Bitcoin, Ethereum, blockchain, doggycoin — oops, “Dogecoin”. Any of these ring a bell?

Advisors, if you or a loved one was recently diagnosed with crypto knowledge deficiency by a teenage nephew, we have the cure.

YCharts recently hosted Tyrone Ross, licensed investment advisor and Co-Founder of Onramp Invest to discuss all things crypto. Onramp is a technology company providing access to cryptoassets for registered investment advisors, and Tyrone was recently named an Investopedia Top 100 financial advisor and one of Think Advisor’s 2021 IA25 VIP’s Pushing Advisors Forward. Enabling advisors to make the best decisions for their clients and practices, Tyrone and YCharts CEO, Sean Brown covered how, what & why advisors should think about cryptoassets.

Cryptocurrency vs. Crypto Assets vs. Blockchain

Tyrone notes that in order to truly understand crypto, it’s important for advisors to get a few definitions engrained.

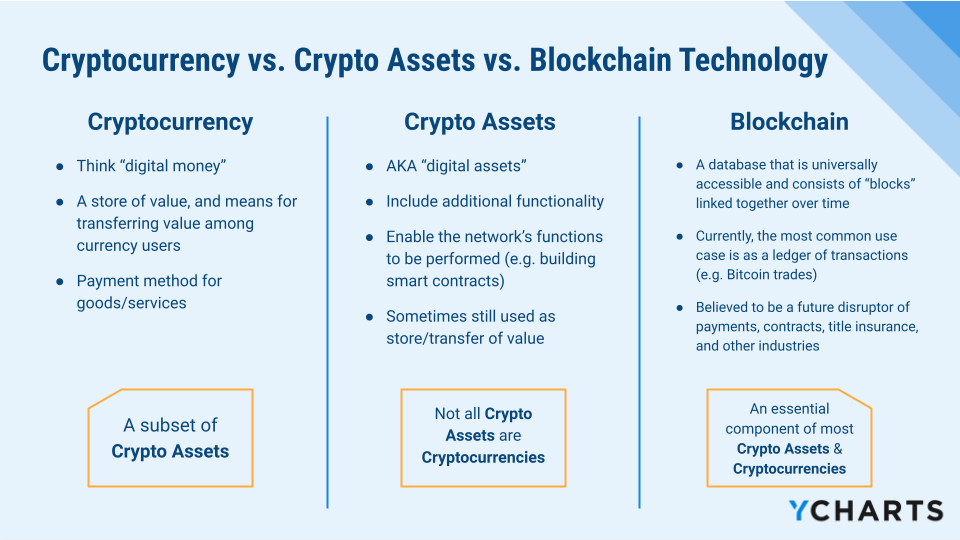

First, there is “cryptocurrency”, or simply “digital money”. Cryptocurrencies are stores of value with means of transferring that value among users, most commonly as payment for goods and services. Separately, “crypto assets” or “digital assets” refer to the larger category of which cryptocurrencies are a subset. Crypto assets are methods of accessing the underlying technology that enable a network’s functions to be performed, often taking the form of crypto coins, crypto cash, utility tokens, security tokens, and non-fungible tokens (NFTs), to name a few.

Finally, there is the “blockchain”, a universally accessible database with a wide variety of applications, the most common of which is a digital ledger of transactions. Blockchain is the technology underpinning for crypto assets and enables cryptocurrency trades, smart contracts, title insurance transfers, and more. The differences can be quite nuanced: Bitcoin is the name of a blockchain, while bitcoin references the currency token. Similarly, Ethereum is a blockchain on which ether, a currency token, is traded, and so on.

In his day-to-day, Tyrone comes across many people who don’t support crypto, yet are backers of the blockchain. But you can’t have one or the other — there would be no cryptocurrencies without an underlying blockchain, nor could blockchain exist if there weren’t any transactions to occur on it.

Prior to the session, we polled a handful of advisor thought leaders in the industry about the most common crypto questions they receive from their clients. According to Dasarte Yarnway of Berknell Financial Group, one of the most common questions about cryptocurrencies he gets is, “Are they safe?” To which Tyrone says, “100%. One of the most secure things in the world is the Bitcoin blockchain.”

Having “The Crypto Talk” with Clients

Financial advisors are no strangers to fielding new topics of questions from clients, and crypto assets are becoming more prominent in those conversations. According to a Bitwise/ETF Trends survey, 81% of surveyed advisors reported receiving questions from clients on crypto in 2020, up from 76% in 2019. On top of that, 22% of advised clients own Bitcoin — a figure Tyrone believes is higher — but only 3.5% hold that Bitcoin with their advisor, says a NYDIG Financial Advisors + Bitcoin survey.

Furthermore, 76% of advisors think clients either are or may be investing in crypto on their own, according to the same Bitwise/ETF Trends survey. If you’re scratching your head at the lack of crypto business from your clients, according to Tyrone, it’s because advisors fail to discuss crypto products with clients before they discover it themselves, or at all.

Clients likely enjoy their current crypto trading platform and as such are unwilling to partake in crypto by the time their advisor surfaces the topic, which would involve using that advisor’s inferior legacy infrastructure (a gap Tyrone’s Onramp Invest platform seeks to close).

Therefore, advisors are providing little to no value for clients in the crypto investing journey. But Tyrone understands and sympathizes with advisors’ viewpoint on crypto — Bitcoin is not yet a store of value—it’s still considered a speculative asset by most. But that’s okay, he says, because the markets are still maturing, as Bitcoin has existed for just 12 years.

For advisors, it all boils down to risk vs. reward. In Tyrone’s view, advisors would be taking a large risk on allocating client money to something that’s only 12 years old, and as such they must be compensated appropriately. If crypto’s return on risk isn’t sufficient for advisors, they won’t — and don’t — talk to clients about the asset class.

The Future of Crypto

A common hesitation among advisors was posed by Steve Dick of Sapiat Asset Management: “The extreme volatility [of crypto assets] may lead to clients making brash, money-losing decisions.” Though Elon Musk “to the moon” tweets and twenty-somethings showing off G-Wagons purchased with crypto winnings might tell a different story, this “upward-to-the-right”, “I-can’t-miss” mindset held by some crypto enthusiasts is “frothy”, according to Tyrone. He believes it’s been caused by a mix of over-exuberance, availability of cash, lack of understanding, and ease of access to trading.

Download Visual | Modify in YCharts

While price appreciation is nice, the asset class has much more potential. Tyrone says blockchain is “the gravity of social justice” because it gives hundreds of millions of people access to banking, investing, and transferring value who wouldn’t have it otherwise. Tyrone believes cryptoassets should be in every ESG mutual fund and ETF since the blockchain can bring these services to disadvantaged areas worldwide.

Currently, advisors can access crypto via digital asset custodian, crypto focused trusts, or crypto-related equities. Though not the best structure in Tyrone’s opinion, trusts created by Grayscale filled demand — including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash — which are easier to set up than crypto tyroneETFs. In Tyrone’s opinion, Bitcoin and Ethereum will be around for the long run, and potentially Cardano — but after those three, it gets to be digging down the rabbit hole.

Above all, Tyrone believes the best way for people to get involved with crypto is by holding the underlying assets, helping the investor to more fully understand what it means to be a part of the crypto economy.

Connect With YCharts

To get in touch, contact YCharts via email at hello@ycharts.com or by phone at (866) 965-7552

Interested in adding YCharts to your technology stack? Sign up for a 7-Day Free Trial.

Disclaimer

©2021 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.