There’s no doubt that the major US indexes remain in a strong uptrend, with stocks putting together a remarkable 2024 as this latest bull market enters its third year.

Technology stocks have mainly led the way higher, but we are beginning to see other pockets of the market return to the forefront. Better-than-expected corporate earnings, decelerating inflation, and a lower interest rate outlook are all contributing to this recent surge.

Still, many stocks appear extended in the short-term, offering little in the way of low-risk entry points for long investors. In fact, one could argue that there are some attractive short opportunities brewing as we head into the New Year.

While the month of December is historically strong, from a seasonal perspective, we tend to see some mid-month weakness as institutions implement tax-harvesting and profit-taking strategies.

When scanning for short opportunities, it’s important to be selective and target stocks that are already in or are just entering downtrends. We also want to look for companies that have been lagging, as that’s the market’s way of telling us overall buying pressure remains minimal.

One such company is Advanced Micro Devices AMD. Despite underlying strength in the semiconductor space, AMD shares have frustrated investors this year as the major US indexes returned to new heights. As we’ll see, the stock’s traits make it a good candidate for a put option purchase.

AMD Stock Downgraded, Lags Rivals

Advanced Micro Devices is part of the Zacks Computer – Integrated Systems industry group, which currently ranks in the bottom 46% out of more than 250 Zacks Ranked Industries. Because it is ranked in the bottom half of all Zacks Ranked Industries, we expect this group to underperform the market over the next 3 to 6 months.

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1.

Bank of America recently downgraded AMD stock to Neutral from Buy, citing downside risks to its 2025 outlook. The bank slashed their price target from $180/share to $155/share and clipped their 2025 and 2026 fiscal EPS estimates by 6% and 8%, respectively.

Stocks with falling earnings estimates tend to underperform the market over time. As we can see below, analysts have been revising their EPS estimates lower for AMD across the board:

Image Source: Zacks Investment Research

While there are many ways to take advantage of a potentially bearish move in AMD stock, options provide us with flexibility, enabling us to tailor our strategy to the current market environment.

Option Essentials

Before we analyze today’s trade, let’s review some option fundamentals as a refresher. There is no need to worry about complex mathematical formulas or equations. Over the years I’ve found that the more complicated a strategy is, the less likely it is to work over the long run.

Options are standardized contracts that give the buyer the right – but not the obligation – to buy or sell the underlying stock at a fixed price, which is known as the strike price. A call option gives the buyer the right to buy a particular security, while a put option gives the buyer the right to sell the same. The investor who purchases an option, whether a put or call, is the option buyer, while the investor who sells a put or call is the seller or writer.

These contracts are valid for a specific period of time which ends on expiration day. There are weekly options, monthly options, and even LEAPS options which are longer-term options that have an expiration date of greater than one year.

Options consist of time value and intrinsic value. In-the-money options consist of both components; at-the-money and out-of-the-money options consist only of time value. At options expiration, options lose all time value.

Below we’re going to explore a put option purchase strategy.

How to Profit from a Decline in AMD Stock

AMD stock has entered a price downtrend and is making a series of lower lows, making it a good candidate for a put option purchase:

Image Source: StockCharts

When done correctly, trading options provides huge profit opportunities with limited risk.

In today’s trade, we’re going to target the January 17th expiration date and the 165-strike price. Purchasing this option gives us the right, but not the obligation, to sell 100 shares of AMD stock at $165 on or before January 17th, which is a bit over 1 month from now.

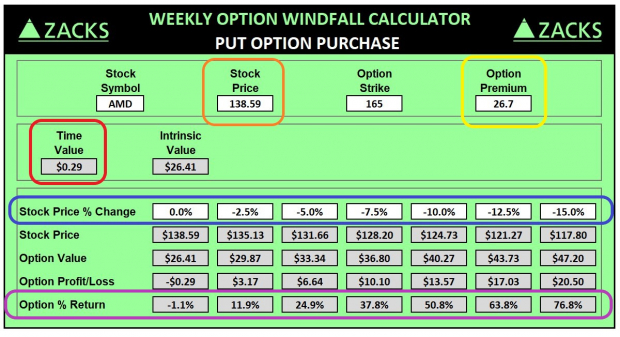

The table below displays the risk/reward profile for this trade. Advanced Micro Devices is currently trading at $138.59/share (orange box). We are purchasing 1 January 17 165-strike put at 26.7 points, which is the option premium. Since options account for 100 shares of the underlying stock, the total cost for this call option trade is $2,670 as we can see in the yellow highlighted box.

Image Source: Zacks Investment Research

The top (blue) row shows the performance of AMD stock based on different percentage scenarios at expiration. The bottom (purple) row shows the corresponding percentage return for our put option trade. We can see that if AMD remains flat, this trade would encounter a minor loss of 1.1%. If AMD moves down 5%, this trade will realize a 24.9% profit. If AMD stock declines 15%, we would realize a 76.8% profit.

This illustration shows the inherent leverage that options provide. A stock trader who shorted 100 shares of AMD would have to effectively borrow $13,859, and the risk is theoretically unlimited. A 15% decrease in the stock price would yield a $2,079 profit.

On the other hand, in this example the put option trader only needs to contribute $2,670 to control the same amount of underlying AMD shares. A 15% move in AMD stock would net a $2,050 option profit – a nearly identical profit amount with only about one-fifth of the investment!

Also note that this option contains relatively little time value. The 0.29 points worth of time value (red box) equate to just 0.2% of the underlying stock price. A good way to manage risk when buying options is to minimize time value and maximize intrinsic value, as time value decays rapidly in the days leading up to option expiration.

Bottom Line

AMD stock continues to lag the general market and is also experiencing negative earnings estimate revisions. Our research has shown earnings estimate revisions to be the most powerful force impacting stock prices.

A great way to take advantage of a decline in AMD is via low-risk put options. The stock is a good candidate for a short-term put option purchase, allowing us to leverage a potential downside move with the power of options.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.