The phrase, “catch them early,” best suits the philosophy behind investing in Nasdaq Q-50 (NXTQ). The Nasdaq Q-50 Index offers an opportunity to own some of the companies which are next in line for inclusion in Nasdaq-100 Index in their formative years. Over the last 13 years, Nasdaq Q-50 has emerged as an index that focuses on innovation and growth as the two key elements for inclusion, successfully bringing forth some of the world’s high-growth advanced companies.

Here’s a look at the Nasdaq Q-50 Index, and ways to invest in it.

Nasdaq Q-50 is a market capitalization-weighted index launched on October 10, 2007 with a base value of 150. Nasdaq Q-50 Index is home to the most eligible securities likely to make their way into the Nasdaq-100 Index over time. The index combines high-growth, global appeal, diversity, advancement, and liquidity in one basket and could be considered as the ‘feeder index’ for the Nasdaq-100 Index, which constitutes companies such as:

- Apple

- Microsoft

- Netflix

- Starbucks

- Tesla

- Alphabet

- Amazon

- Intel

- Pepsi

- Cisco

- NVIDIA

- Adobe

- Amgen

- Qualcomm

At the launch of the Nasdaq Q-50, an SVP had said, “The Nasdaq Q-50 index is a new benchmark for some of the world's most up-and-coming growth companies. The index arms investors with a portfolio of some of Nasdaq's fastest-growing companies in a diverse range of industries. The launch of the Nasdaq Q-50 Index represents a significant extension of Nasdaq's success in bringing attention to its largest and most liquid innovative growth companies.”

Over the years, many companies have graduated from the Nasdaq Q-50 Index to become a part of the Nasdaq-100 Index. Some of notable companies on this graduation list are:

- Baidu (BIDU)

- Illumina (ILMN)

- Micron (MU)

- Sirius XM (SIRI)

- Facebook (FB)

- Netflix (NFLX)

- Electronic Arts (EA)

- Expedia (EXPE)

- lululemon athletica (LULU)

- Moderna (MRNA)

The screening methodology and eligibility criterion used for Nasdaq Q-50 is similar to what is followed for the Nasdaq-100 Index. The process begins by scrutinizing all companies, both domestic and foreign, that are listed on the Nasdaq Stock Exchange. There is a strong focus to find the next-generation market leaders. The companies which are classified as ‘financials’ according to the Industry Classification Benchmark (ICB) are excluded. Further, the security should not be issued by an issuer currently in bankruptcy proceedings and should have an average daily trading volume of at least 200,000 shares.

Based on such criteria, the top 50 names by market capitalization that are not currently in the Nasdaq-100 are included in this index. Currently, technology (42.23%), healthcare (19.49%), industrials (14.98%), consumer services (4.47%), and utilities (1.76%) are the top five sectoral allocations of NDTQ.

Overall, three versions of the Index are calculated—a price return index (NXTQ), a total return index, and a notional net total return index. The Nasdaq Q-50 Index is subjected to a quarterly evaluation and the review for eligible NASDAQ-100 Index Securities is performed monthly.

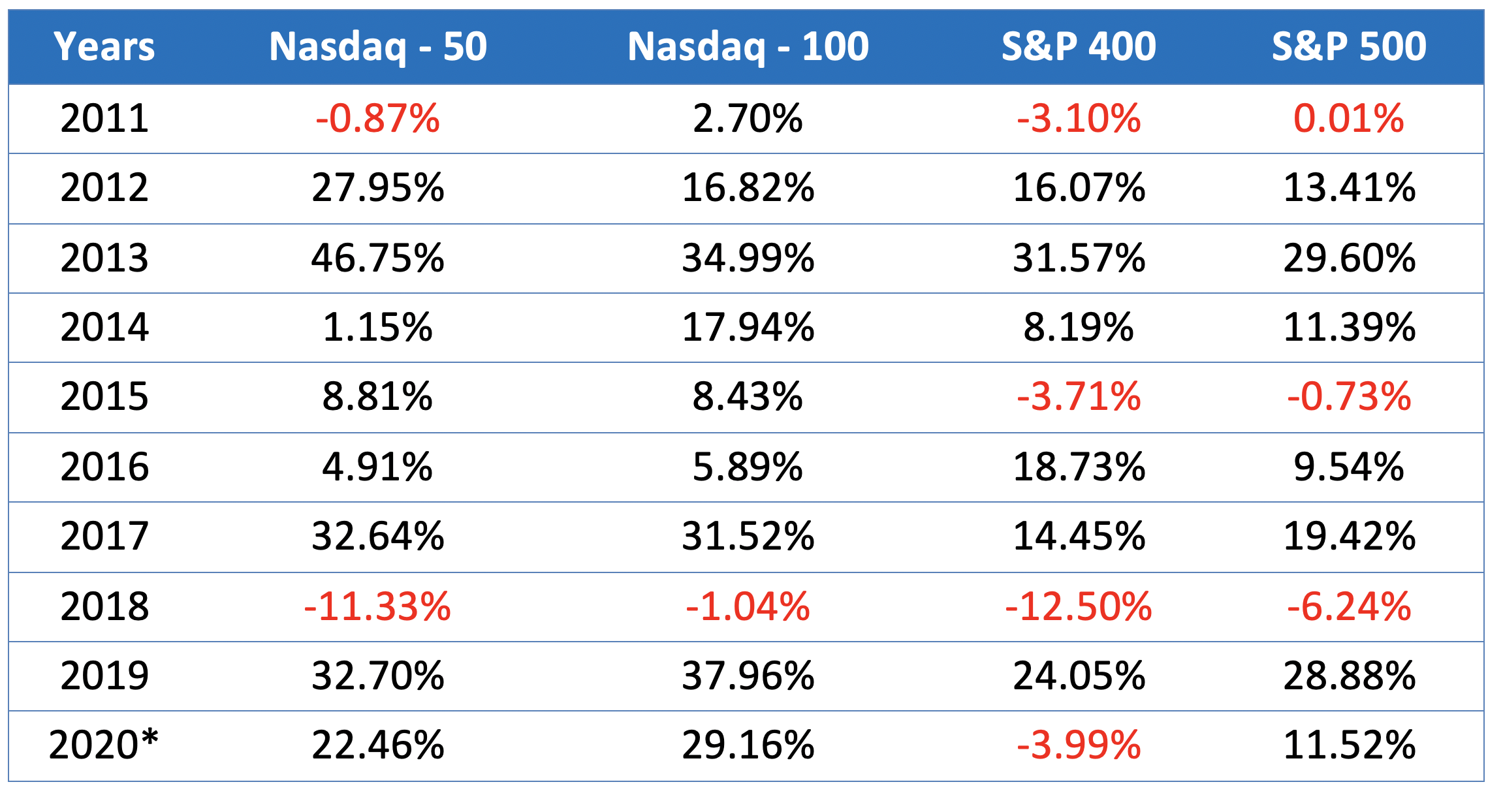

The table below reflects the yearly performance of Nasdaq Q-50 compared to three Indices—Nasdaq-100, S&P 500, and S&P 400.

Until recently, there was no exchange-traded fund available to take exposure to the Nasdaq Q-50 Index. The VictoryShares Nasdaq Next 50 ETF (QQQN) was launched in September 2020. The fund’s investment document reads, “it offers an opportunity to invest in the next generation of companies—those with proven business models but, presumably, at an earlier stage with still long runways of potential growth.” The fund tracks the Nasdaq Q-50 Index before fees and expenses. It has an expense ratio of 0.18% and $81.47 million. The top ten holdings of the fund currently are:

- Peloton Interactive, Inc. (PTON)

- Okta, Inc. (OKTA)

- Marvell Technology Group Ltd. (MRVL)

- The Trade Desk, Inc. (TTD)

- CrowdStrike Holdings, Inc. (CRWD)

- Atlassian Corporation Plc (TEAM)

- Old Dominion Freight Line, Inc. (ODFL)

- Roku, Inc. (ROKU)

- Liberty Broadband Corp (LBRDK)

- Garmin Ltd. (GRMN)

Disclaimer: The author has no position in any stocks mentioned. Investors should consider the above information not as a de facto recommendation, but as an idea for further consideration. The report has been carefully prepared, and any exclusions or errors in it are totally unintentional. The AUM, expense ratio, index returns and sectoral allocations are variable data (as on November 3, 2020) and subject to change.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.