What the Bears are Missing About Stock Valuations

Based on what I hear from traders and investors, it seems there are a lot of people living in an almost permanent state of anxiety right now. Every time the market indicates a lower opening, as it did this morning, they hold their breath, anticipating "the big drop." The theory is that such a drop is inevitable because the fundamentals don’t support stocks at these levels.

There is some truth to that: We really are at high multiples of earnings, and still have economic weakness left over from the Covid shutdowns, but maybe those people are looking at the wrong fundamentals.

The thing is, existing data, such as earnings, unemployment, and growth rates, are looking back at an exceptional time. It is no wonder that 12-month earnings and GDP growth are low when that 12-months includes a period when the global economy basically shut down. The stock market, on the other hand, is looking forward towards normality. So, to understand whether current levels are sustainable, let alone if there are further gains ahead, we have to look at other forward-looking indictors rather than looking back.

When you do that, current levels in the stock market look not just reasonable but if anything, a little too pessimistic.

Domestically, Treasury yields are beginning to recover as the dollar gets weaker. You could look at that in a glass half empty kind of way and say that those two things happening together indicate international worry about America’s potential to meet its obligations. After all, we do have $28 trillion in debt and growing ... but there is also a potentially more positive take on it. Both would be consistent with expectations for an inflationary environment which, providing it doesn’t get out of control, would mean higher prices of everything. And that includes stocks.

With Treasury yields and the dollar sending mixed messages, how do we decide which to trust? One way of doing that is to look outside the U.S., at global markets considered good indicators of coming economic strength. That would include things like copper and shipping rates.

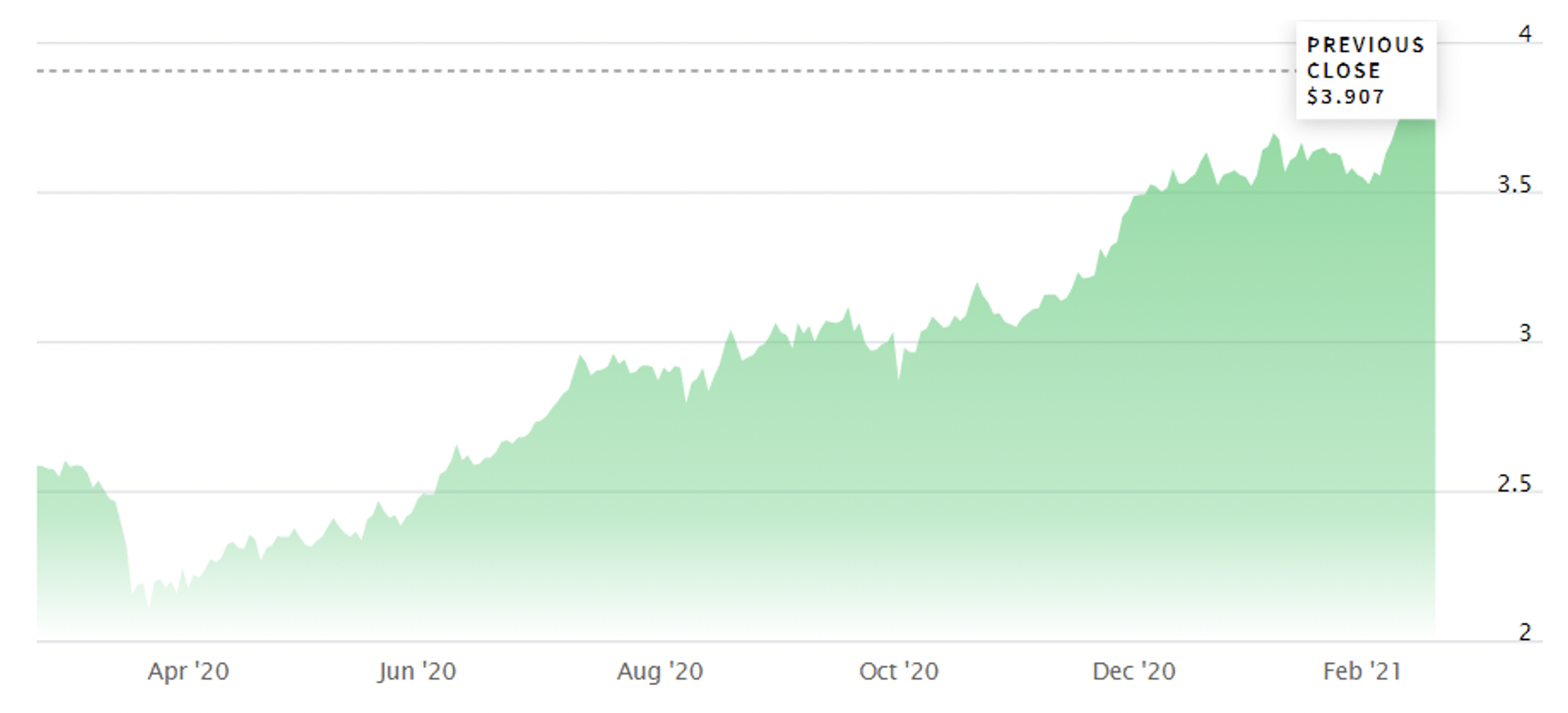

Copper is considered an indicator of future economic strength because of its role as an industrial metal used in some form or other in most traditional manufacturing. I know that we live in an increasingly virtual, tech-y world, but ultimately wealth creation on a global scale still comes down to making things, so copper prices still matter. If manufacturers are expecting a rise in demand, they order copper at levels to meet that increased future production. As demand for the metal increases, prices get pushed up based on what is expected in the future, rather than what is happening right now. That is why this 1-year chart for copper is so bullish for stocks over the next few months:

The other main forward indicator that traders and analysts often look at, but one that is less well known by most individual investors, is something called the Baltic Dry Index. That is an average of shipping costs for different types of vessels, and so indicates the level of trade between nations. Given that shipping goods takes time, manufacturers’ and retailers’ orders are placed based on what is anticipated a month or two ahead, which is why the Baltic Dry is considered a pretty reliable indicator of future economic conditions.

Once again, the chart tells the story:

After the immediate effects of the shutdown passed, the Baltic Dry jumped close to 300% in June and, while it has bounced around a bit since then, is still significantly higher that it was before the effects of the pandemic were felt. That suggests that stock prices being higher than pre-pandemic levels are not excessive.

In fact, if you consider that copper is up around 100% from its lows and the Baltic Dry is up well over 200% since May of last year, the S&P 500, which is up only 70% from the March low, is still lagging and has quite a bit further to run.

Of course, none of this means for sure that stocks will charge higher. Progress has been made but we still aren’t done with Covid. There have to be some lasting effects of a shock of that magnitude, so the negative impact of any setback, or of another, separate problem would be exaggerated. What is does mean, though, is that historically reliable predictive markets are indicating a stronger recovery than stocks currently have priced in, so a move higher from here would be about more than frothiness and irrational exuberance.

If nothing else, that should help some people sleep at night.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.