I like the written word. When I was young, my mom instilled a love for reading. Authors have opened me up to new worlds and made my life significantly richer. Generally, I’m not put off by longer narratives, but I still recall my junior year of college when I was expected to read The History of the Peloponnesian War in two weeks. That seemed like a significant challenge. I finished the book and did well in the class, but I must admit that very little of the material sticks with me today.

In other situations, I’ve failed. For example, I’ve tried to read James Joyce’s Ulysses multiple times and never finished, despite the fact that I love most of his other work. Another lengthy work that I’ll never conclude is the United States Tax Code. According to a cursory search, the Tax Code is more than 2,500 pages long and includes roughly 1.2 million words.

I leave my tax preparation to a Certified Public Accountant (CPA), and around this time of year, I really appreciate his time. The point here is I’m not an expert, and in complex situations, working with a professional can be helpful.

There’s one specific “chapter” of the Tax Code that’s of particular interest to me, given the work I do and the derivative tools I typically use for personal trading. On the first point, I work to support the Nasdaq-100® Index Options (NDX). I believe that the Nasdaq-100 Index (NDX) is the most reflective of the economies of the 21st century and may become the bellwether for U.S. equity performance in the coming years.

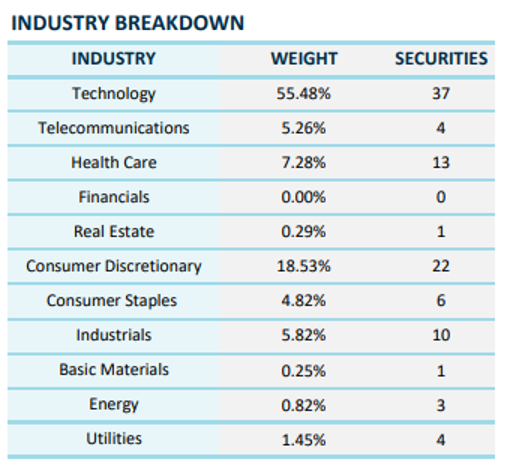

Historically, the NDX has been viewed as the “Technology Index.” That moniker makes sense, given the constituent weightings for the index methodology. Public companies operating in the “Information Technology” sector currently comprise ~56% of the overall composition.*

Not only do I focus on index options for work, but much of my personal trading is also centered around index products. There are a few reasons I gravitate toward index options. I prefer products with less idiosyncratic risk. By that, I mean that an index doesn’t have quarterly earnings reports. An index won’t be subject to corporate actions like a takeover, bankruptcy or receivership.

An individual company that’s part of an index could be taken over or go out of business. Individual securities report quarterly earnings. There’s the potential for corporate mismanagement or malfeasance.

In general, I’m willing to assume more systematic risk and less idiosyncratic exposure. It works for me. You may not share that focus. I also favor cash-settled products. In my experience, there’s less need to “babysit” a position. I can allow my options to expire and not end up long or short an underlying security. Furthermore, European styling means there’s no risk of early assignment in situations where I’m short a particular strike. It’s simpler, and it works for me.

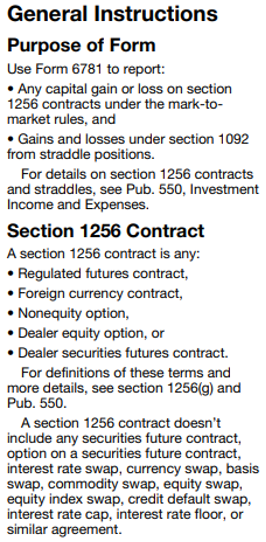

There are also potential tax implications associated with the use of index options. Form 6781 from the Department of the Treasury lays out the products they consider “1256 Contracts.”

These contracts often qualify for beneficial tax treatment when compared to single-name equity and exchange-traded fund (ETF) options. I’ll reiterate that I’m NOT a tax professional, and potential tax benefits are not necessarily an appropriate reason to use a specific product.

If “non-equity” options (or regulated futures/FX contracts) are part of your trading, then consider making sure your tax preparer understands the potential implications.

I’ll outline the significance from my perspective.

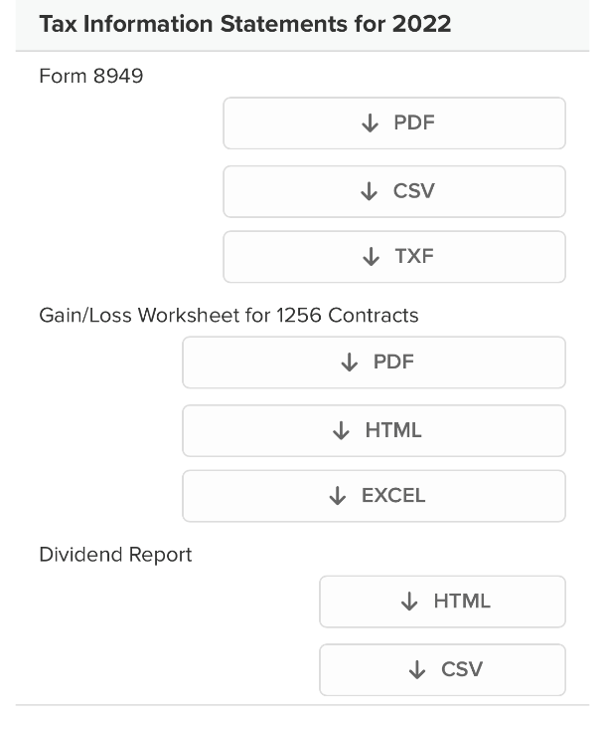

Every year, I’ll receive tax information from any active brokerage (taxable) account. The top section (Form 8949) is a report on sales and exchanges of capital assets. In my case, that documents all the individual securities I’ve bought/sold as well as options transactions on equities or ETF products. Gains (or losses) from those transactions will likely be taxed at the same level as my ordinary income. That assumes that the securities were held for less than 365 calendar days.

Tax brackets vary from 10% to 37% for income earned in 2022.

Let’s imagine that I made exactly $10,000 from securities transactions last year (Form 8949). Let’s also imagine that none of the securities were considered “long-term” (held for more than 365 days). The gains would likely be subject to tax based on my income level. For the sake of example, let’s say I fall in the 35% bracket.

Short-term equity gains are often taxed at 60% short-term rates (same as ordinary income) and 40% long-term capital gains rate. Again, I am no expert and tax rates may vary, so you should consult a tax professional.

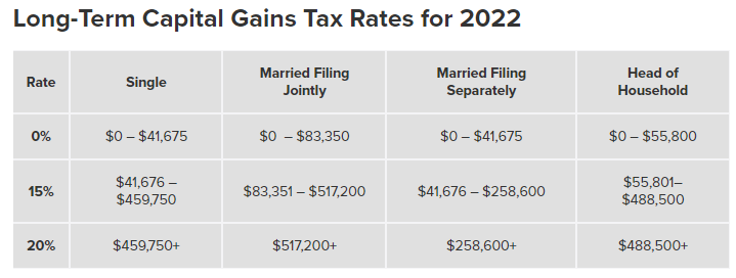

For our example, let’s say I fall in the long-term capital gains bracket of 15%.

- $10,000*0.60*0.35 = $2,100 (short-term rate applied to 60% of gains)

- $10,000*040*0.15 = $600 (long-term rate applied to 40% of gains)

I would likely owe $2,700 in taxes based on my $10,000 gain on equity products. That works out to a blended rate of 27% on my equity transactions.

Now, let’s move on to the 1256 Contracts report. For the sake of simplicity, let’s also assume that I made exactly $10,000 on non-equity index options transactions in 2022. Let’s also assume none of the positions were held for longer than a year.

These gains will likely be taxed at 60% long-term rates and 40% short-term rates because of the provisions carved out during the Reagan-era tax overhaul.

For more information, read about Dan Rostenkowski and the tax legislation of the early 80s.

Doing the math:

- $10,000*0.60*0.15 = $900 (long-term rate applied to 60% of gain)

- $10,000*0.40*0.35 = $1,400 (short-term rate applied to 40% of gain)

As such, my theoretical tax liability from the $10,000 gain on non-equity products would likely be ~$2,300. That works out to a blended rate of 23% as opposed to 27% on the equity side.

Education, Not a Recommendation

This piece is designed to raise awareness about potential tax benefits often associated with non-equity (index) option products. A growing number of market participants have discovered the options markets over the past three years. Volumes continue to grow, which is a testament to the product’s utility and broader understanding.

The industry has responded with more optionable products, including new non-equity (index) options. These tools may allow for broad-based risk management and come in a variety of notional sizes. In many cases, there are more granular expiries.

These index products are generally European-styled, cash-settled and may benefit from 1256 tax treatment. Perhaps it’s no wonder that index options volume growth has outpaced equity options volumes (percentage terms) over the past two years.

You have choices with respect to the tools you use, and understanding the risks, as well as the potential benefits, is key.

Click here to learn more.

*As of March 21, 2023. Sector weights change based on market conditions and index reconstitutions.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.