As we go into the last month of 2023, some of the uncertainty and confusion that has been such a feature of the stock market for the second half of the year so far seems to be fading somewhat, but the immediate future is still not exactly clear. More and more traders, investors, economists, and analysts are convinced that the Fed is done with rate hikes given the softening of inflationary pressure, and therefore that both severely punitive interest rates and a recession can be avoided.

Some, however, still believe that raising the Fed Funds rate from zero to above five percent in a relatively short time must have a negative effect at some point and that the impact of that has simply been delayed. There is also a belief among the more bearish-minded that core inflation at around three percent is still too high for Jay Powell et al and that they will continue to squeeze, with a mild recession not being seen as a bad thing at all.

The stock market spent November pricing in the bullish scenario. The Dow Jones Industrial Index and the S&P 500 each gained 8.9% during the last month, with the Nasdaq doing even better, having risen by 10.7%. Other markets, however, reflected the remaining uncertainty. Treasury yields fell, which supported the rise in stocks, but Treasury futures are pricing in a rate cut earlier next year than they were a month ago, something that would probably only come if the economy weakened significantly. Crude oil, meanwhile, which is typically sensitive to the outlook for global growth, is well off its October highs, and dropped yesterday despite OPEC+ announcing extended production cuts.

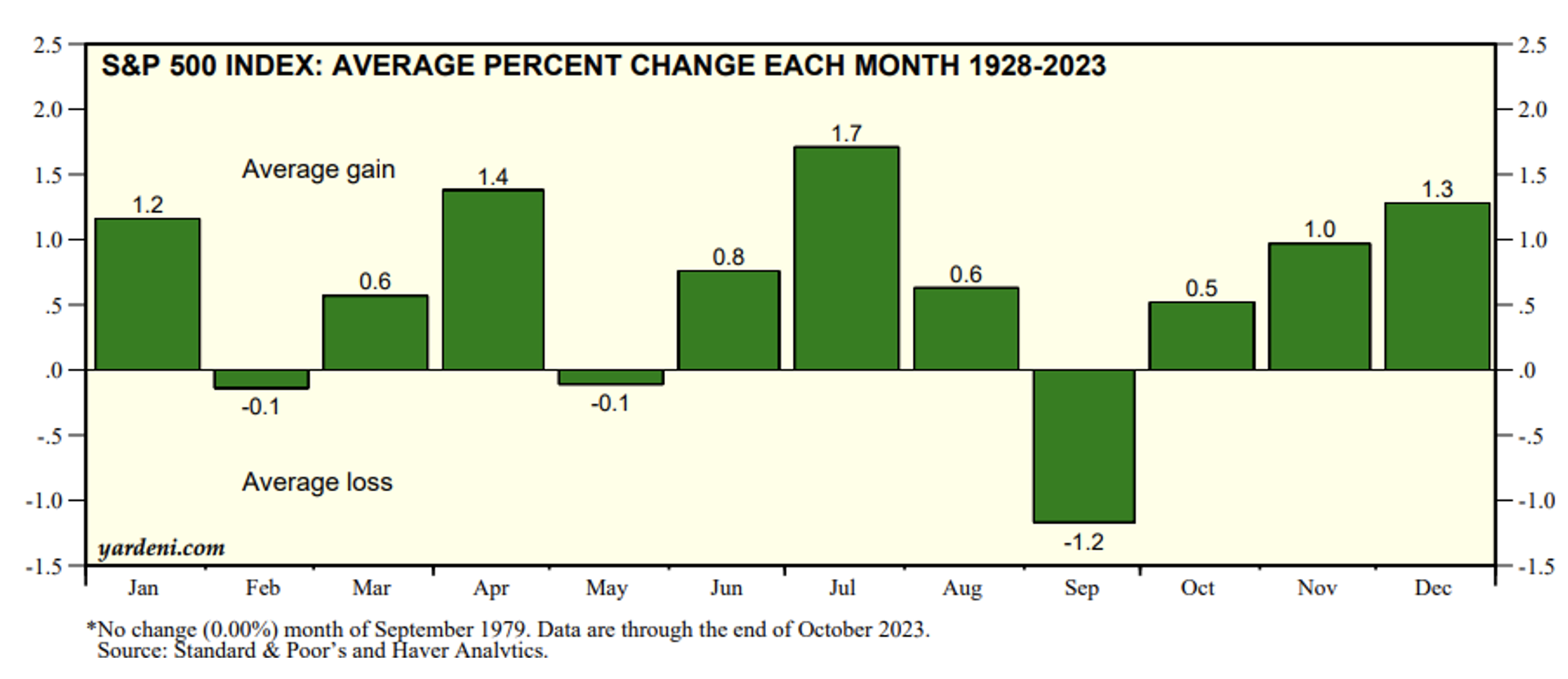

So, what can individual investors expect in December? Well, historically, December is one of the better months of the year. As the chart below, from Yardeni Research shows, it ranks third among all months with an average return since 1928 of +1.3%.

There are various reasons why that might be. Maybe it is just a sense of optimism that comes with the holiday season, or the result of year-end repositioning, with funds wanting to appear fully invested in their year-end statements. There is even some evidence to suggest that the tendency towards market gains in December is because many big institutional traders close their books for the year early, which enhances the influence of individual investors, who generally tend to be net buyers and less sensitive to any possible negative news or conditions. Or maybe it is just the positive influence of the season of goodwill.

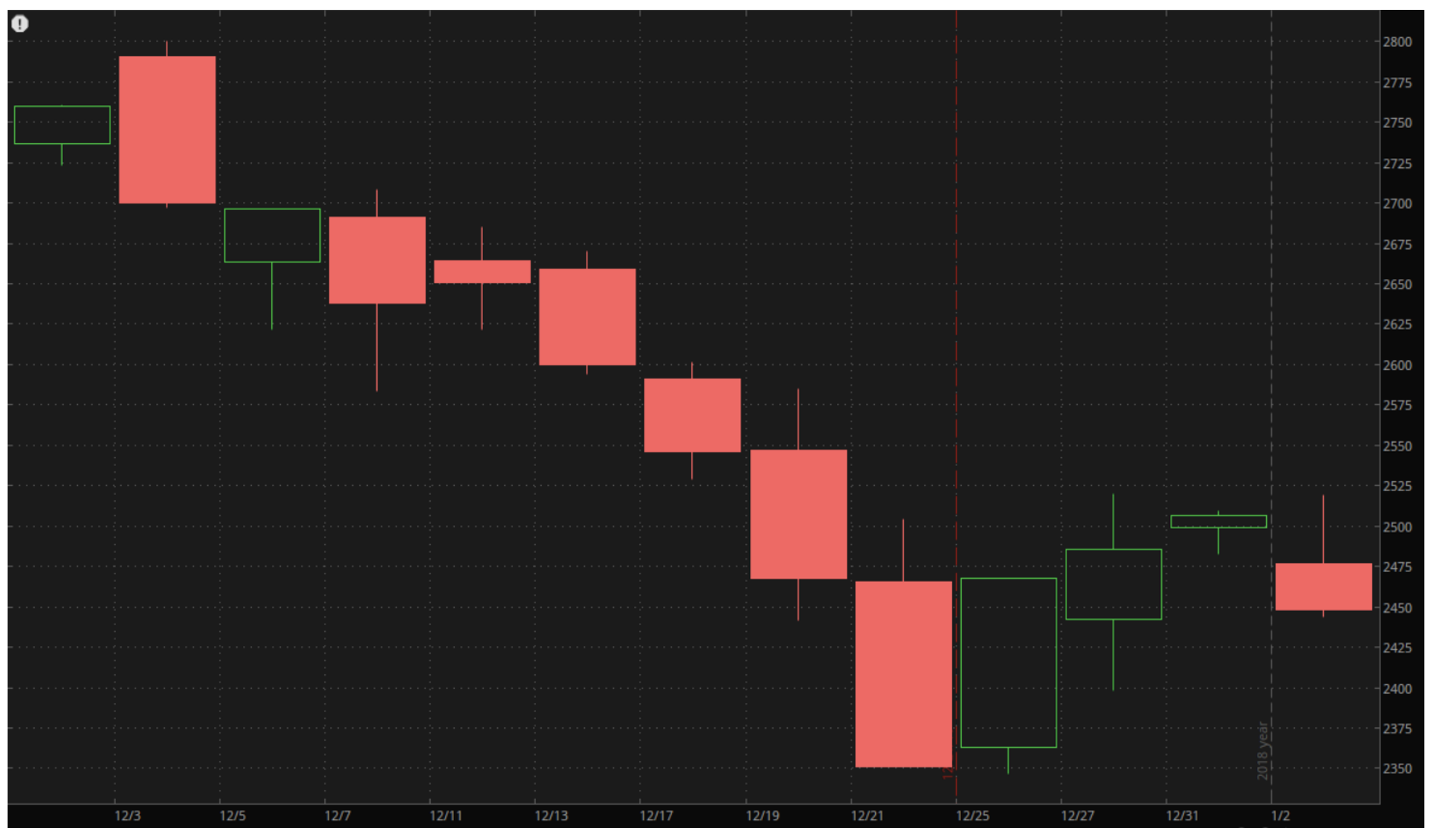

Whatever the reason, on average, December skews towards positive returns. However, as with all averages, there is a lot of variation in the underlying data. December of 2018, for example, was a terrible month for stocks, with a chart that looked like this:

Obviously, that had nothing to with what month it was, but was the product of a few other factors. America had started an ill-thought-out and ultimately short-lived trade war with China, the U.S. economy was slowing, partly because of that and partly just because of cyclical factors, and it was believed that the Fed was about to start a series of rate hikes. During 2019, the trade war faded from the news, the economy picked up, and the Fed held back and, as a result, the S&P 500 had one of its best years, gaining 28.88%.

The point here is that it was the events of December of 2018 and the market’s perception that moved the market that month, even though none of those things turned out to have a lasting negative impact. The mood going into December this year is much more positive, which leads to the obvious conclusion that, barring any big shock in the data and/or a massively hawkish move from the Fed, stocks will have a strong close to the year. For that reason, it may make sense to deploy any available cash over the next few weeks, even if there is still some uncertainty around.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.