What Is the Vix, Why Is It High, and What Does That Mean for Investors?

If you follow financial markets at all, you have probably heard of the Vix. It has certainly been in the news a bit recently, having popped more than 25% in a week to hit levels not seen since October of last year. It is often referred to as the market’s “fear index,” but if you understand what the Vix is and how it typically moves, you can see that that is at best an oversimplification and may be very misleading.

The Vix is in some ways the ultimate derivative in that it is an index derived from derivatives of an index, which is itself derived from the prices of certain stocks. Let's unpack that. What it actually measures is the implied volatility that is priced into near-term S&P 500 options.

Basically, the theory is that the higher the price demanded by options traders for bets on the index hitting a set level in the future, the more likely hitting that level is. If the options force traders to pay a high price for insuring against, say, a 10% drop in the S&P 500 within a month, that would indicate that such an event is considered quite likely.

The higher the fear of a big drop, the more in demand insurance against it is. So, the higher the price of put options (contracts which make money for their owners when the index declines), the more fear there is that a decline is coming.

That is why the Vix is known as the "fear index" and is considered by many to be an indicator of market turbulence to come.

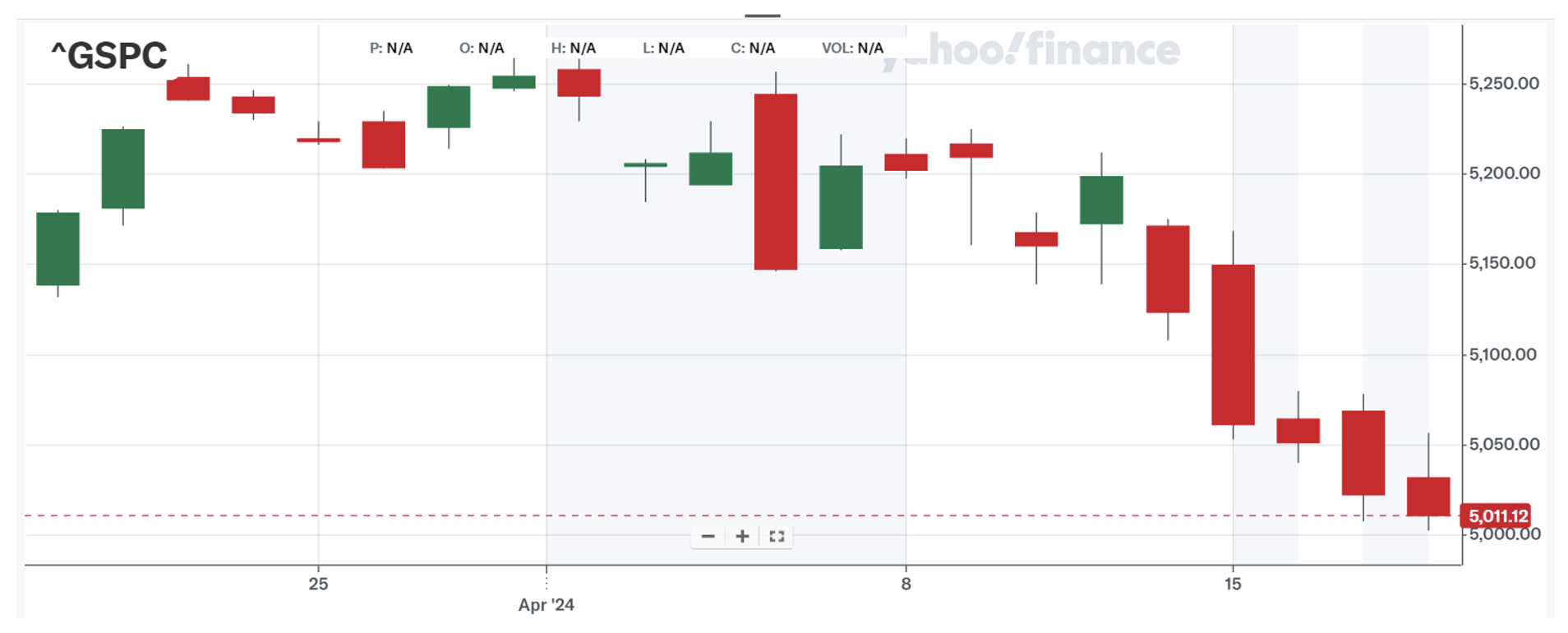

There are, however, a few problems with that, or at least things that should be considered. Firstly, the Vix is usually not predictive, but reactive. The recent climb, for example, has come at a time when the index has lost ground on six of the last seven trading days, with the chart for the last month looking like this:

While the chart for the Vix over the same period looks like this:

What we have is a chicken and egg situation. Is the index falling because the Vix is climbing, or is the Vix climbing because the index is falling? It is probably a little bit of both. Both the S&P 500 and its derivative are responding to the same stimuli: an increasing realization that the Fed is not going to cut interest rates soon or often, and the situation in the Middle East.

Then the two indices feed off of each other: the Vix heads lower because the market is falling, then the market falls because the Vix is heading lower. Whatever the relationship, though, while I am no genius, not even I need a derivative index to tell me that traders are fearful about the future when the S&P 500 chart looks like the above.

And even if we do accept the Vix as a good measure of fear in the market, there is an inherent problem with reading too much into that. Good traders must live in a perpetual state of fear, or at least have an awareness that bad, disruptive things could happen. If not, they would run all of their losing positions into the ground and never take profits on their winners.

Fear is an emotion, and while an awareness of the possibility of a downturn in the market at any point is a good thing, becoming emotionally convinced a drop is coming is not a good thing, and certainly isn’t logical.

That doesn’t mean that you should ignore the Vix completely. When the Vix and the market send contradictory messages, it can be informative.

Take a look again at the two charts above and you will see that in the last couple of days, the Vix seems to have turned and be headed lower as the risk of any massive escalation between Israel and Iran declines, while the S&P is still falling. That may be because the S&P is reacting to something other than the Middle East situation, but it may also be because it is still falling due to momentum rather than the current situation.

Either way, if fear of a big drop is declining, the market could well reflect that early next week. Of course, it might not, if there is another reason to sell.

So, the next time you hear somebody tell you that a big drop in the market is coming because the Vix is elevated, stop and think before acting. First, look at the charts for the S&P 500 and the Vix side by side and ask yourself whether the Vix is predicting a market move or reacting to one. Then consider what might be causing the fear that the Vix supposedly measures.

If it is something of which you are already aware, like a possible change in interest rate policy or tensions between Israel and its neighbors, then you have presumably already taken those things into account and the Vix is simply reflecting something that is priced into the market already.

Ultimately, your trading and investment decisions should reflect your take on current conditions, and while the Vix may be one of the factors you consider when summing up those conditions, it should not itself be a trigger for any drastic action.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.