A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

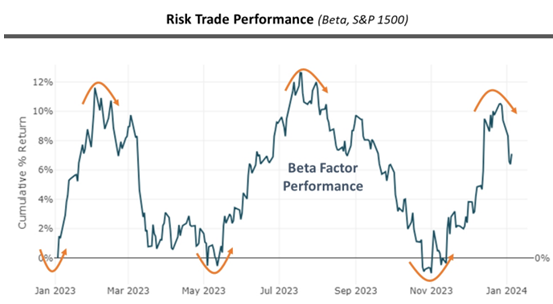

| Volatile markets = biggest challenge for investors for the second year in a row, JPMorgan investor poll -BBG | constantly shifting narratives + market leadership styles

* source: Piper Sandler

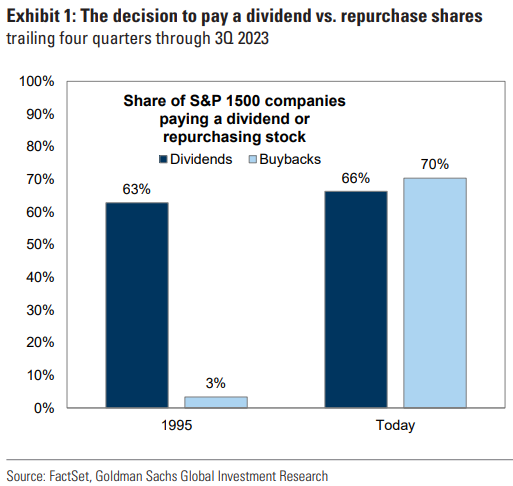

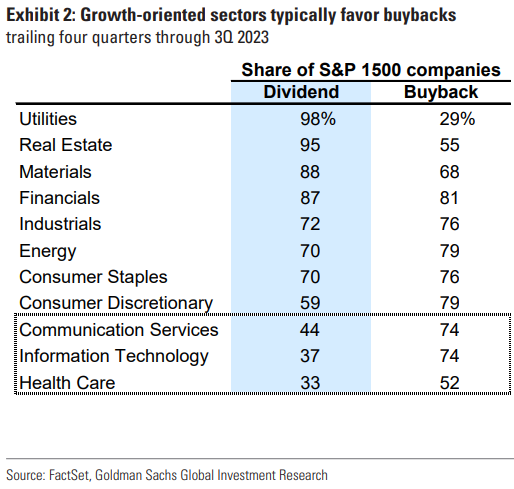

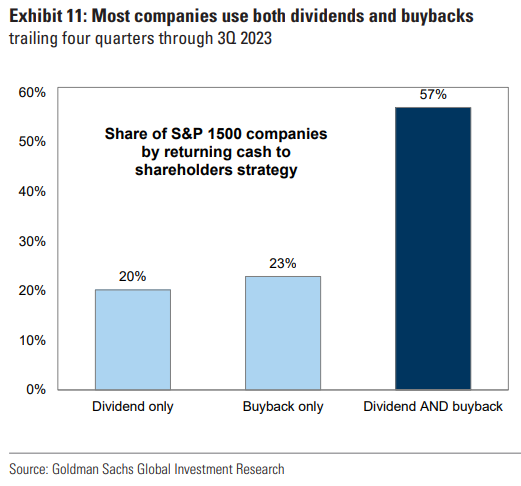

| Goldman's C-Suite Conversations:

"The share of US companies paying a dividend has been roughly unchanged during the past 30 years at 66%, while buybacks have surged in popularity from 3% of firms to 70%. Meta (META) initiated its first ever dividend last week, but several large firms still pay no dividend, including Alphabet (GOOGL) and Amazon (AMZN).

Based on our conversations, managements are grappling with how best to return cash to shareholders in today's environment."

-Goldman Sachs, Ryan Hammond

* source: Goldman Sachs Global Investment Research

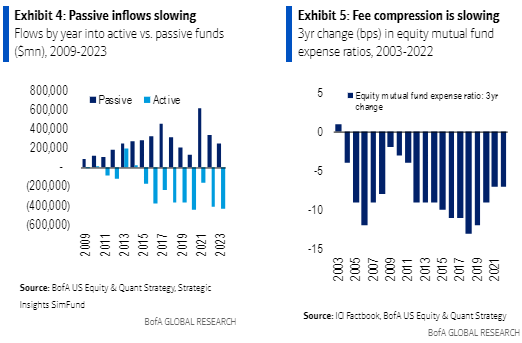

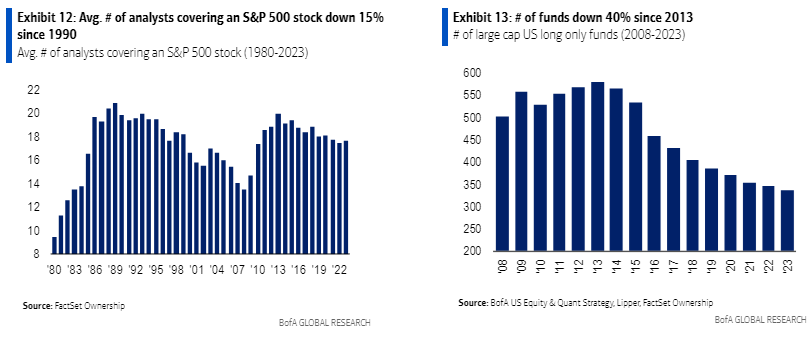

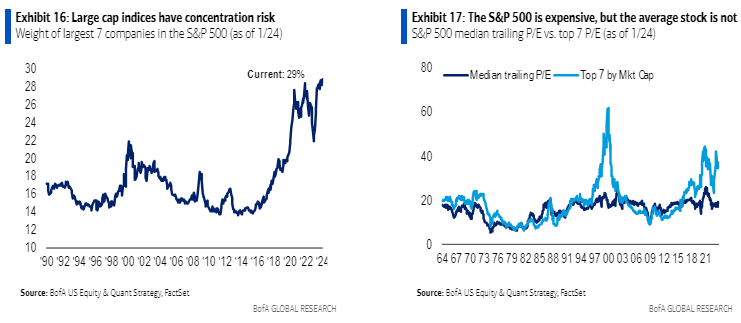

| BofA: "The tide is turning for stock picking

-Fundamental stock selection should outperform passive index investing. The market is rife with inefficiencies...

-Valuation dispersion is high, public equity cheaper than private, fewer eyeballs on stocks. Single stock flows are shifting."

* source: BofA's Savita

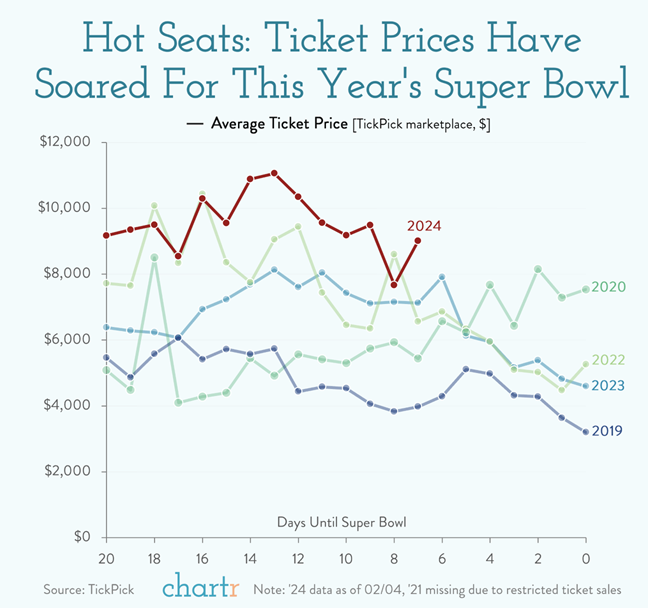

| Food for thought

*source: Chartr

1) KEY TAKEAWAYS

1) Equities + Oil + Gold + Dollar HIGHER / TYields LOWER

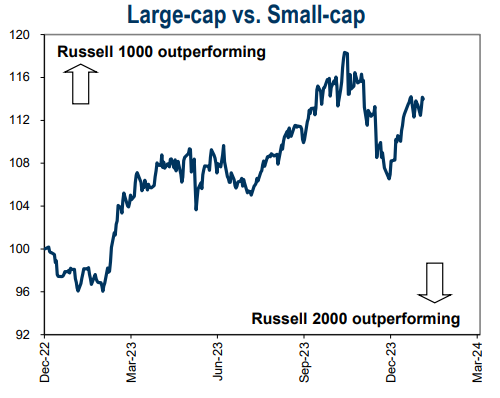

DJ +0.3% S&P500 +0.2% Nasdaq +0.1% R2K +0.5% Cdn TSX +0.1%

Stoxx Europe 600 +0.4% APAC stocks MIXED, 10YR TYield = 4.135%

Dollar HIGHER, Gold $2,031, WTI +1%, $74; Brent +1%, $79, Bitcoin $42,937

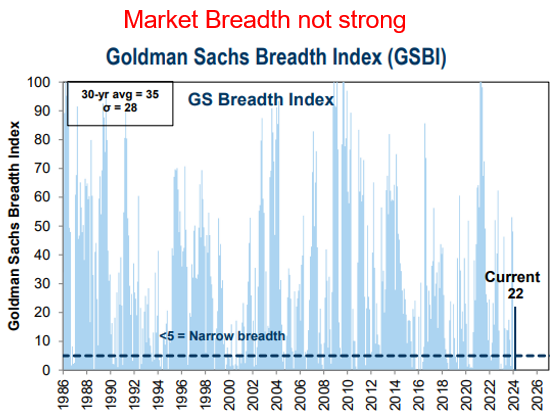

* source: Goldman Sachs Global Investment Research

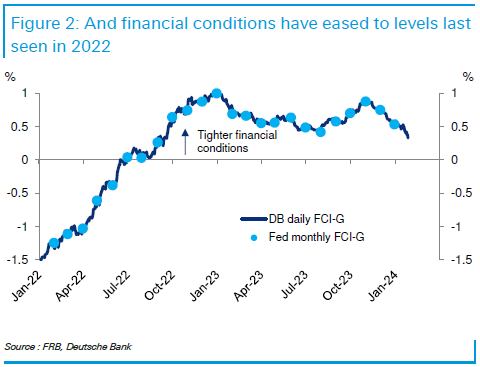

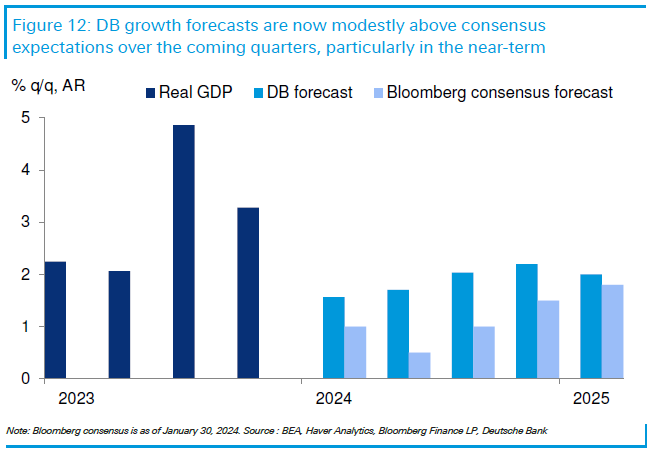

* source: Deutsche Bank

* source: Goldman Sachs Global Investment Research

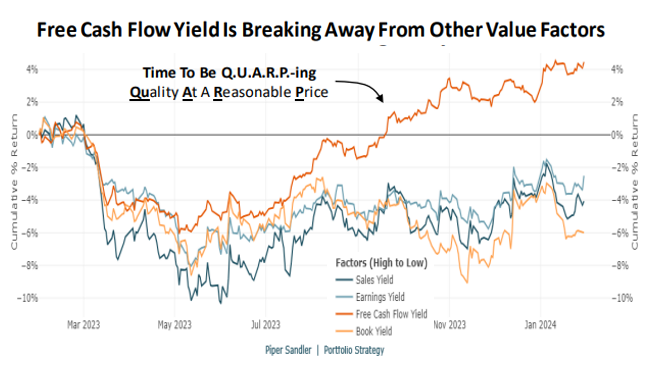

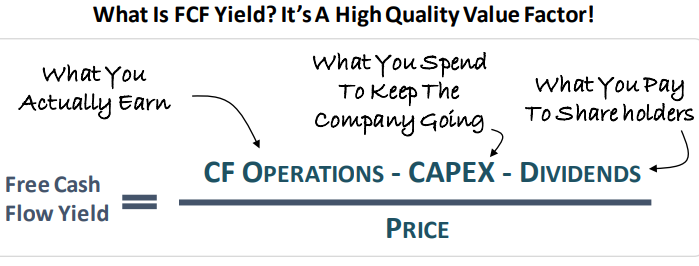

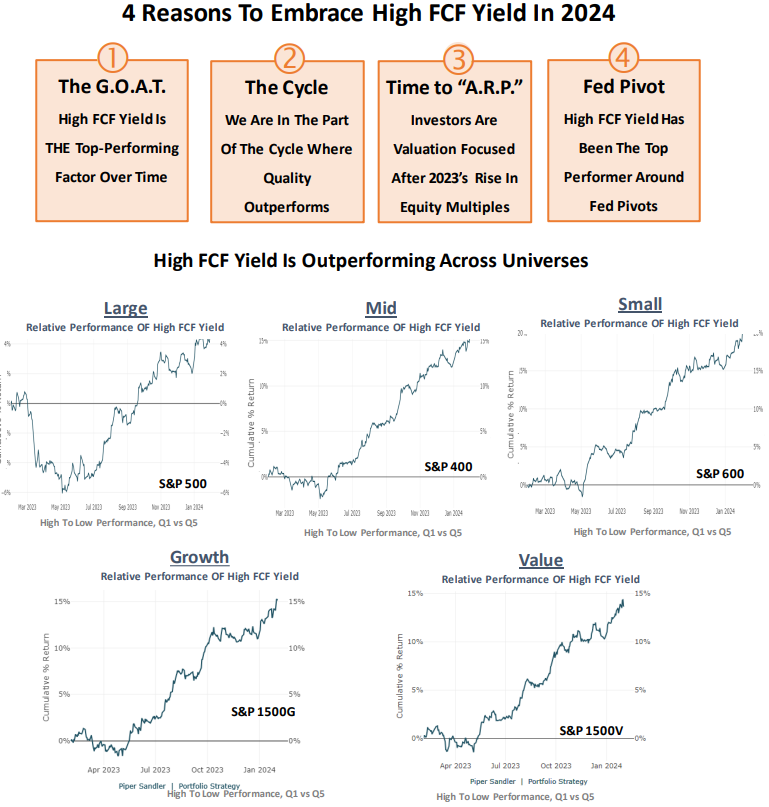

2) Piper Sandler advising their clients (buy side) to focus on Quality at a Reasonable Price / Free Cash Flow Yield...

* source: Piper Sandler's Michael Kantrowitz

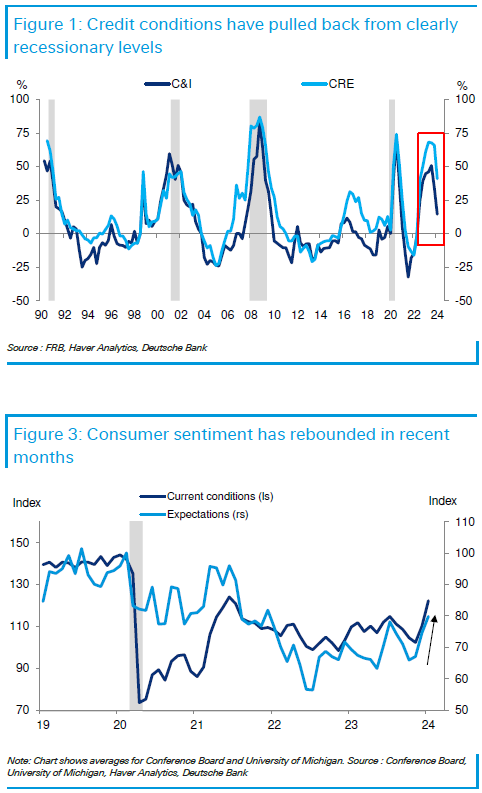

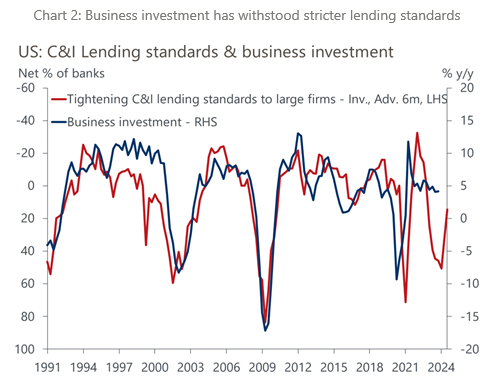

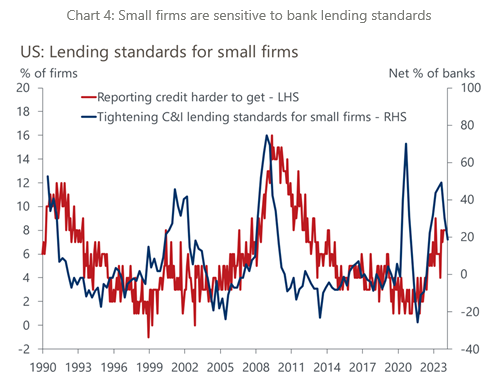

3) "The latest Senior Loan Officer Survey showed banks tightened standards on C&I lending to firms of all sizes in Q4, but to a lesser extent than in the preceding quarter."

* source: Oxford Economics

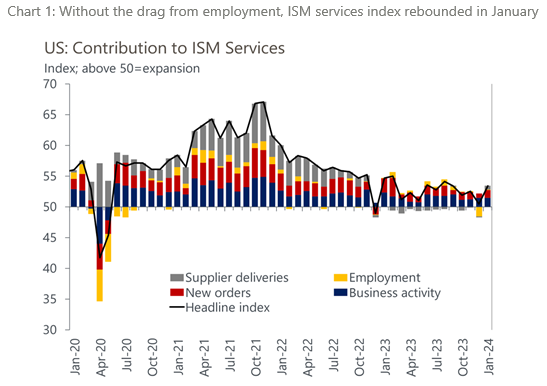

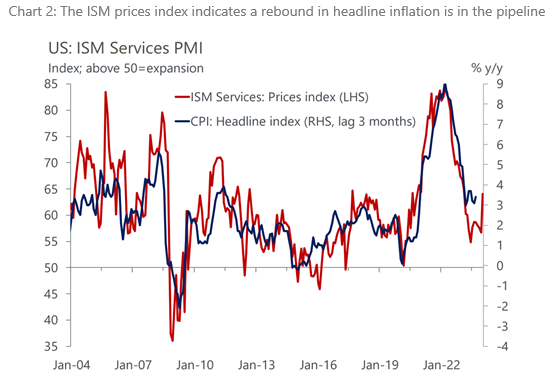

4) Yesterday - ISM Services in slight expansion territory:

"The decline in the ISM services index in December proved short-lived, with the January report showing the index bouncing above its six-month average."

The least encouraging result was the marked jump in the prices paid index, which recorded its fastest pace of expansion since February 2023.

* source: Oxford Economics

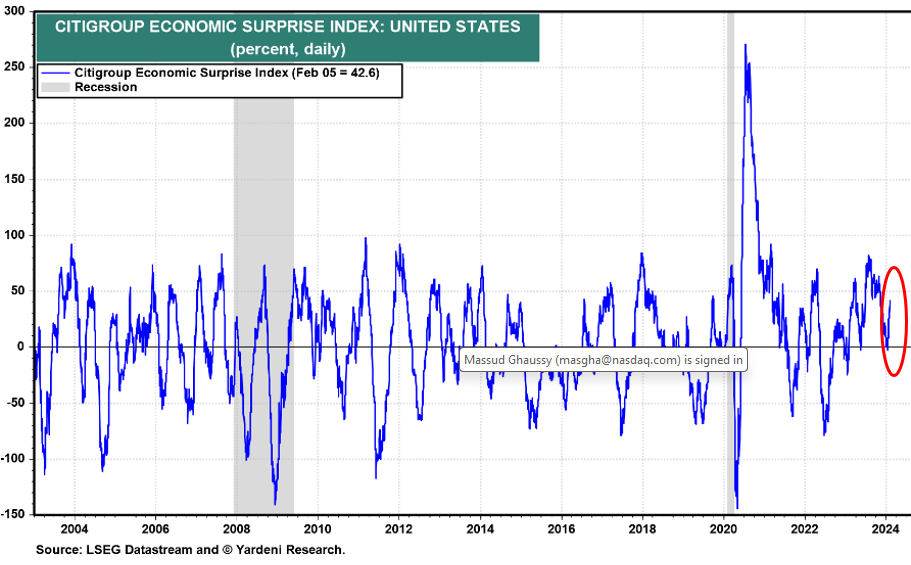

Economic data is surprising to the upside slightly

* source: Yardeni Research

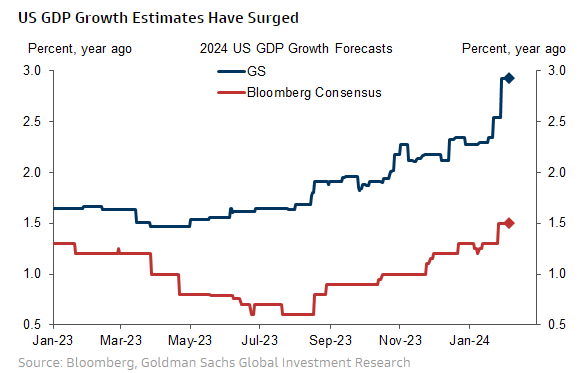

Economy much better than expected? Maybe a no landing...

* source: Goldman Sachs Global Investment Research

* source: Deutsche Bank

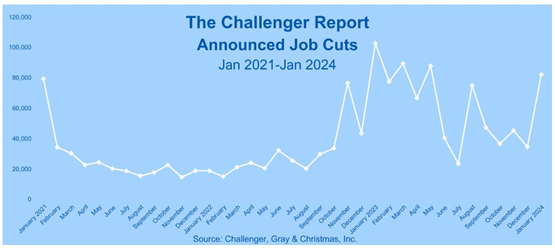

5) "As for those job cut announcements? Yea, they’ve surged in January. But they surged even more last January, and the labor market was able to absorb that without too many issues."

* source: Grindstone Intelligence

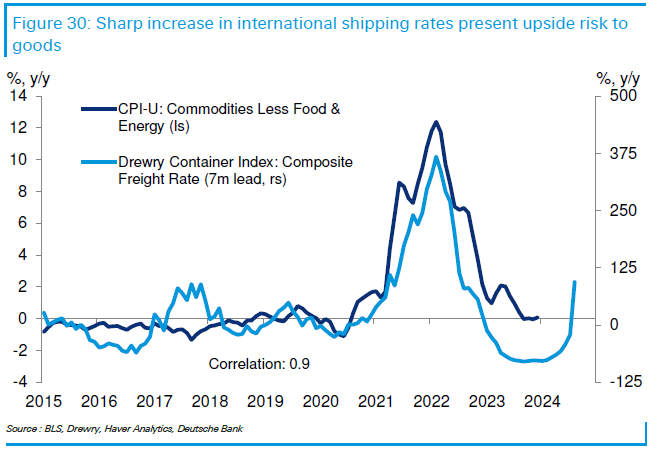

6) ACHTUNG!

* source: Deutsche Bank

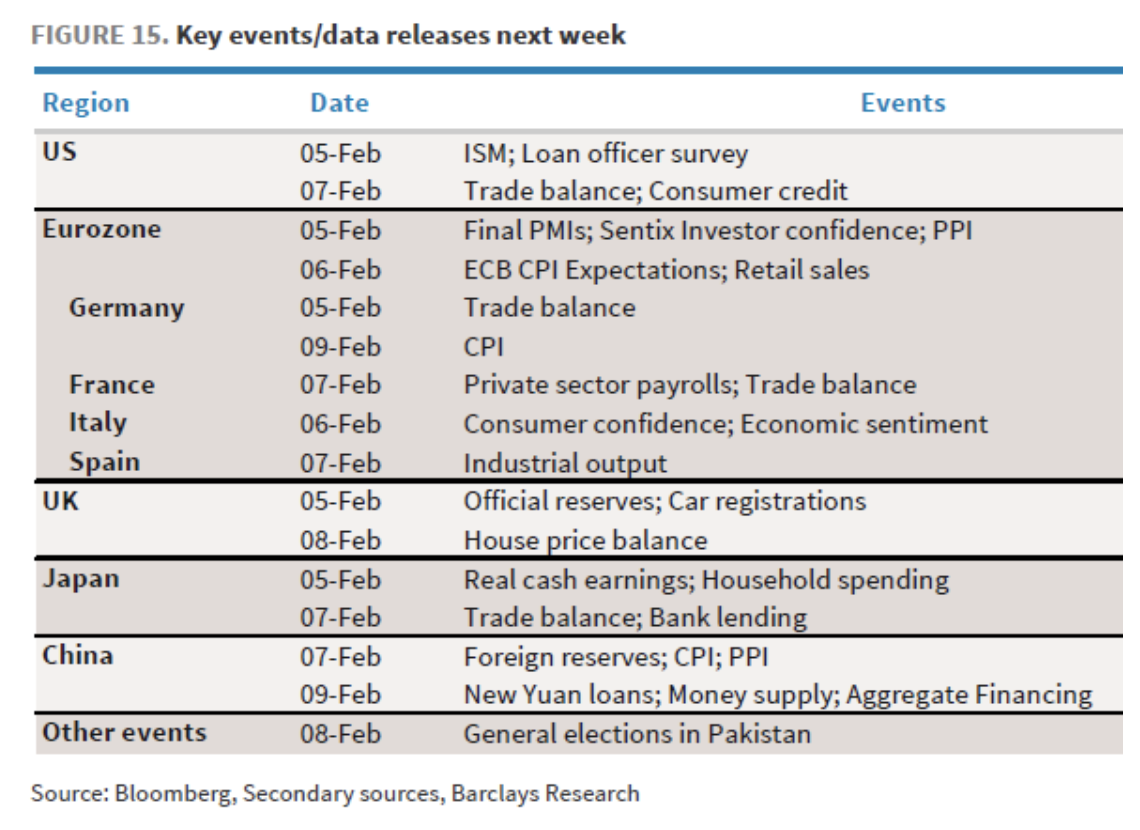

7) THIS WEEK - quieter week ahead:

US: ISM Services | SLOOS - loan officer survey

Europe: retail sales

China: inflation data

Earnings: Disney, Eli Lilly, and Alibaba

* source: Barclays' Emmanuel Cau

2) ESG, COMPILED BY NATHAN GREENE

Global ESG Bond Sales Reach $150 Billion in Busiest January Ever - BNN

-Global sales of green, social, sustainability and sustainability-linked bonds totaled $149.5 billion last month, making it the most active January since the inception of the green debt market in 2007, according to data compiled by Bloomberg.

-“Investor demand for sustainable bonds remains strong and we expect that to continue, even as we anticipate more activity in near term,” Andrew Karp, head of the sustainable banking solutions group at Bank of America.

EU agrees its first ever rules for ESG raters in sector shake-up - Reuters

-Under the incoming rules, unregulated ESG ratings providers in the European Union will have to be authorized and supervised by the European Securities and Markets Authority. Raters based outside the bloc will need to have their ratings endorsed by a rater regulated in the EU.

-Raters will have to explicitly disclose if their ratings cover how a company's operations affect the environment or social factors such as human rights, and not just the impact of ESG on a company's bottom line.

3) MARKETS, MACRO, CORPORATE NEWS

- China stocks rebound sharply on renewed talk of official support-RTRS

- Chinese equities rebound on hopes of support from Beijing-FT

- China on cusp of next-generation chip production despite US curbs-FT

- Traders abandon hopes of March interest rate cut-FT

- BOJ on track for policy shift by April, helped by wage outlook-RTRS

- ECB rate-cut timing is only first tricky call in easing process-BBG

- Bank of England official sees interest rate cuts ahead ‘reward’ lower inflation-FT

- UK policymakers hit by six-month delay in key jobs data-FT

- RBA keeps rate at 12-year high, signals higher bar for rate hikes-BBG

- Fed says banks tightened credit standards in fourth quarter-BBG

- German factory orders unexpectedly advanced at year end-BBG

- UK retail sales slow as consumers tighten their belts-BBG

- US, China officials to meet in Beijing, furthering economy talks-BBG

- Pentagon says it’s not planning for a long-term campaign in Iraq and Syria-POL

- Antony Blinken pushes for ‘enduring’ Gaza peace deal in Riyadh visit-FT

- US border-Ukraine aid deal near collapse in Senate on GOP doubts-BBG

- Ticketmaster DOJ antitrust probe sees new document requests-BBG

- New York Community Bancorp’s chief risk officer left weeks before big loss-FT

- Alphabet is seeking outside investment for its GFiber internet business-RTRS

- E-commerce startup ShipBob seeks to hire banks for 2024 IPO-RTRS

- Anglo American boss resists asset sales despite investor pressure-FT

- China on cusp of next-generation chip production despite US curbs-FT

- Four PSBs may get approval to raise funds in H1 of FY25-ECON

- Toyota to invest in TSMC's Kumamoto plant in Japan-NIKKEI

- NYCB’s tense talks with watchdog led to moves that rocked market-BBG

- RTX probed by SEC over disclosures in huge jet-engine recall-BBG

- Tech layoffs continue to roil industry with 32,000 jobs cut-BBG

- Novartis to acquire cancer-focused MorphoSys for $2.9 billion-RTRS

Oil/Energy Headlines: 1) Saudi Arabia keeps Arab Light crude price to Asia unchanged in surprise move-RTRS 2) Oil investors try to get bullish as global economy improves-RTRS 3) Russian oil-refining drops as drone attacks halt two plants-BBG 4) INTERVIEW: India's twin focus on Middle East, Russian oil will soften Red Sea crisis impact - FIPI chief-PLATTS 5) India's robust energy growth outlook to set tone for global markets: Modi-PLATTS 6) BP beats forecast with $3 billion quarterly profit, boosts buybacks-RTRS

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.