Market’s lost steam this week as Walmart WMT gave a cautious outlook after releasing its Q4 results on Thursday.

With more retail earnings set to provide insight into the strength of the consumer in the coming weeks, Wall Street will be anticipating Target’s TGT Q4 report on Tuesday, March 4.

Walmart’s Q4 Results

Walmart’s Q4 sales increased 4% year over year to $180.55 billion versus $173.38 billion in the prior year quarter. Edging Q4 sales estimates of $180 billion, CEO Douglas McMillon stated Walmart continues to gain market share across countries and income levels.

McMillon highlighted that Walmart’s profit is growing faster than its sales, with Q4 EPS of $0.66 rising 10% from $0.60 per share a year ago and topping expectations of $0.65. However, while Walmart expects a relatively stable operating environment this year, the company still expects uncertainties related to consumer behavior and global economic and geopolitical conditions. Still, Walmart has now reached or exceeded earnings expectations for 11 consecutive quarters with an average EPS surprise of 7.36% in its last four quarterly reports.

Image Source: Zacks Investment Research

Target’s Q4 Expectations

Based on Zacks estimates, Target’s Q4 sales are thought to have dipped 3% to $30.73 billion compared to $31.92 billion in the comparative quarter. Following a tougher-to-compete-against period, Target's earnings are slated to drop to $2.24 per share from Q4 EPS of $2.98 a year ago.

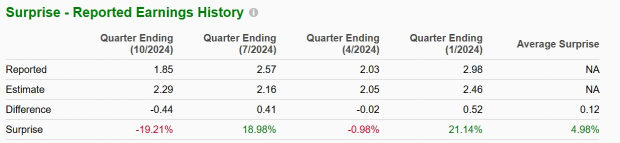

Target has exceeded bottom line expectations in two of its last four quarterly reports but most recently missed Q3 EPS expectations by 19%, with earnings at $1.85 a share and the Zacks Consensus at $2.29.

Image Source: Zacks Investment Research

Tracking Walmart & Target’s Outlook

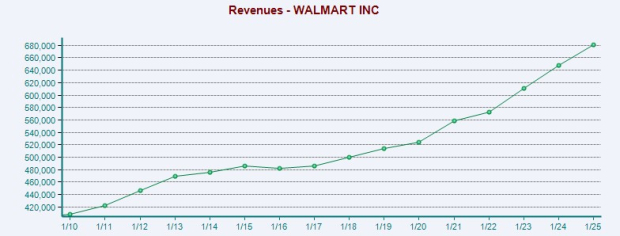

Rounding out its fiscal 2025, Walmart’s total sales increased 5% to $680.99 billion. Even better, annual earnings rose 13% to $2.51 per share from EPS of $2.22 in FY24. Offering full-year FY26 guidance, Walmart expects its consolidated net sales to expand by approximately 3-4%, which fell in line with Zacks projections of $702.4 billion and just over 3% growth.

That said, Walmart projects FY26 EPS in the range of $2.50-$2.60, which came in below the current Zacks Consensus of $2.74 or 9% growth.

Image Source: Zacks Investment Research

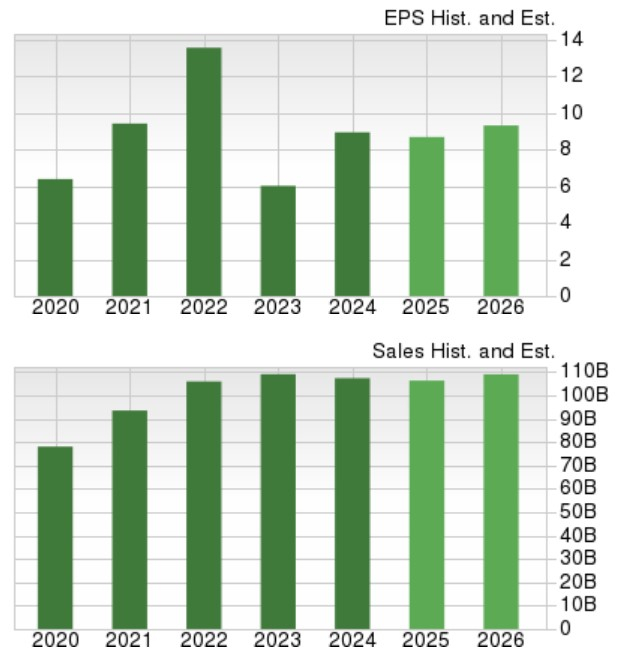

As for Target, the company is expected to round out its FY25 with total sales dipping roughly 1% to $106.38 billion, based on Zacks estimates. Target’s annual earnings are slated to decrease 3% to $8.69 per share from EPS of $8.94 in FY24.

Optimistically, Target’s top line is projected to stabilize and increase 2% in FY26 to $109.09 billion. Furthermore, annual earnings are forecasted to rebound and rise 7% in FY26 to $9.32 per share.

Image Source: Zacks Investment Research

Stock Performance & Valuation Comparison

Correlating with Walmart’s steady growth, WMT has soared over +60% in the last year. This has impressively outperformed the benchmark S&P 500’s +21%, with Target’s stock down -17%.

Image Source: Zacks Investment Research

While shrink and other inventory issues has caused TGT to lose its mojo in recent years, Target’s stock trades at its cheapest levels in over a decade at 13.7X forward earnings. In comparison, Walmart shares are at a 35.4X forward earnings multiple, with the benchmark at 23.1X.

Image Source: Zacks Investment Research

Bottom Line

Investors may feel inclined to invest in Target’s stock at a significant discount to Walmart in terms of its P/E valuation. Meanwhile, Walmart’s expansion is hard to overlook, with both stocks landing a Zacks Rank #3 (Hold). Target’s valuation and Walmart’s growth are certainly suitable for long-term investors, but there could still be better buying opportunities ahead amid recent market volatility.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpTarget Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.