Berkshire Hathaway's (NYSE: BRK.A) (NYSE: BRK.B) cash pile reached a record level in the third quarter. The company, run by investor Warren Buffett, keeps trimming its equity portfolio and is now sitting on close to $325 billion in cash on its balance sheet. While this does not necessarily mean Buffett is making a directional call on the stock market, the Oracle of Omaha is being more cautious with his investments today as the market shoots up to all-time highs. Be greedy when others are fearful, as he might say.

His largest source of raising cash has been Apple (NASDAQ: AAPL), which Buffett has consistently trimmed this year. He sold yet again in the third quarter, reducing the stake for Berkshire Hathaway to an estimated 300 million shares worth around $69.9 billion. Earlier in the year, he sold close to 400 million shares, which reduced the company's stake by around half.

Even as Buffett sold down Berkshire's Apple position, the stock kept climbing and has been up by around 25% in the last 12 months. Does that give other shareholders the opportunity to trim their positions in the technology giant at the right time? Let's take a closer look and investigate whether now is a good time to sell Apple stock from your portfolio.

Slow revenue growth, antitrust risk

Apple reported its Q4 and full fiscal 2024 earnings at the end of October. The maker of iPhones grew its revenue for the first time in a while during the quarter, up 6% year over year to $95 billion. This was driven by iPhone sales and the company's lucrative software services division. For the full fiscal year, software services revenue hit $96 billion, up from $85 billion a year prior.

Growth was strong this quarter, but Apple's revenue has been anemic compared to the rest of the big technology companies over the last few years. Its revenue and free cash flow are still below their peaks at the midpoint of calendar 2022. Its big technology peers, Alphabet, Amazon, and Microsoft, have posted much more consistent and faster revenue growth than Apple in the last few years. Perhaps this revenue growth slowdown is why Buffett has greatly trimmed his Apple position.

The iPhone is still putting up wonderful numbers for Apple. It is the other divisions that are lagging. The iPad and wearables (watches/headphones) segments saw declining revenue last fiscal year, and these are newer products than the iPhone. Even worse, Apple released the Vision Pro this year. Remember that monstrosity? Well, it seems that few people do, as the product has been a total flop and money waster for the tech giant. Few people are using it today.

Another risk that could be on Buffett's mind is the antitrust lawsuit over Google Search. Alphabet pays Apple an estimated $20 billion annual fee for Google Search to be the default search engine of choice on Apple devices. The government is deciding whether this should be made illegal due to anti-competition concerns. If the decision falls against the companies, Apple could see $20 billion in annual profits evaporate in an instant. That is a good chunk of the $123 billion in operating earnings generated this year.

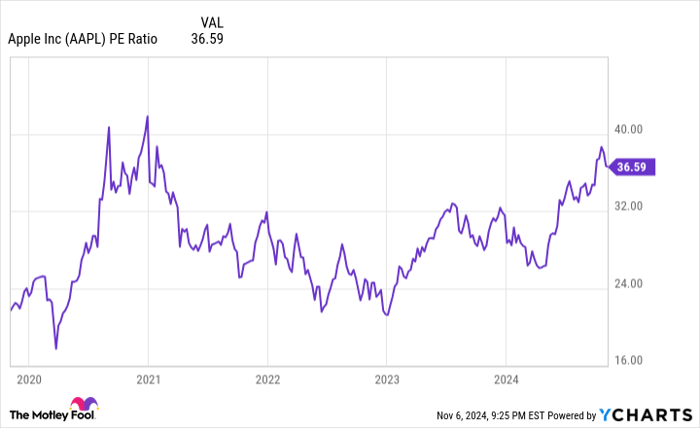

AAPL PE Ratio data by YCharts

Should you follow Buffett?

There are a lot of puts and takes with Apple's business. IPhone and software services are driving stable earnings, but there is some downside risk due to weak demand from any of its new product lines, along with the antitrust lawsuit against Google Search. On the whole, I don't think this factors too much in Buffett's decision-making. He believes -- and has said many times -- that Apple has a wide moat due to its fantastic brand and the switching costs that come with joining its hardware ecosystem.

I believe the main reason Buffett has trimmed his Apple position is valuation. The stock trades at a price-to-earnings ratio (P/E) of about 36 as of this writing, which is a nosebleed multiple for a low-growth business. When Buffett was buying Apple, it had a P/E of between 10 and 15. Buffett mentioned earlier this year that he felt corporate tax rates in the United States would go up due to the huge spending deficit of the federal government.

Should you trim Apple along with Buffett? If it is an outsized position like at Berkshire Hathaway (at one point, it was over 50% of his stock portfolio), then it might be smart to trim at this inflated earnings multiple along with Buffett. However, the company still has a strong competitive advantage and a great brand. As long as that is the case, there's no reason to dump your entire position to the curb.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $23,446!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,982!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $428,758!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Brett Schafer has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.