On Monday, as we entered a huge week for big tech earnings, I offered a warning: I said then that in the case of these mega-cap tech companies, the generally bearish mood in the market would cause traders to focus on any negative they saw, either in the earnings reports themselves or in more general news, so it would pay to wait before reacting to good EPS and revenue numbers. After the market closed yesterday, we saw that in spades when Apple (AAPL) reported.

The good news was that they had a great quarter by almost every metric, with EPS of $1.52 per share versus the average estimate of $1.43 on revenue of $97.3 billion, also higher than expected and representing 8.6% growth from the same quarter last year. iPhone sales also improved on the same basis, while the company’s second most important revenue generator, services, posted an impressive 17% jump. As you might expect, AAPL jumped initially on those numbers.

But then came the bad news that traders were looking for. On the call following earnings, CFO Luca Maestri warned of a potential hit from supply chain restraints in the coming months and the stock quickly turned south:

The thing is, though, Maestri’s warning was neither new nor particularly worrying. It has been widely reported, like here, as a "possible $8 billion hit." That is indeed what Maestri spoke of, but the key word here is "possible." It is hard to find without going to the actual transcript of the call, but what he actually said was, "We expect these constraints to be in the range of $4 billion to $8 billion." The company actually offered a similar warning to analysts and investors after the last two quarters’ earnings, but with a slightly lower, $6 billion upper end for the expected range.

And yet, as we saw again in last quarter’s report, they continue to grow revenue.

That tells us that one of two things are true. Either Apple is consistently overestimating the negative impact of Covid restrictions in China and elsewhere on their supply chain, or they are surprising even themselves by how well they are managing them. In fact, it is probably a bit of both. Overestimating a possible negative is what responsible companies tend to do. It has a CYA effect: It is far better to under-promise and over-deliver than to do the opposite. For a company like Apple, with a lot of purchasing power and clout, suppliers will drop everything to meet their obligations, meaning that the actual impact is usually lower than expected. For the last few quarters, that is what Apple has consistently done, and yet the bigger top end number still caused the stock to drop nearly ten percent from its high in premarket trading.

In that light, it doesn’t take a genius to see that the pullback is more of a buying opportunity than anything. In reality, it doesn’t much change the picture for long-term investors. The question there is whether or not Apple can continue to defy the law of large numbers as applied to business and maintain decent percentage increases of their already massive sales and profits. So far, the answer to that has always been yes, but neither this earnings report nor the market reaction to it leaves us any the wiser on that front.

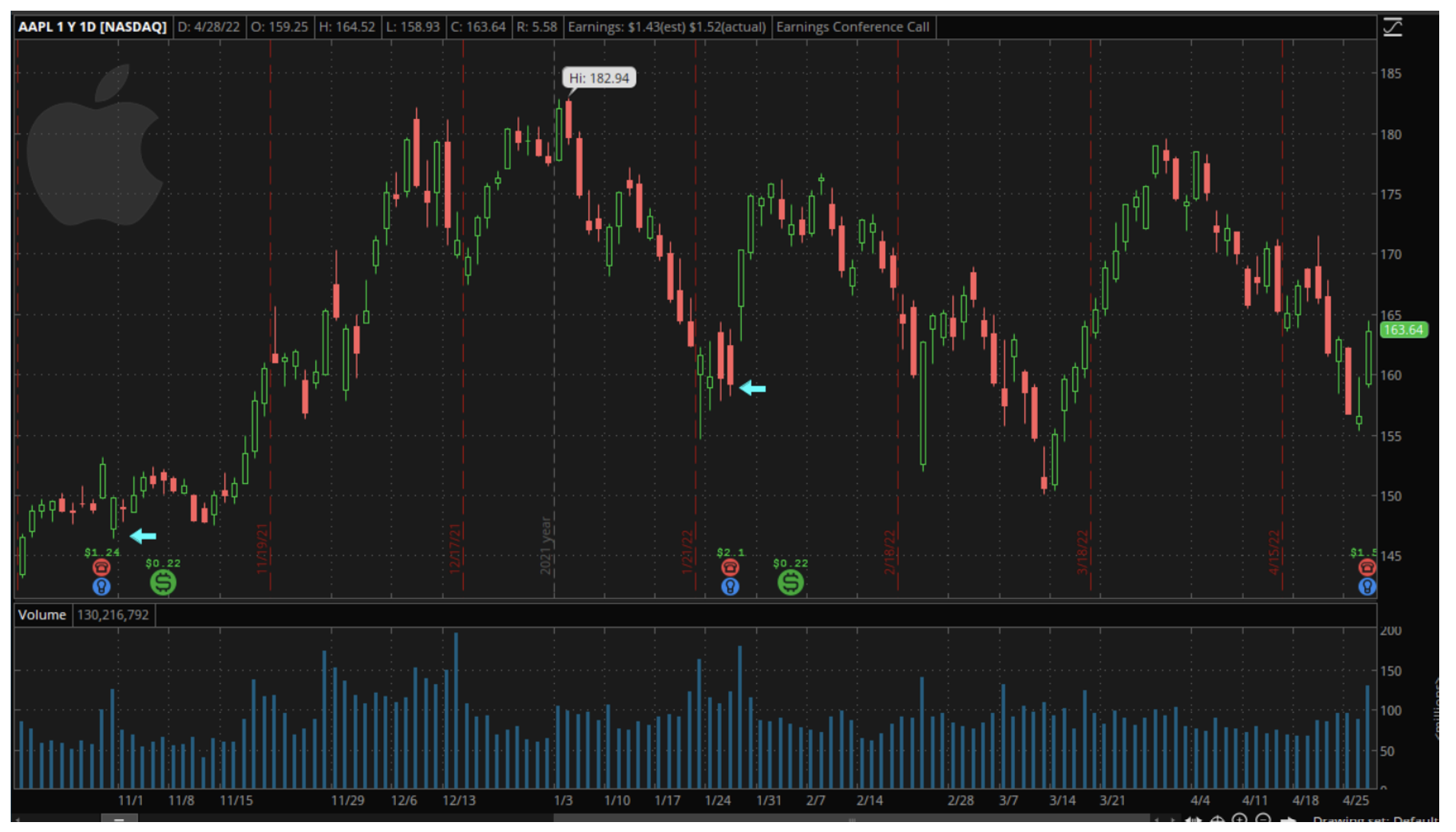

What it does is create a trading opportunity in the stock. The day after each of the last two earnings reports from Apple, both of which contained similar if slightly less drastic warnings about supply chain constraints, the stock opened lower the next morning, as marked by the light blue arrows on the chart below.

Within just a few days it had gained back those losses and was trading significantly higher than before the release. It could be that this time will be different, of course, but I wouldn’t bet on it if I were you.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.