Are you looking for a particular amount of recurring dividend income? Maybe you've got ongoing bills to pay from your retirement savings? Whatever the case, Bank of America (NYSE: BAC) is a compelling way to generate reliable cash flow from your investments.

Bank of America stock's dividend-paying potential

BofA stock currently boasts a dividend yield of just under 2.5%. If you needed $1,000 worth of annual dividend income, a $40,816 investment in Bank of America right now would produce this amount of cash in a year. If you need that amount of income on a quarterly or monthly basis, the required investment is ratcheted up to $163,265 and nearly $490,000, respectively.

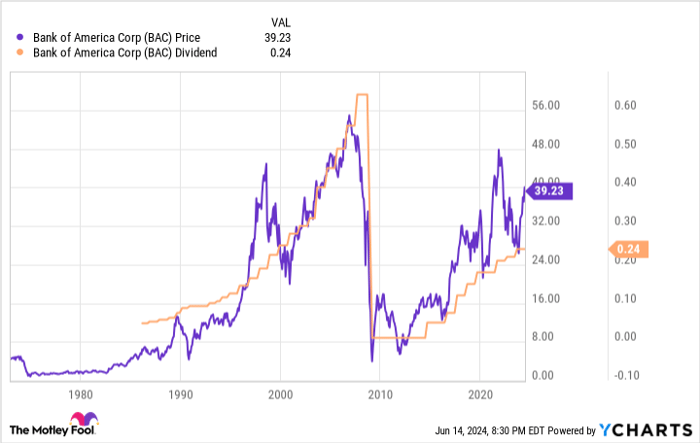

That's a pretty large chunk of change for what's not a great deal of dividend income. There are certainly higher-yielding dividend stocks out there. What BofA lacks in total yield, however, it makes up for in reliable dividend growth and capital appreciation. Ever since finally and fully shrugging off the effect of 2008's subprime mortgage meltdown in 2016, the U.S.'s second-biggest bank has been steadily raising its per-share dividend payment. It's grown at an annualized pace of 25% since that time.

The stock itself has a strong performance track record as well, rallying from late 2011's low of $4.92 per share to its present price near $39.

BofA is a reliable, low-maintenance dividend payer

There are prospective risks worth keeping in mind should you decide to step into a stake in Bank of America. Chief among them is the prospect of another financial crisis like the one we saw in 2008, which up-ended BofA stock in addition to forcing a prolonged reduction of its dividend. Although there are now safeguards in place to prevent such a calamity from taking shape again, never say never -- most problems are inherently unpredictable. Bank of America isn't immune to them.

Barring this sort of generational event, however, Bank of America is one of the more reliable dividend-paying stocks you can rely on to generate consistent income.

Should you invest $1,000 in Bank of America right now?

Before you buy stock in Bank of America, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bank of America wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.