Earlier this month, Nvidia was added to the Dow Jones Industrial Average. It has nearly tripled in value this year -- making it by far the best-performing Dow component in 2024. But when it comes to Dow stocks that have been in the index for longer than just a few weeks, Walmart (NYSE: WMT) takes first prize as the best performer year to date, with a whopping 72.1% gain compared to just a 17.5% gain for the index.

Here's what's behind Walmart's breakout year and if the dividend stock is worth buying at its all-time high.

Image source: Getty Images.

The anatomy of a breakout

The following chart provides an excellent picture of Walmart's performance over the last 20 years.

WMT Revenue (TTM) data by YCharts

In the late 2000s, Walmart thrived, with strong revenue growth and 5.5% to 6% operating margins. 2010 to 2015 saw slower sales growth and slightly lower margins.

From 2015 to 2020, Walmart struggled to adjust to Amazon and the proliferation of e-commerce. The momentum of wholesale retailers like Costco Wholesale directly challenged Walmart-owned Sam's Club. Then came the COVID-19 pandemic, which disrupted all retailers and forced Walmart to make tough choices. But it also led to creative ideas that Walmart has since expanded upon (more on that later).

As you can see in the chart, Walmart's sales ticked higher in the early part of the pandemic, paused as supply chain disruptions and inflation took a sledgehammer to growth and margins, and then entered a new gear over the last two years or so as margins have also recovered.

What's so impressive about Walmart's performance in recent quarters is that it is delivering record results during a time when so many of its peers are struggling. The simple reason why Walmart is lapping the competition is because its long-term investments are paying off.

Walmart's reimagined business model

On Sept. 1, 2020, during the height of the pandemic, Walmart introduced Walmart+, a contactless home delivery service leveraging thousands of Walmart stores. Walmart+ would grow to become an integral aspect of Walmart's expanded customer offering.

In the recent quarter, income from Walmart+ grew double digits -- which has been the theme for a while now. Global e-commerce sales grew 27%, which includes store-fulfilled pickup, delivery, and Walmart Marketplace. Walmart Marketplace is a business-to-business e-commerce offering that allows customers to leverage Walmart's fulfillment services, advertising, and more to boost their sales.

Walmart Connect offers sellers a variety of solutions and insights into ad performance. Walmart Connect offerings have expanded in recent years and now include sponsored searches, mobile media, in-store offerings, and more.

For example, Brand Shop allows sellers to customize a virtual storefront with built-in search engine optimization to boost results. The continued evolution of Walmart's e-commerce business and the tools it provides to sellers are translating into meaningful results.

Walmart's U.S. comparable sales were up 5.3% in the quarter thanks to a 3.1% increase in transaction volume and a 2.1% increase in the average transaction amount. The real standout from the results was that e-commerce alone contributed 290 basis points or over half of the comparable sales growth.

For the full fiscal year, which ends Jan. 31, Walmart is guiding for a 4.8% to 5.1% increase in sales, an 8.5% to 9.1% increase in adjusted operating income, adjusted earnings per share (EPS) of $2.42 to $2.47 (a 10.1% year-over-year increase at the midpoint), and capital expenditures (capex) of 3% to 3.5% of net sales, which would be around $21.9 billion.

As good as Walmart's results are, margins could be even higher if the company weren't investing so much in capex. For context, Walmart's capex as a percentage of revenue was just 2% five years ago. Walmart's revenue has grown by 28.6% over the last year, but capex is up 111%.

It's also worth mentioning that Walmart bought back just $3 billion in stock so far this fiscal year, which is relatively small for a company of its size. Walmart's aggressive capex paired with its stock repurchase behavior shows that the company prefers to invest in long-term growth through business improvements. In other words, it has ideas and wants to put capital to work rather than just buy back stock.

In addition to its digital and e-commerce investments, Walmart has invested in new stores and existing store remodels to improve the customer experience and offer more optionality for its advertisers. It has even used generative artificial intelligence to improve its product category and has changed its supply chain and fulfillment process.

On theearnings call Walmart CEO Doug McMillon answered an analyst question about wages and pricing -- calling Walmart's capital allocation strategy "appropriately aggressive."

We think we are investing the right amounts, obviously, but it is a fluid situation. We watch price gaps. We watch what's happening in the employment market and have freedom now to be able to make different investments if we want to. So, I think from a kind of an income statement point of view, I feel like we're being appropriately aggressive. And on the capital side, you know that we've made some significant decisions over the last few years to invest in automation in the supply chain, for example. But we're also being, I think, very aggressive as it relates to store and club remodels. So, I feel like on the capital side, we're also being aggressive. And as we do that, because of the way that we've set ourselves up, we can grow profit faster than sales and do those things at the same time.

McMillon's confident response shows that Walmart believes it can be competitive on pricing and wages and still allow profits to grow faster than sales -- leading to higher operating margins.

Walmart has become a growth stock

While there is so much to like about Walmart as a business, Walmart (the stock) does have a couple of glaring problems. The first is its dividend yield. Walmart is a Dividend King with more than 50 consecutive years of dividend raises. But until recently, many of those raises were small. Walmart's surging stock price, paired with years of tiny raises, has pushed its yield down to just 1%, which is lower than the S&P 500 average yield of 1.2%.

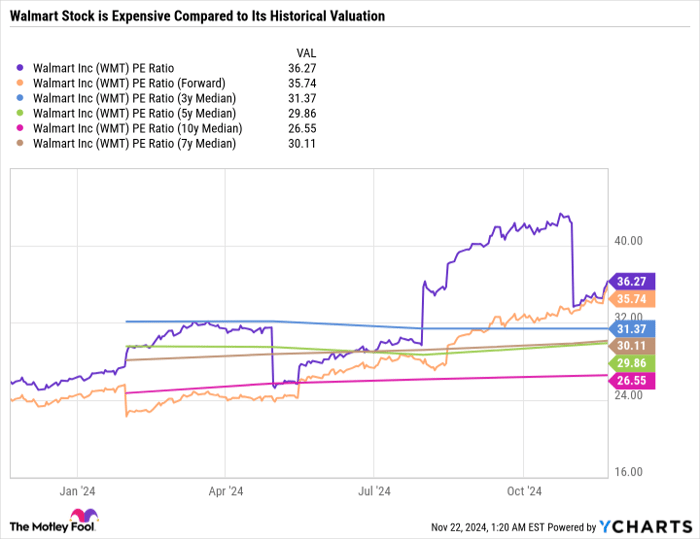

Another issue is valuation. Walmart's price-to-earnings (P/E) ratio is a whopping 36.5. Even if it achieves the midpoint of its adjusted fiscal 2025 earnings guidance, it will still have a P/E ratio of 36.2 -- not much better.

As you can see in the following chart, Walmart has historically been a fairly expensive stock -- regularly commanding a premium valuation to the S&P 500. But nothing like today.

WMT PE Ratio data by YCharts

Given Walmart's valuation and low yield, it resembles more of a growth stock than the value and income characteristics investors may be used to.

Walmart stock isn't a great deal right now

Despite its expensive valuation, Walmart is still a stock worth holding or maybe even opening a starter position in. Walmart's results are impressive, and the company has proven that it has plenty of excellent ideas worth investing in. The company is getting more out of each store and expanded its revenue beyond in-store shopping thanks to e-commerce and Walmart+.

Walmart is delivering impeccable results when so many of its peers are struggling. It's also the kind of business that would likely continue doing well despite a recession. Walmart's supply chain and distribution network are some of the best in the world. So Walmart is well positioned to endure a downturn and possibly even take market share.

In sum, Walmart is checking all the boxes and then some. It's just that the stock has gotten so expensive that it simply isn't a screaming buy anymore.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $352,678!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,102!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $466,805!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, Nvidia, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.