If you've been looking for smart investments to add to your portfolio, you may have come across the term "blue-chip stocks." Blue-chip stocks are renowned for being reliable investments and can offer numerous advantages.

This article will give you a comprehensive overview of the answer to the question, "What are blue chip stocks?" When you finish reading, you'll know what they are, where they come from and why they provide a safe investment option.

Overview of Blue-Chip Stocks

The term "blue chip" originated in 1923 with Oliver Gingold, who worked on Wall Street at Dow Jones & Co. He coined the term to describe stocks with high value and potential for long-term growth. Blue chips usually grow over time and outperform the market indices such as the S&P 500 or Dow Jones Industrial Average (DJIA). The term comes from poker, where the highest-value chips are blue, so a blue chip refers to some of the highest-quality stock on the market.

A blue-chip stock comes from a well-established company with consistently strong performance. These stocks have a long history of paying dividends and increasing their market share. Blue-chip stocks also tend to be resilient when markets take a dip. Since well-established and successful companies issue them, their prices tend to rise more slowly than other stocks, making them less likely to experience rapid drops during downturns. They have strong balance sheets and business models, making them one of the safest investments. By investing in blue chips, your investment is more likely to bring good returns and relatively low risk.

Blue chips tend to have higher dividend yields, which can provide more income without selling the stock. They also tend to be less risky because their performance is more predictable than other stocks. The downside is that a blue chip stock doesn't always outperform the market. You may miss out on potential returns if you don't diversify your portfolio with other investments.

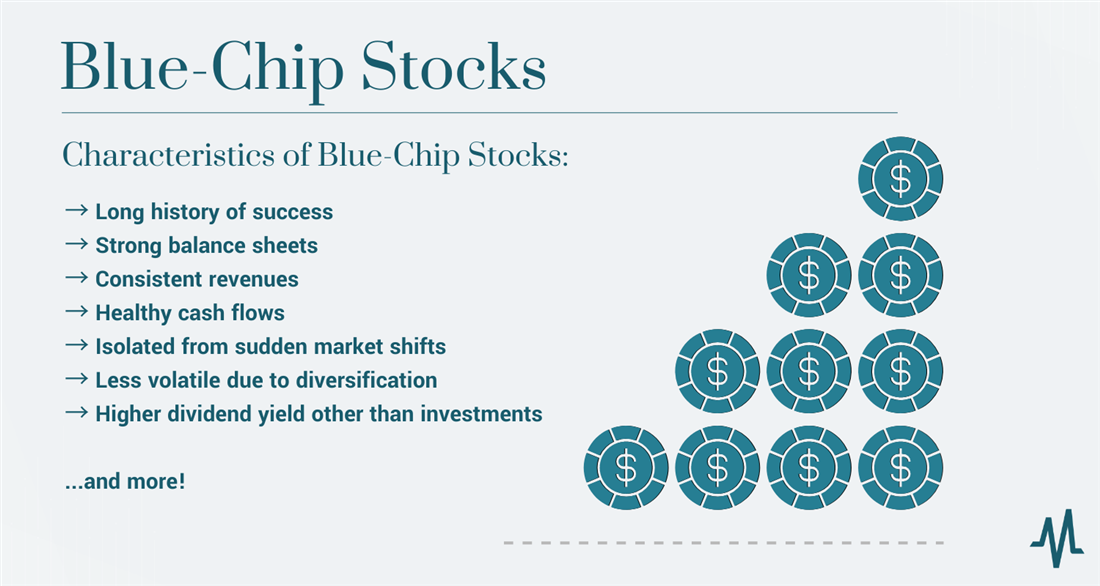

Characteristics of Blue-Chip Stocks

Blue-chip stocks are those of large, well-established and financially sound companies. These companies have operated for many years. Due to their stable history and outlook, their stocks offer investors a steady stream of dividend income and capital appreciation. These stocks usually have a track record of raising dividends over time and have a reputation for stability in the market.

Blue-chip stocks are often less volatile than other types of stocks, which makes them attractive if you're a conservative investor seeking low-risk investments. Here are some critical characteristics of blue-chip stocks:

- Reputation: Blue-chip stocks are associated with more established companies with a long history of success.

- Financials: These stocks typically have strong balance sheets, consistent revenues and healthy cash flows.

- Stability: Since they're associated with larger companies with long-standing operating histories, blue chips are more insulated from sudden market shifts. Blue chips are also less volatile due to their diversification across different industries and sectors, which makes them an appealing choice if you want steady returns.

- High dividend yields: Blue-chip stocks usually offer higher dividend yields than other investments. The companies behind these high-yield blue chips have established dividend policies where they can provide attractive returns to their shareholders.

Reasons to Invest in Blue-Chip Stocks

Blue-chip stocks can offer you numerous advantages. They are some of the most popular investments because they provide a reliable and safe option. Here are five reasons to invest in blue-chip stocks.

Reason 1: Diversification

Investing in blue chips can provide diversification for your portfolio. They tend to have lower volatility than other types of stocks. You're less likely to experience significant losses if one stock performs poorly. Because the companies behind these stocks tend to operate in different sectors and industries, you can diversify further by investing in blue chips across various industries.

Reason 2: Income

Blue-chip stocks usually offer higher dividend yields than other stocks, making them a solid choice if you want regular income from your portfolio. These companies have strong financials and a record of paying dividends with good yields. They're likely to continue to deliver steady dividends over time.

Reason 3: Stability

Companies behind blue-chip stocks have a long operating history and strong financials, making them reliable investments over the long term. Since blue-chip stocks tend to be less volatile than other investments, they're more likely to provide steady returns. Investing in blue chips at a low stock price can offer you a prime opportunity for capital appreciation. Remember, while these stocks are generally more stable, their share prices still fluctuate and may even dip below their 52-week lows.

Reason 4: Recession Protection

Blue-chip stocks are often recession-resistant. These stocks generate strong balance sheets, steady revenues and healthy cash flows. They can provide a buffer against economic downturns because they're more insulated from sudden market shifts.

Reason 5: High Liquidity

Many buyers and sellers of blue-chip stocks make them easy to buy, sell or trade quickly. If needed, you can easily access your capital because more buyers and sellers provide more liquidity to the market.

Reason 6: Valuation

Blue-chip stocks may not experience the same type of volatility as other stocks, but they usually have high valuations and are relatively expensive compared to other equities. They have strong fundamentals and consistent track records, making them popular investments.

Reason 7: Tax Advantages

Investing in blue chips can also offer several tax advantages, depending on your circumstances. If you reinvest your dividends in more shares of the same stock (known as "dividend reinvestment"), this may help you reduce your taxes. Consult with a tax professional to see if investing in blue chips can provide you with any tax advantages.

Examples of Blue-Chip Stocks

Blue-chip stocks can come from various industries, some of the most common being banks, technology and energy. Here is a list of blue-chip stocks, along with their key characteristics:

- Apple Inc. (NYSE: AAPL): This tech giant is one of the most well-known companies in the world. It has delivered steady returns. Apple's long track record in the tech space and its reputation as an innovator makes it a popular choice.

- Microsoft Co. (NYSE: MSFT): Microsoft is one of the largest tech companies in the world. Its stock has seen significant growth over the past decade. As an industry leader, this blue-chip stock can offer you high stability.

- Johnson & Johnson (NYSE: JNJ): The pharmaceutical company has existed for over 100 years. It shows consistent returns and dividends. Johnson & Johnson makes a great choice if you're looking for income from your portfolio.

- Exxon Mobil Co. (NYSE: XOM): Exxon Mobil Co. is the largest publicly traded oil and gas company in the United States and the fourth largest in the world.

- Walmart Inc. (NYSE: WMT): Walmart is one of the world's largest retailers, offering competitive prices on everyday items. Its stock has been relatively stable.

Consider Investing in Blue-Chip Funds

If you want a diversified portfolio, consider investing in blue-chip funds. These mutual and exchange-traded funds (ETFs) invest primarily in blue-chip stocks. Investing in a blue-chip fund allows you to diversify your portfolio without buying individual stocks.

The benefits of investing in a blue-chip fund include:

- Low management costs: The administrative costs of an ETF are typically lower due to passive management.

- High liquidity: Blue-chip funds tend to have high liquidity because they contain easily traded stocks, which means you can access your capital quickly if needed.

- Stability: Because these funds focus on large, established companies, they tend to be less volatile than other investments. They can offer you steady returns and a way to reduce portfolio risk.

- Diversification: These funds offer you exposure to different industries and sectors. They can help you spread out your investments among the most reliable companies in the world.

Investing in blue-chip funds can be a great option if you want reliable returns with minimal risk. It can also give you access to some of the biggest and most well-known companies.

The Bottom Line on Blue Chip Stocks

Blue-chip stocks are an appealing option if you're looking for a long-term, low-risk approach to investing. They offer a variety of advantages, such as consistency in returns, steady income, high liquidity, low risk and recession protection.

Investing in blue-chip funds allows you access to professional advice and diversification across companies and industries. Investing in blue chips can bring you peace of mind. You'll know your portfolio is in the hands of some of the most reliable companies in the world.

FAQs

After discovering the answer to the question "What is a blue chip stock?" and how to invest in blue-chip stocks, you may have further questions. Here are answers to some of the most frequently asked questions about these types of stocks.

What are considered blue chip stocks?

Blue-chip stocks are shares of large, well-established companies and are proven reliable investments. The best blue-chip stocks on MarketBeat offer numerous advantages, such as consistent returns, steady income, high liquidity and minimal risk.

Is Apple a blue-chip stock?

Yes, Apple is a blue-chip stock. It is one of the world's largest and most well-known companies, offering reliable returns and dividend yields. As a leader in the tech industry, investing in Apple can provide you with a high level of stability.

How do you know if a stock is a blue chip?

To determine if a stock is a blue chip, look at its financials and track record, including whether it has a large market capitalization (at least $10 billion). It should also have strong balance sheets, high liquidity and healthy dividend yields. Look for companies that have consistently performed well and are leaders in their respective industries.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.