Westlake Chemical Corporation WLK recently completed the acquisition of Boral Limited’s North American building products businesses consisting of roofing, siding, trim, and shutters; decorative stone; and windows. The all-cash transaction is valued at $2.15 billion.

The acquisition has significantly added to the scale, diversity, and sustainability of its products. The company expects the deal to be incremental to earnings in the first full year of combined operations.

The move follows the recently completed acquisitions of Dimex LLC and LASCO Fittings LLC. It brings the company to the forefront of the mushrooming building products and construction markets, making way for more future innovations.

Westlake said that the transaction doubles its portfolio size in the high-growth North American building products segment. Market analysis forecasts roughly 15% growth in this segment in the next three years. Boral’s high-quality architectural solutions and products will enable Westlake to extend its leading expertise to the segment and bolster it further.

This particular business of Boral has roughly 4,600 employees at 29 manufacturing sites in the United States and Mexico and has generated revenues exceeding $1 billion during the fiscal year ended Jun 30, 2020.

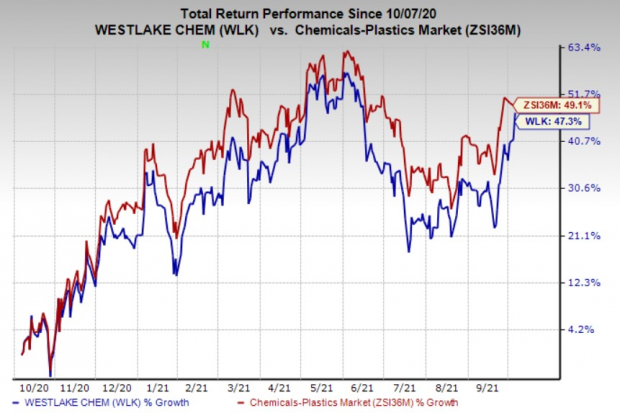

Westlake's shares have risen 47.3% in the past year, underperforming the industry’s 49.1% growth.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In the second-quarterearnings call the company noted that it is keen to continue with its business investments, going forward. It expects the acquisitions of Boral North America and LASCO Fittings, totaling approximately $2.4 billion, to initiate a stage of development and growth for the company. The LASCO buyout is also expected to add to Westlake subsidiary NAPCO’s product portfolio with a focus on new markets and products. Westlake is optimistic about strengthening the housing, repair, and remodeling markets by leveraging the growth opportunities arising from the acquisitions.

Westlake Chemical Corporation Price and Consensus

Westlake Chemical Corporation price-consensus-chart | Westlake Chemical Corporation Quote

Zacks Rank & Stocks to Consider

Currently, Westlake carries a Zacks Rank #3 (Hold).

Better-ranked players in the basic materials space include AdvanSix Inc. ASIX, flaunting a Zacks Rank #1 (Strong Buy) and Atotech Limited ATC and Aperam S.A. APEMY, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AdvanSix has a projected earnings growth rate of 178.1% for the current year. The company’s shares have skyrocketed 213.6% over the past year.

Aperam has a projected earnings growth rate of 429.8% for the current year. The company’s shares have climbed 84.5% over the past year.

Atotech has a projected earnings growth rate of 122% for the current year. The company’s shares have rallied 23.7% in a year.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Aperam (APEMY): Free Stock Analysis Report

AdvanSix Inc. (ASIX): Free Stock Analysis Report

Atotech Limited (ATC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.