The Western Union Company WU recently signed a Memorandum of Understanding (MoU) with the Department of Migrant Workers of the Philippines to provide remittance-related support for Filipino workers working outside the country.

The MoU is expected to bolster Western Union’s efforts to enable Filipino workers to send money back home utilizing its money movement network, which has a strong presence globally. The company’s vast platform capabilities include both digital and physical money movement networks.

WU and the executive department are likely to work together to improve workers’ awareness of financial services through different campaigns. According to the company, more than 10 million Filipino workers stay overseas, which signals the potential traffic that can move to WU’s networks.

The company stated that Philippines is fourth among the largest remittance-receiving countries, per World Bank. In 2022, Filipino workers sent $38 million back home in remittances.

The latest move strengthens Western Union’s relationship with the Department of Migrant Workers of more than two decades. The company is operating in the country for more than three decades. The move is also expected to enable WU to expand its presence to executive department sites in the country.

Western Union’s efforts to increase its presence in developing countries can position it for long-term growth. This can help the company reduce the adverse effects of suspending operations in Russia and Belarus.

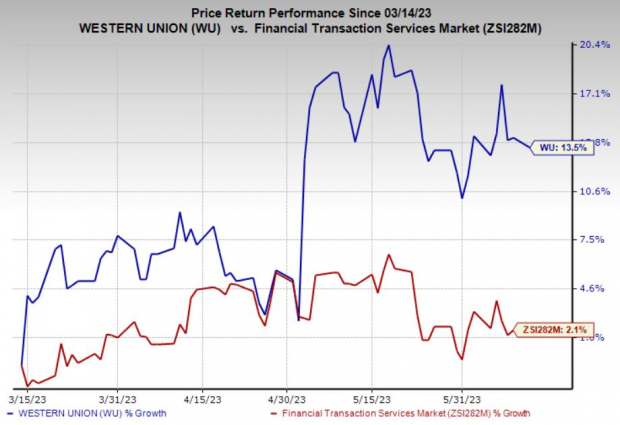

Price Performance

Western Union shares have gained 13.5% in the past three months compared with 2.1% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Western Union currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Business Services space are Green Dot Corporation GDOT, Paysafe Limited PSFE and Remitly Global, Inc. RELY, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Austin, TX-based Green Dot operates as a financial technology and bank holding firm. The Zacks Consensus Estimate for GDOT’s 2023 earnings is currently pegged at $1.83 per share and remained stable over the past month.

Headquartered in London, Paysafe offers digital commerce solutions to different businesses. The Zacks Consensus Estimate for PSFE’s 2023 earnings has improved 243.8% in the past 30 days.

Based in Seattle, WA, Remitly Global is a digital financial services provider. The Zacks Consensus Estimate for RELY’s 2023 earnings suggests 7.4% year-over-year growth.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.The Western Union Company (WU) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Remitly Global, Inc. (RELY) : Free Stock Analysis Report

Paysafe Limited (PSFE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.