Visa Inc. V reported encouraging results for August, showing little impact of consumer spending decline. The financial transaction juggernaut witnessed 11% year-over-year growth in U.S. payments volume last month despite suspending Russian operations. U.S. payments volume remained in line with the July figure. Individuals gaining confidence to travel will likely continue boosting its results.

Per the regulatory filing by Visa, global processed transactions jumped 12% in the month from the prior-year period. The volume was 140% of the 2019 level. Credit payments volume in the U.S. increased 17% in August, while debit payments rose 7%. These metrics are also showing a sequential increase.

Total cross-border volume increased 36% year over year in August, following a 45% jump in July. Excluding intra-Europe transactions, cross-border volume rose 51% year over year in August and 58% in July. If this trend continues, Visa is likely to register a significant year-over-year increase in volumes in the fourth quarter of fiscal 2022.

The price inflation is likely to keep benefiting Visa’s revenues. Even though the ongoing recovery in travel is expected to keep volumes up, there are some factors that can affect the figures. Fed rate hikes can trigger higher savings and lower spending levels. Macroeconomic volatility can also be a cause of concern. Yet, the company has managed to continue to grow, bypassing the ongoing turmoil.

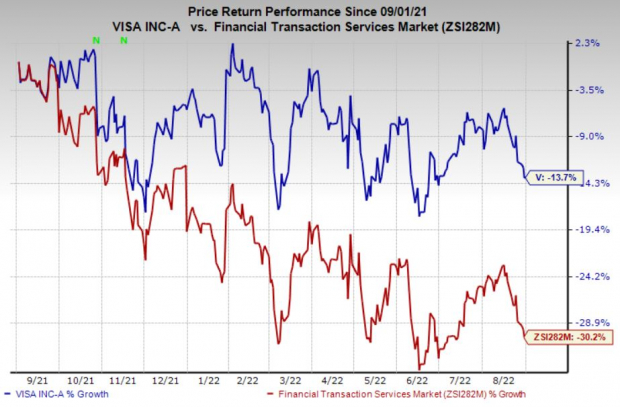

Price Performance

Shares of Visa have decreased 13.7% in the year-to-date period compared with the industry’s 30.2% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Visa currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Business Services space are Marqeta, Inc. MQ, Mastercard Incorporated MA and International Money Express, Inc. IMXI, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Headquartered in Oakland, CA, Marqeta provides card issuing and transaction processing services. The Zacks Consensus Estimate for Marqeta’s 2022 bottom line indicates 13.3% year-over-year growth.

Based in Purchase, NY, Mastercard is a global payment solutions company. The Zacks Consensus Estimate for MA’s 2022 earnings indicates 26.9% year-over-year growth.

Miami, FL-based International Money Express works as a money remittance services company globally. The Zacks Consensus Estimate for IMXI’s 2022 bottom line indicates 18.4% year-over-year growth.

Zacks' Top Picks to Cash in on Electric Vehicles

Big money has already been made in the Electric Vehicle (EV) industry. But, the EV revolution has not hit full throttle yet. There is a lot of money to be made as the next push for future technologies ramps up. Zacks’ Special Report reveals 5 picks investors

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

INTERNATIONAL MONEY EXPRESS, INC. (IMXI): Free Stock Analysis Report

Marqeta, Inc. (MQ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.