but have grown their revenue and earnings at a better-than-average rate in recent years, and are expected to continue doing so. Often, growth companies will ignore profitability to continue pushing revenue results. Consistently high growth rates for key top and bottom-line metrics justify their relatively higher valuations.

Higher P/E Ratios than the broad market: Because investors expect their earnings to continue growing, growth stocks carry high valuations such as above average P/E, price-to-book (P/B), and price-to-sales (P/S) ratios. A strong Forward P/E, which considers estimates made by the company and Wall Street analysts, indicates an expectation of continued growth for these companies.

More growth with less reliable return on investment: Growth companies typically opt to reinvest earnings instead of paying dividends to shareholders. This makes an investor’s ROI dependent on the share price increasing, but when a growth stock plows earnings back into the business, it increases the likelihood of capital appreciation.

More volatile than the broad market: Due to their higher valuations, prices of growth stocks tend to be more volatile than the broader market average. When share prices are already lofty, they can plummet quickly if a company misses expectations, or when negative news, like a key employee departure, surfaces.

In addition to value vs. growth, investors also need to consider whether to use stocks or funds to implement these strategies. Mutual funds and ETFs offer broad exposure to value and growth strategies, capturing many companies that fit the bill, but also others that don’t. And stock pickers may be able to identify the single best value or growth company in the market, but also might choose wrongly.

Performance of Value vs Growth Stocks

Investors are curious about which strategy generates more returns. While the two strategies historically ebb and flow quite regularly, the returns table below shows that growth has handily outperformed value since the 2010s.

Market cyclicality is an important factor to consider when comparing value vs. growth performance.

Growth stocks generally perform better during bull markets, when interest rates are falling, and when corporate earnings are trending up. However, during economic slowdowns, growth tends to lag behind value. Similarly, value tends to outperform growth during a bear market or economic recession, as well as in the early stages of an economic recovery.

Take for instance the recent rise in long-term treasury bond rates. As interest rates rise and future cash flows are increasingly discounted, investors are likely rotating out of growth stocks and into less risky or speculative assets, such as value stocks and fixed income.

Company size (given by market capitalization) is also often a contributing factor. When further breaking down value and growth companies by size, such as large, mid and small market capitalizations, more nuanced performance differences appear. There are over 67,000 funds available in YCharts, including some popular value and growth ETFs with strategies that incorporate market cap:

Large-cap funds:

Invesco Dynamic Large Cap Value ETF (PWV) and Growth ETF (PWB)

iShares Morningstar Large-Cap Value ETF (JKF) and Growth ETF (JKE)

Nuveen ESG Large-Cap Value ETF (NULV) and Growth ETF (NULG)

Schwab US Large-Cap Value ETF (SCHV) and Growth ETF (SCHG)

Mid-cap funds:

iShares Morningstar Mid-Cap Value ETF (IWS) and Growth ETF (IWP)

Nuveen ESG Mid-Cap Value ETF (NUMV) and Growth ETF (NUMG)

Vanguard Mid-Cap Value ETF (VOE) and Growth ETF (VOT)

Small-cap funds:

iShares Morningstar Small-Cap Value ETF (JKL) and Growth ETF (JKK)

MFAM Small-Cap Growth ETF (MFMS)

Opus Small Cap Value Plus ETF (OSCV)

Vanguard Small-Cap Value ETF (VBR) and Growth ETF (VBK)

Using YCharts to Compare Value and Growth Stocks

YCharts features several tools and data sets to enable more informed comparisons of value vs. growth stocks, or value funds vs. growth funds:

Create Value vs. Growth Stock Visuals

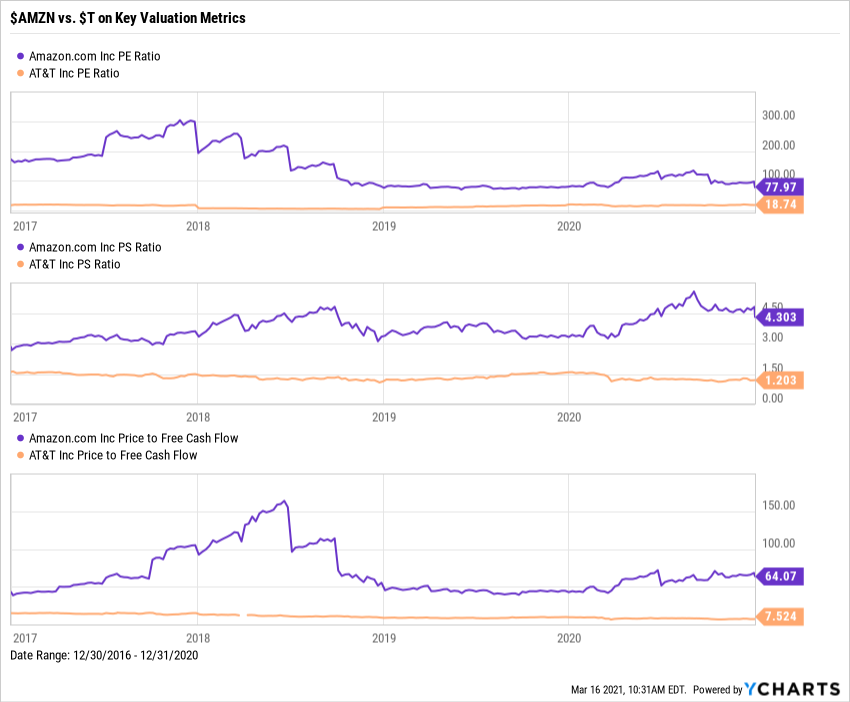

The chart above illustrates long-term performance for value and growth strategies, but what about individual stocks and the metrics that define them? Use Fundamental Charts to compare two companies based on underlying metrics that define value and growth opportunities, and over any time period. For example, put the P/E, P/S, and price-to-free cash flow ratios for Amazon (AMZN) and AT&T (T), two common top holdings in growth and value funds, respectively, head-to-head.

Screen for Value and Growth Stocks, Funds & ETFs

Whether your mind is already made up on value vs. growth, or you want to dig a little deeper, the YCharts Stock and Fund Screeners narrow in on the best equities and funds for your portfolio. The YCharts Screeners feature several pre-built templates to make finding new investment opportunities even easier.

The Trailing Revenue, EPS, and Cash Flow Growth screen, one of many growth-focused Stock Screener templates, finds stocks with strong revenue growth, earnings-per-share (EPS) growth, and cash from operations growth over several timeframes. Other pre-built templates include the growth-focused Forecasted Growth Screen, and Relative Value Stocks and Dividend Growth Over Time for value-minded investors.

Evaluating value and growth mutual funds and ETFs is a slightly different analysis. With all fund managers trying to pick the best stocks, you can compare and contrast managers’ success by looking at those funds’ performance and risk metrics. Templates like Top Growth Funds and Top Value Funds help identify the best-performing funds of both styles:

Build Custom Scoring Models for Value and Growth Stocks

Once you have a more manageable list of securities (like the results from a screen above), use Scoring Models to create a custom score or ranking using the metrics you find most important. For example, the Value Score below incorporates relative P/E ratio, relative P/S and dividend per share growth, at varying weights, to compare several value stocks against each other.

Value vs Growth: Which Is Better For You?

Your preference for, or belief in, value vs. growth typically comes down to your investment objectives, risk tolerance, and time horizon. You may also prefer to achieve exposure to growth, value, or both via mutual funds and ETFs, or individual stocks.

Some general rules of thumb: growth may be right for you if you’re comfortable with larger price movements and you aren’t in need of current income (by way of dividends); and you might prefer value if you’re looking for more stable investments that regularly pay dividends.

There’s also a case to be made for including both value and growth in your portfolio to smooth out times of volatility, and still keep pace when the market starts to run. “Blend” funds, created by asset managers, have emerged to achieve “growth at a reasonable price.” This hybrid approach focuses on companies poised for growth, but still incorporates traditional value indicators.

Connect With YCharts

To get in touch, contact YCharts via email at hello@ycharts.com or by phone at (866) 965-7552.

Interested in adding YCharts to your technology stack? Sign up for a 7-Day Free Trial.

Disclaimer

©2021 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.