Even as consumers have experienced some continued stress from the prior period of high inflation, Walmart (NYSE: WMT) continues to be one of the biggest winners in the retail space. The retail giant posted another strong quarter of sales and took a positive view on the upcoming holiday season.

The stock is now up more than 60% year to date, as of this writing. The question for investors is, can the momentum in the stock continue? Let's take a closer look at its most recent results and guidance to help find out.

Strong sales and raised forecast

Continuing its string of solid mid-single-digit growth, Walmart's revenue rose 5.5% in the third quarter, which ended Oct. 31, to $169.6 billion. Adjusted earnings per share (EPS), meanwhile, climbed up 14% to $0.58. Both metrics topped analysts' expectations, which called for revenue of $167.2 billion and adjusted EPS of $0.53.

In the U.S., Walmart store sales increased by 5% to $114.9 billion, while same-store sales climbed 5.3% without fuel. Average ticket increased by 2.1%, while transactions rose by 3.1%. E-commerce sales were a standout, jumping 22%. The e-commerce gains were helped by a big jump in new sellers on its marketplace.

Walmart+ memberships once again rose by double digits as the retailer leans into convenience. General merchandise sales grew by low single digits as the category continues to rebound despite rolling back some prices. Grocery, meanwhile, grew by mid-single digits, and health and wellness jumped by mid-teens, helped by GLP-1 drugs.

Internationally, Walmart sales climbed 8% to $30.3 billion, and were up over 12% in constant currencies. The company credited this growth to strength at Flipkart (India e-commerce), Walmex (Mexico), and China. It noted Flipkart's big shopping day event fell in Q3 this year versus last year, which helped growth. International e-commerce sales surged 43%, while advertising revenue soared 50%.

Its warehouse store concept, Sam's Club U.S., grew revenue nearly 4% to $22.9 billion. Same-store sales, excluding fuel, soared 7% with transactions up 6.4% and the average ticket up 0.5%. E-commerce sales jumped 26%, while memberships climbed 15% year over year. The company's Scan and Go technology continues to be a driver for Sam's.

This table shows Walmart's important revenue and profitability metrics by segment for the third quarter:

| Metric | Walmart U.S. | Walmart International | Sam's Club | Overall |

|---|---|---|---|---|

| Revenue (in billions) | $114.9 | $30.3 | $22.9 | $169.6 |

| Revenue growth | 5% | 8% | 3.9% | 5.5% |

| Same-store sales growth | 5.3% | N/A | 7% | 5.5% U.S. only |

| - Transactions | 3.1% | N/A | 6.4% | |

| - Ticket | 2.1% | N/A | 0.5% | |

| - E-commerce | 22% | 43% | 26% | 27% |

Data source: Walmart

Looking ahead, Walmart increased its full-year guidance for both sales and earnings. It now expects revenue to grow between 4.8% to 5.1% in constant currencies, with adjusted EPS to come in a range of $2.42 to $2.47. This chart below shows how Walmart has raised its guidance throughout the year.

| Metric | Original Guidance (Feb) | Prior Guidance (Aug) | New Guidance (Nov) |

|---|---|---|---|

| Revenue growth (constant currency) |

3% to 4% |

3.75% to 4.75% |

4.8% to 5.1% |

| Adjusted operating income growth |

4% to 6% |

6.5% to 8% |

8.5% to 9.25% |

| Adjusted earning per share |

$2.23 to $2.37 |

$2.35 to $2.43 |

$2.42 to $2.47 |

Data source: Walmart

Image source: Getty Images.

Is now a good time to buy Walmart stock?

Walmart is firing on all cylinders at the moment. Consumers are looking for value after all the inflationary pressure of the past couple of years, and they are finding it at Walmart, which has been rolling prices back. Meanwhile, it is able to do this without sacrificing gross margins, given its buying power.

The company is gaining a lot of customers from higher income brackets, who both like the value the retailer brings and the convenience through its Walmart+ membership that offers same-day delivery. Walmart said households earnings over $100,000 accounted for 75% of its gains in the quarter.

It's also notable that Walmart is not just seeing strength in everyday consumables, but also in areas such as in-home tech, toys, and seasonal decor. This should bode well for the all-important holiday season.

Walmart is also starting to nicely benefit from other revenue streams as well, including advertising and memberships. In the quarter, membership fees and advertising income accounted for more than half of its operating income improvements. Meanwhile, e-commerce now makes up about 18% of its sales.

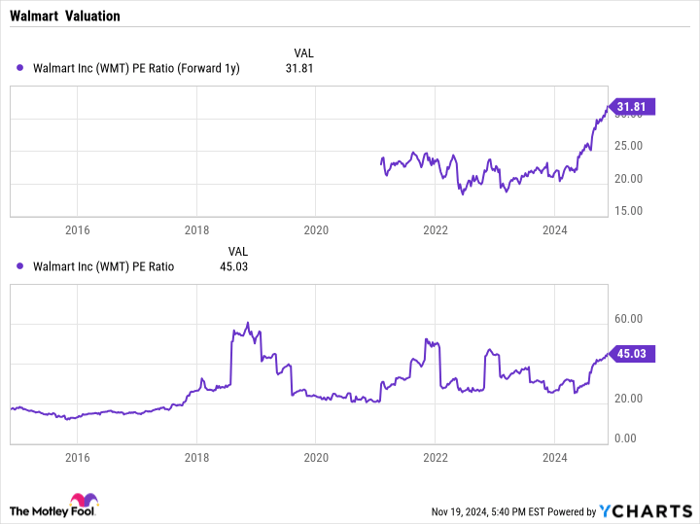

From a valuation perspective, Walmart's shares now trade at a forward price-to-earnings (P/E) ratio of just under 32 times next year's analyst estimates and 45 times trailing P/E. The latter is toward the high end of its historical value range.

WMT PE Ratio (Forward 1y) data by YCharts

Thus, while I think Walmart is doing a great job and will continue to be a long-term winner, I would be more inclined to hold the stock at current levels than be a new buyer based on valuation. The company is performing well, and the upcoming holiday season looks promising, but its valuation is just a bit ahead of itself at the moment.

Should you invest $1,000 in Walmart right now?

Before you buy stock in Walmart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walmart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $833,545!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 25, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.