If you're looking for solid advice on how to build wealth, there's no better source than experts who have done it themselves. One of the great things about building wealth is that there are so many ways to do it.

I'm a Millionaire: Why I'm Not Passing Generational Wealth to My Kids

See: How To Get Cash Back on Your Everyday Purchases

For example, if you're looking to boost your net worth via real estate investments, a popular expert like "Shark Tank" regular Barbara Corcoran might appeal to you. If you're just out to learn the basic fundamentals of wealth creation in a no-nonsense way, radio personality and author Dave Ramsey might be more your speed. Regardless of how you're trying to grow your wealth, the more you can learn, the better.

Mark Cuban: Take Some Risks, Build a Financial Base, Get Out of Debt

Billionaire Mark Cuban earned most of his money from taking risks. But while Cuban advises investors to take prudent risks, he's also a bit conservative at heart. As Cuban told Vanity Fair, taking risks is an important part of generating wealth, but you should limit them to 10% of your portfolio. Cuban went on and advised individuals to keep at least six months of money in an emergency fund, saying, "If you don't like your job at some point or you get fired or you have to move or something goes wrong, you're going to need at least six months income."

But Cuban's strongest advice about building wealth is to eliminate debt at all costs, even student loans. As Cuban told MarketWatch, "The best investment you can make is paying off your credit cards, paying off whatever debt you have. If you have a student loan with a 7% interest rate, if you pay off that loan, you're making 7%, that's your immediate return, which is a lot safer than picking a stock, or trying to pick real estate, or whatever it may be."

Jaspreet Singh on the 75/15/10 Rule: This Is How the 1% Manage Their Wealth

The Great Wealth Transfer: How Baby Boomers Are Passing on Trillions to Heirs

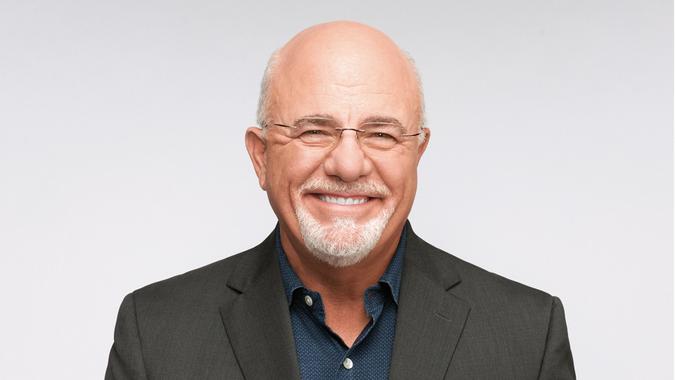

Dave Ramsey: Create a Budget, Invest In 401(k) Plans and Roth IRAs, Use Mutual Funds

Dave Ramsey is a radio personality known for his direct, down-to-Earth perspective on getting out of debt and creating wealth. Ramsey believes that creating a budget is an essential step to creating a road map for wealth, as you can see in black and white where your money is going and force yourself to carve out savings of at least 15% of your income. Ramsey highly recommends using tax-advantaged accounts like 401(k) plans and Roth IRAs to maximize your long-term growth -- and to that end, he recommends using mutual funds instead of individual stocks. According to Ramsey's own research on the financial behavior of 10,000 millionaires, not a single one said single stocks were one of their top three wealth-building tools. Investing in an employer-sponsored retirement plan was actually the most common path to a higher net worth, according to the millionaires in his survey.

I'm a Financial Planning Expert: Here Are 5 Things You Should Never Spend Money on If You Want To Be Rich

Grant Cardone: Don't Sit on Your Money

Grant Cardone, CEO of Cardone Capital and author of "The 10X Rule," offers some wealth-building advice that may seem counterintuitive at first. But in terms of building your net worth, it makes a lot of sense.

According to Cardone, "Saving, saving, saving won't bring you wealth." Cardone explained in a video tweet that "True wealth is through investing. Invest in things that [create] cash flow." Examples provided by Cardone include investing in yourself or your business and buying assets like real estate that generate cash flow. The point Cardone makes is that simply protecting and preserving your money isn't doing anything to generate real wealth. Taking that money and putting it into motion -- using it to own assets that literally create more money -- is the path to long-term wealth creation.

Barbara Corcoran: Buy Real Estate

Perhaps surprisingly, Barbara Corcoran doesn't believe in saving money. In fact, according to Corcoran, she has "never saved a dime [her] whole life." As the investor told CNBC Make It, "Believing that money makes money, if you're willing to share it and spend it, really works, or at least it has certainly worked for me. I really believe if you spend money it comes back to you."

Of course, Corcoran doesn't mean this in the sense of just blowing your money on discretionary expenses but rather investing. And as a real estate mogul, Corcoran of course believes in the power of real estate to build wealth. As she told the Chicks in the Office podcast, "I believe the best thing you could do is buy something as fast as you can...You have to get in the game of real estate...Forget about the timing."

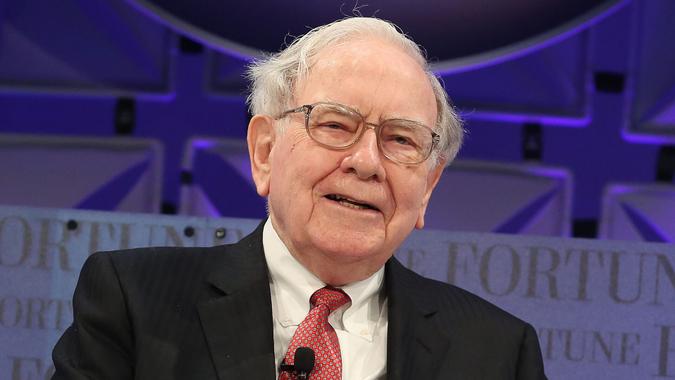

Warren Buffett: Buy Index Funds

The "Oracle of Omaha" and CEO of Berkshire Hathaway is one of the most listened-to financial experts in the world. Investors flock to Berkshire Hathaway's annual meeting in Omaha every year just to hear what type of home-spun, folksy wisdom the billionaire will dispense, and he's frequently quoted in the financial press throughout the year.

One of his most noted bits of advice is that for most investors, simply buying and holding the S&P 500 is the best choice they can make. In his 2017 letter to shareholders, he put this recommendation in quite frank terms: "When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds." The famed investor also told CNBC's Becky Quick that he has instructed the trustee of his estate to invest 90% of his money into the S&P 500 for his wife after he dies.

More From GOBankingRates

- First Year of Retirement: 7 Money Moves You Absolutely Must Make

- Money Expert Jaspreet Singh Says You Can Use ChatGPT To Become a Millionaire -- Here's How

- 3 Ways to Recession Proof Your Retirement

- 55 Easy Ways To Save Money Daily

This article originally appeared on GOBankingRates.com: What Dave Ramsey, Grant Cardone and 3 Other Money Experts Say Is the Best Way To Build Wealth

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.