Prime is a membership program from e-commerce giant Amazon, and its importance to the company is probably under-appreciated. With Prime, members get fast free shipping, as well as access to streaming video content and more. In short, there are benefits to being a Prime member, and they've helped drive adoption at Amazon.

Home-goods e-commerce platform Wayfair (NYSE: W) hopes that a membership program of its own can provide the same boost.

On Oct. 22, Wayfair launched Wayfair Rewards, a loyalty program that costs $29 per year. With it, members can get free shipping and discount pricing. According to management, it could boost the company's market share by 50% if things go according to plan.

How Wayfair hopes this works out

In the third quarter of 2024, Wayfair's net revenue was down 2% year over year,and it recorded a net loss of $74 million. The new rewards program lowers prices for members, which could negatively affect revenue. With products at cheaper prices, it could also hurt profits. On the surface, it would seem like this program is a bad idea for boosting the top and bottom lines.

However, Wayfair's management feels differently and laid out a reasonable case. As of Q3, the company had 22 million active customers. This customer base had made almost two orders on average in the past year. But management believes they make four to six additional purchases elsewhere in a given year. With the rewards program, it hopes these members will go from two purchases on Wayfair to at least three -- an increase of 50%.

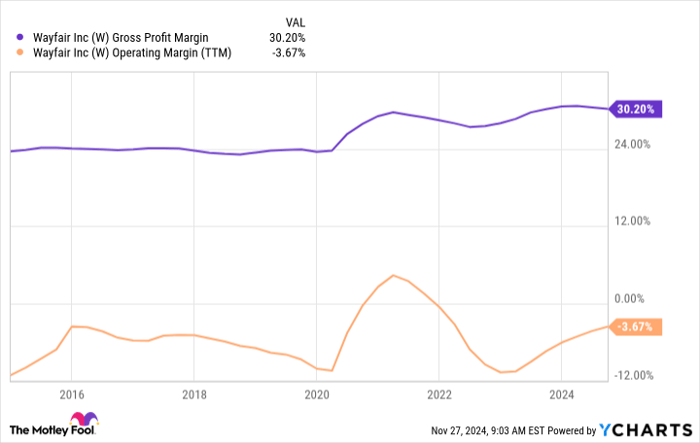

Increasing order frequency with a membership program that helps customers save money would seemingly be problematic for the bottom line. Keep in mind that at 30%, Wayfair's gross margin isn't particularly high to begin with, and its operating margin is normally negative, as the chart below shows.

W Gross Profit Margin data by YCharts.

That said, there are second-order benefits to the plan. Consider that if a customer pays the annual membership fee, this customer likely doesn't need advertising to make a purchase -- they already have incentive. This is actually quite significant.

Through the first three quarters of 2024, Wayfair has spent 40% of its gross profit on advertising. Any meaningful reduction on advertising spend would have a dramatically positive effect on the company's bottom line. Indeed, the membership program could be a much more efficient way to get customers to buy products from its platform with greater frequency.

What shareholders should watch for now

Will Wayfair's plan actually work? Obviously, there's no way to know for sure at this point. That said, this is a development that will be extremely easy for shareholders to monitor in coming quarters.

In Wayfair's quarterly financial reports, it provides quarterly highlights. Included in these highlights is its active customer count and its orders per customer. Shareholders should monitor orders per customer now that Wayfair Rewards has launched. If it starts ticking higher and its overall customer count stays at least steady, then it would strongly suggest its program is indeed incentivizing customers to spend more money on the platform.

The other thing to watch is how much Wayfair is spending on advertising. This metric is found on its statement of operations in the quarterly reports. If advertising ticks lower while orders per customers tick higher, then it likely means the rewards program is working. That could have big effects on the bottom line, which would almost certainly send the stock higher.

Should you invest $1,000 in Wayfair right now?

Before you buy stock in Wayfair, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Wayfair wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $847,211!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool recommends Wayfair. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.