The stock market has been hitting new highs this year as excitement continues to build with respect to artificial intelligence (AI) and the opportunities that may open up for many businesses. But while retail investors have been eagerly buying up stocks, Warren Buffett has been fairly quiet and doing more selling than buying.

The Oracle of Omaha has cautioned investors in the past "to be fearful when others are greedy," which reflects his overall cautious approach to investing. Minimizing losses are a priority for him, and AI likely wouldn't fall into his circle of competence, which is what he focuses on when deciding which stocks to buy.

Should investors take Buffett's conservatism in the markets this year as a red flag?

Valuations are high based on historical levels

In the third quarter, Buffett continued selling stocks, and Berkshire Hathaway's cash balance reached more than $325 billion, which is higher than the nearly $277 billion it reported a quarter earlier. He has been selling shares of Apple and Bank of America for multiple periods, two top holdings in the Berkshire portfolio, and hasn't been making big moves with that money, resulting in a growing cash balance.

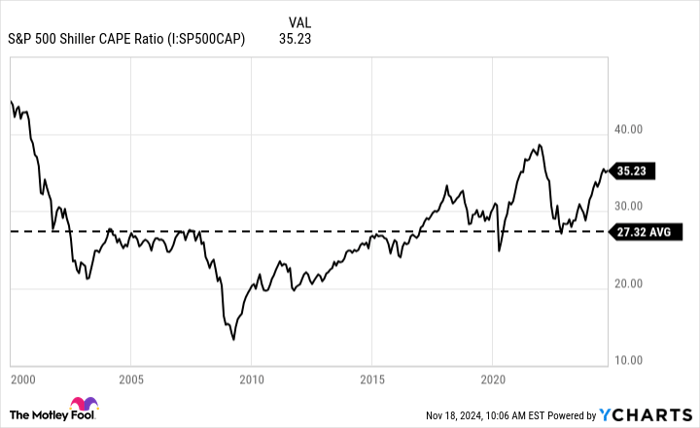

But given how expensive the stock market has become these days, it's perhaps little wonder that he's taking a cautious position. One metric investors should pay close attention to is the S&P 500 Shiller price-to-earnings (P/E) ratio, which averages inflation-adjusted earnings over the past decade. Today, the ratio is well above what it has averaged since 2000. The previous times it has been this high, there have been significant declines in the market the following year.

S&P 500 Shiller CAPE Ratio data by YCharts.

The Shiller P/E ratio was higher in 2021. The following year, in 2022, the S&P 500 would crash by more than 19%. In the early 2000s, the market underwent a significant dot-com crash due to the tech bubble. Many value-oriented investors may be concerned that the same could be happening with AI stocks today; many of them are trading at egregious multiples. Shareholders of Palantir Technologies, for example, don't seem to be balking at its massive earnings multiple of more than 300.

A value-focused option for investors to consider

Even if you're worried about valuations or the possibility of a crash in the markets, it may not necessarily mean that you should sell all of your stocks and pull all of your money out. If a correction takes place, some stocks will inevitably be hit much harder than others. Stocks trading at more reasonable valuations could weather the storm better than stocks which are at obscene multiples. Meanwhile, trying to time the market and waiting for ideal investing conditions is not an optimal strategy as it could result in you missing out on gains along the way.

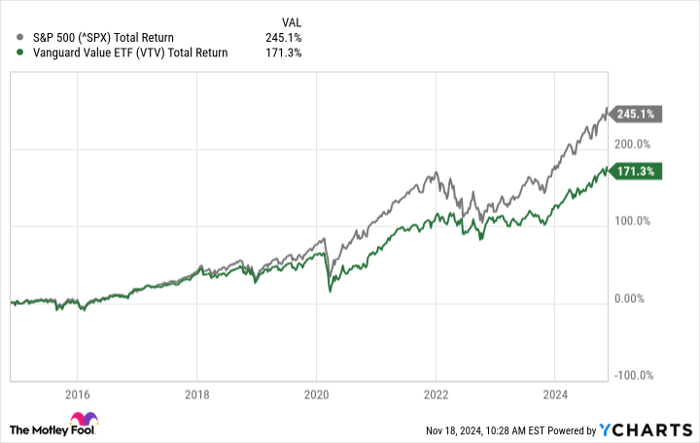

An alternative for investors is to consider an exchange-traded fund (ETF) which prioritizes value investments. A good example of that is the Vanguard Value Index Fund ETF Shares (NYSEMKT: VTV). The fund has a low expense ratio of 0.04% and tracks the U.S. Large Cap Value index. With the average holding in the ETF averaging an earnings multiple of just over 20, investors are getting exposure to more attractively priced stocks than the overall S&P 500 index, which is averaging a multiple of nearly 26.

The top holding in the Vanguard fund is Buffett's own Berkshire Hathaway, but at just 3% of the fund's weight, it doesn't represent a huge chunk of the overall portfolio. Investors will also get access to many other blue chip stocks with the ETF, including UnitedHealth Group and Home Depot. Historically, the fund has underperformed the S&P 500, but in a possible downturn, it could be the better buy, especially given how expensive many growth stocks are right now.

Investors should prepare for a possible correction

Timing the market is risky, but what can be even riskier is holding stocks which trade at extremely high premiums because they can be vulnerable to a sell-off at a moment's notice.

When stocks are highly valued, expectations will also be high, and any sign that a company could face difficulty could prompt investors to hit the sell button. It doesn't have to be a bad earnings report, as corrections could happen at any time investors start to smell trouble ahead. That's why it's important to consider valuations and potentially move money into cheaper stocks which may not only provide more protection during a downturn but may possess more upside in the long run.

And if you aren't sure which stocks to buy or sell, a good option is to consider the Vanguard Value ETF or similar types of investments which prioritize value stocks.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $380,291!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,278!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $484,003!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 18, 2024

Bank of America is an advertising partner of Motley Fool Money. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, Home Depot, Palantir Technologies, and Vanguard Index Funds-Vanguard Value ETF. The Motley Fool recommends UnitedHealth Group. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.