My start in financial markets came in the London interbank forex market, which was more years ago than I care to remember, but it taught me many lessons that have stuck with me. One of them is that all markets have multiple influences, and, in some way or other, all are connected. Obviously, some relationships are more influential and obvious than others, but the basic thing to remember is that the value of everything, including the dollars, yen, euros, or whatever in our pocket is always expressed in terms of something else.

When the price of something changes, whether that thing is a stock, a barrel of oil, an apple, or another currency, it could be because of a change in the relative value of either side of the pricing equation. Once we understand that basic fact about pricing, we are able to better understand many economic concepts, including something particularly relevant right now: inflation.

Inflation can be caused by two things, either separately or in combination: a change in the value of the object purchased, or a change in the value of the currency used for that purchase. If an apple gets more expensive, it could be because there is a shortage of apples, making each one more valuable, or because there is a surplus of dollars, making each less valuable. When prices of everything are rising together, it is usually far more likely that what we are seeing is a fall in the value of the currency rather than simultaneous scarcity in everything else.

That is what inflation watchers, including the Fed, currently believe is happening. Blame is being apportioned and “inflation-fighting” policy set on that assumption. There is, however, one market that is telling us that this assumption is wrong. If the problem were really the excess supply of currency, then that currency would be losing value against everything, including other currencies. The forex market is saying, or nearly screaming at this point, that this isn’t the case.

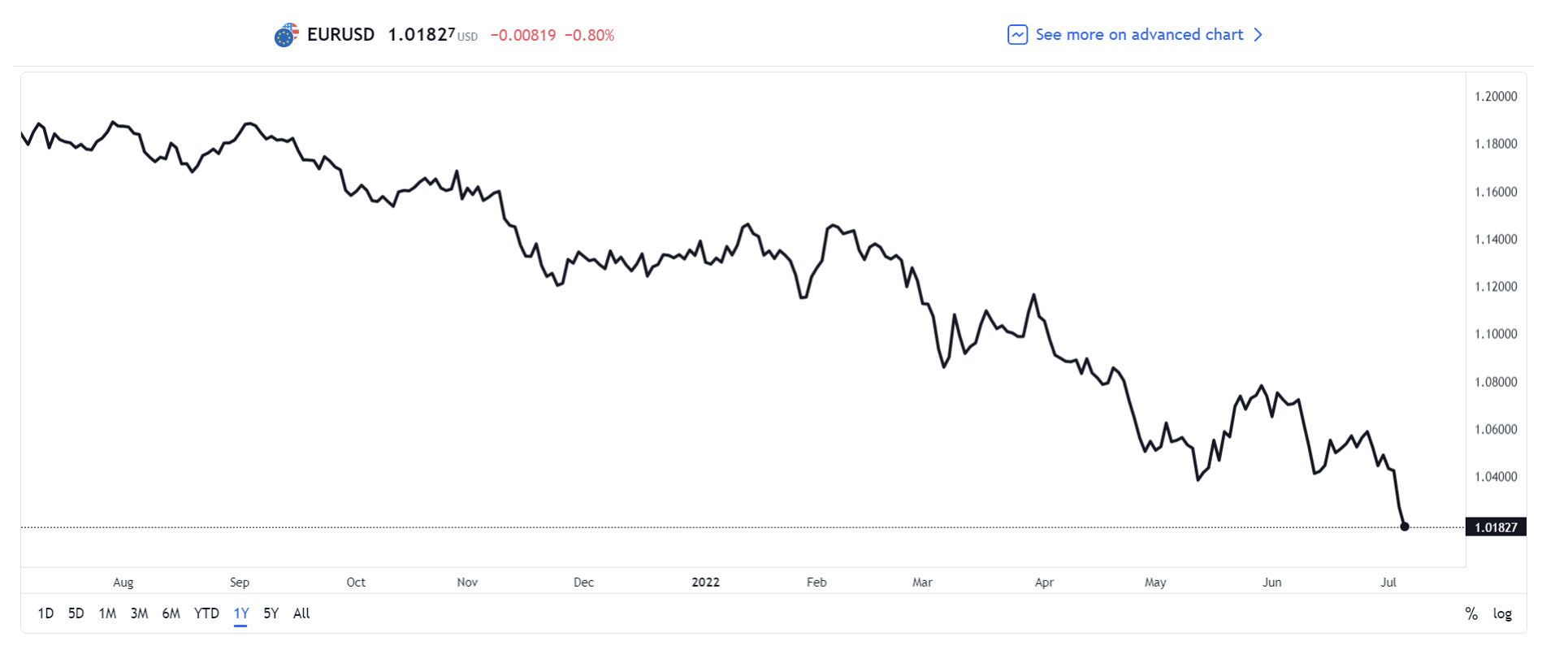

The Dollar Index (DXY) is an index showing the value of the dollar against a basket of other currencies and, as you can see from the chart above, it is at its highest level in twenty years. The move is even more striking when you look at significant individual currency pairs. The chart for Euro Dollar (EUR/USD) over the last year, for example, looks like this:

This is showing that the Euro has collapsed, or the dollar has gained, to the point where the exchange rate is approaching parity with the dollar (1:1). The value of the dollar against the yen has also sky-rocketed, to above 135. In both cases, those are levels not seen since the early 2000s.

If the current problems were really all about an excess supply of dollars, that couldn’t happen. The dollar would be worth less than before against everything. Not just apples and gasoline, but also against other currencies too. There may be some degree of “safe-haven” buying of dollars by traders worried about a global recession, and the Fed raising rates more aggressively than other central banks play a part, too. But still, the dollar couldn’t be that high if its fundamental value had collapsed.

As unlikely as it seems, the problem must be that there is a shortage of everything else. In fact, that isn’t really that unlikely. The pandemic caused mass shutdowns of production and manufacturing facilities, and re-opening has been at best patchy, particularly in the all-important Chinese market, so ongoing generalized shortages make perfect sense.

This is good news for investors in the long run. The inflation-related stock market moves have always been about the reaction to inflation rather than to the problem itself. Traders aren’t scared of rising prices; they are scared of higher interest rates and reduced liquidity. However, the forex market is telling us that, while those things will slow down the economy and help slow price increases, the problem is more on the product supply side. The upshot? This is therefore temporary and will be fixed by market forces, if nothing else. China has such a dominant place in the supply chain because it can produce goods cheaply, but rising prices mean that others can also start producing at a profit and supply will increase as more profit becomes available.

The logical conclusion is that while the Fed may be barking up the wrong tree to some extent, at least they won’t have to raise rates too far or for too long. And that means that the biggest thing spooking markets at the moment, a long period of Fed tightening, is unlikely. As the current cycle of higher rates plays out, we can still go lower, but the forex market is saying that there is an end in sight.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.