Based on the concept of factor investing, factor ETFs are exchange-traded funds that invest in companies displaying certain characteristics, or factors, that are associated with risk and return. Factors could include momentum, quality, or low volatility, for instance.

In contrast to index ETFs, which invest in all the companies comprising a benchmark index, factor ETFs construct their portfolios around specific factors to achieve specific investment objectives.

Factor ETFs have become increasingly popular among investors. However, investing in factor ETFs is also considered to be riskier than investing in the broader stock market. It is often suggested that factor investing requires a long-term horizon and is only suitable for investors who are patient enough to ride through market cycles.

How do factor ETFs work?

Factor ETFs operate through a rule-based approach for selecting and weighting stocks. These ETFs establish specific criteria, based on their factor-based methodologies, to identify companies that align with their desired factor profile. Once identified, the ETFs assign weights to these companies

For example, a value ETF might focus on stocks that display low price-to-earnings ratios, while a low volatility ETF might focus on stocks with lower volatility relative to the broad stock market. By selecting stocks based on specific factors, factor ETFs are designed to provide investors with exposure to diverse investment styles and strategies.

Who can invest in factor ETFs?

Traditionally, factor investing is an investment approach implemented by institutional investors. With the proliferation of factor ETFs, individual investors can also incorporate factor-based strategy into their own portfolios.

Factor ETFs are more suitable for long-term investors seeking exposure to specific factors while desiring greater transparency compared to traditional actively managed funds. Having a long-term investment horizon is important, as research studies have shown that factors have experienced, at a minimum, a consecutive two to three-year period of underperformance.

Timing the market is extremely difficult. It is essential to possess the patience required to remain committed to a factor-based investment strategy.

What are the main factors?

There are over 300 factors, but the most popular ones are set out below. All main ETF providers offer factor ETFs on the following:

- Value: This factor refers to buying undervalued stocks and selling overvalued stocks based on some financial metric.

- Dividend: This factor can be defined as the outperformance of those stocks paying high dividends compared with peers with lower dividends.

- Low volatility: This factor assumes that the performance of stocks with low volatility is superior to their riskier counterparts over the long term.

- Momentum: This factor focuses on buying outperforming stocks and selling underperforming ones.

- Quality: This factor assumes that high-quality stocks with more stable earnings, stronger balance sheets and higher margins outperform low-quality stocks, over a long time horizon.

Examples of factor ETFs

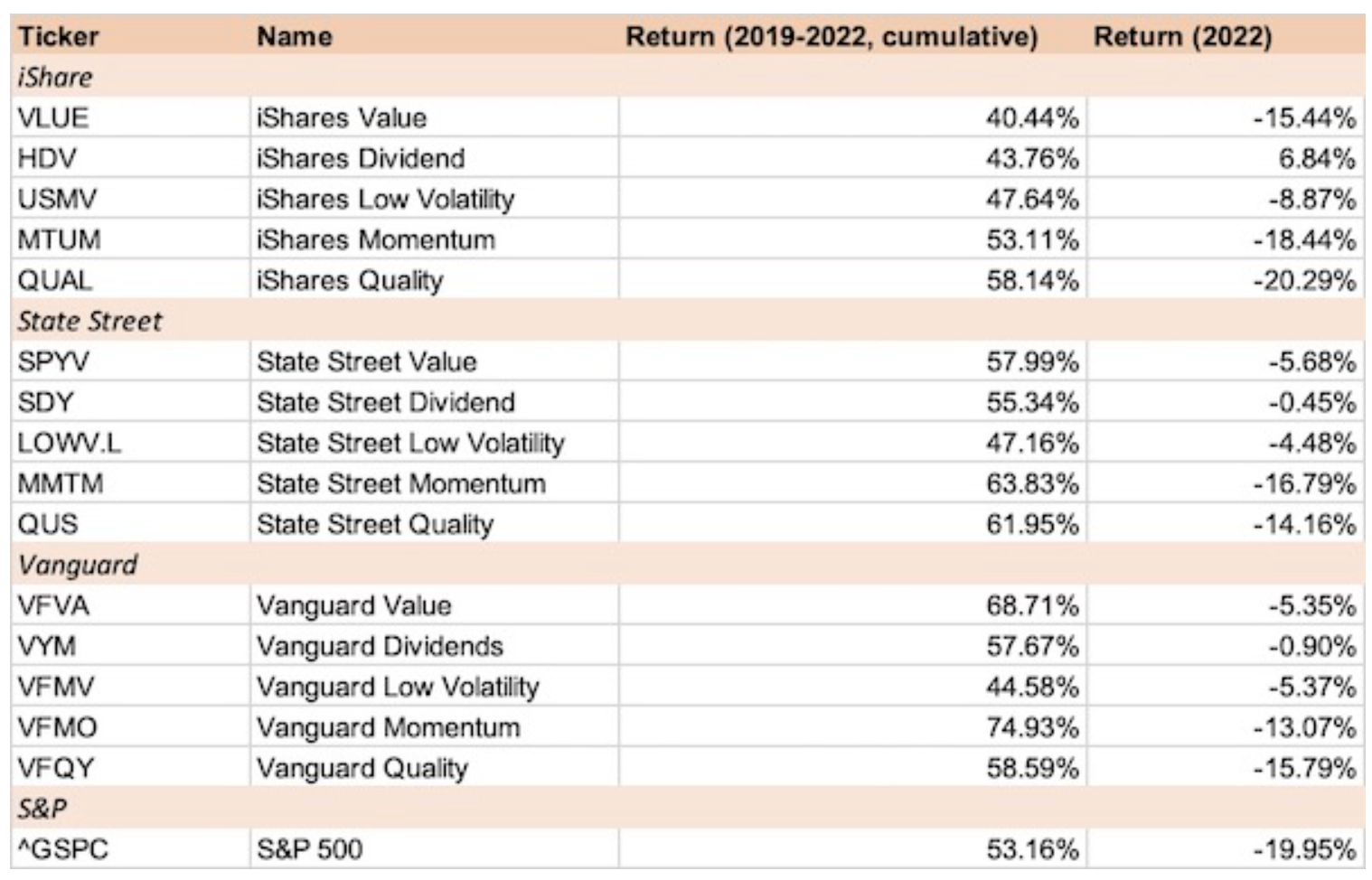

Below is a table put together by Marco Santanché, a former Credit Suisse strategist and author of a monthly research series Quant Evolution. The table features factor ETFs provided by iShare, State Street and Vanguard, along with their cumulative returns in recent years. Notably, the performance of different ETFs focusing on the same factor can vary significantly.

Source: Quant Evolution

Investors should therefore conduct thorough due diligence and comprehend the specifics of each ETF prior to making any investment decisions.

Benefits and risks of factor ETFs

There are several benefits of factor ETFs, although they are not without pitfalls either. Let’s first look at the benefits:

- Intuition: Investing in factor ETFs is generally more intuitive for investors compared with traditional stock picking, as the concepts behind each factor are relatively easy to grasp.

- Potential for higher returns: Factor ETFs are structured to outperform traditional index funds by employing alternative weighting schemes based on factors that have been demonstrated by research studies to generate excess returns over the long term.

- Diversification: Factor ETFs offer investors the opportunity to diversify their portfolio by investing in a broad range of securities that represent a particular factor.

But factor ETFs are also risky in many ways:

- Complexity: There are plenty of factors, and uninformed investors might find it difficult to understand which factors to invest in.

- Timing: It is extremely difficult to time your market entry, and research studies have shown that factors have gone through years of underperformance. It is therefore only suitable for investors who have the patience for long-term investing.

- Methodology: The methodology behind each factor is sometimes unclear, and investors may be exposed to factors that are constructed in a way that is different from what they anticipated.

Overall, we can conclude that factor investing is a useful strategy for enhancing the equity profile of a portfolio. However, rather than solely evaluating factor ETFs based on surface-level information, investors would benefit from dedicating time to understanding the underlying factors within each fund. This diligent approach serves to mitigate potential risks and optimize the overall effectiveness of the strategy.

Related materials:

How to Implement Factor Investing? We spoke to an ex-Credit Suisse strategist

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.