Shares of WesBanco, Inc. WSBC have seen no significant change since it announced an additional share repurchase authorization late last week. The company’s board of directors authorized the buyback of up to an additional 3.2 million shares. The program has no expiration date.

WesBanco already has a share buyback program in place, which was announced in April this year. Under this plan, the company was authorized to repurchase up to 1.7 million shares. The company now has almost 0.6 million shares remaining under this plan.

WesBanco noted that the combination of these two authorizations represented nearly 5.8% of the shares outstanding as of Jun 30, 2021.

In addition to the share repurchases, WesBanco pays regular quarterly dividends. The company has been paying dividend of 33 cents per share since April 2021, marking an increase of 3.1% from the prior payout of 32 cents.

Considering the last day’s closing price of $34.16, WesBanco’s dividend yield currently stands at 3.86%. This yield is not only attractive to income investors but also represents a steady income stream. It is also impressive compared with the industry’s average of 1.89%.

WesBanco has a solid balance sheet and liquidity position. As of Jun 30, 2021, the company had total borrowing worth $641.8 million, and cash and due from banks of $846.3 million. Further, its times interest earned of 14.7 and total debt/total capital of 15.4% at the second quarter 2021-end improved sequentially. Thus, the company’s earnings strength and robust liquidity imply that it will be able to meet debt obligations in the near term even if the economic situation worsens.

Its earning strength indicates that WesBanco’s capital deployments are sustainable and will continue enhancing shareholder value. However, low interest rates and weak loan demand are likely to keep hurting its financials in the near term.

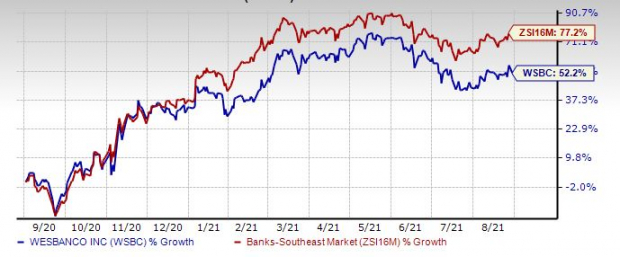

Shares of WesBanco have rallied 52.2% over the past 12 months, underperforming the industry’s growth of 77.2%.

Image Source: Zacks Investment Research

Currently, WesBanco carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Similar Moves by Other Banks

Over the past few months, several banks have announced new share-repurchase programs. Some of these are Civista Bancshares, Inc. CIVB, First Financial Northwest, Inc. FFNW and Zions Bancorporation ZION.

Civista Bancshares’ board of directors authorized the buyback of up to an aggregate $13.5 million of its outstanding shares. The plan will expire on Aug 10, 2022. First Financial Northwest announced a new share-repurchase program, under which it will buy back about 5% of the outstanding common stock or 476,000 shares.

Zions announced that its board of directors authorized additional share repurchases worth up to $200 million for the third quarter of this year. Earlier, in July, the company had announced third-quarter repurchase authorization worth up to $125 million. Thus, now, the total buyback authorization for the third quarter is $325 million.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zions Bancorporation, N.A. (ZION): Free Stock Analysis Report

WesBanco, Inc. (WSBC): Free Stock Analysis Report

Civista Bancshares, Inc. (CIVB): Free Stock Analysis Report

First Financial Northwest, Inc. (FFNW): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.