February 2022 Equity Highlights and Sector Activity From Trade Ideas.

The Trade Ideas February 2022 report below comprises:

- The Trade Ideas Trade of the Week for each week in February

- A summary showing the number of times that HOLLY traded in the industry and what was the

profit or loss associated with those trades - About Trade Ideas

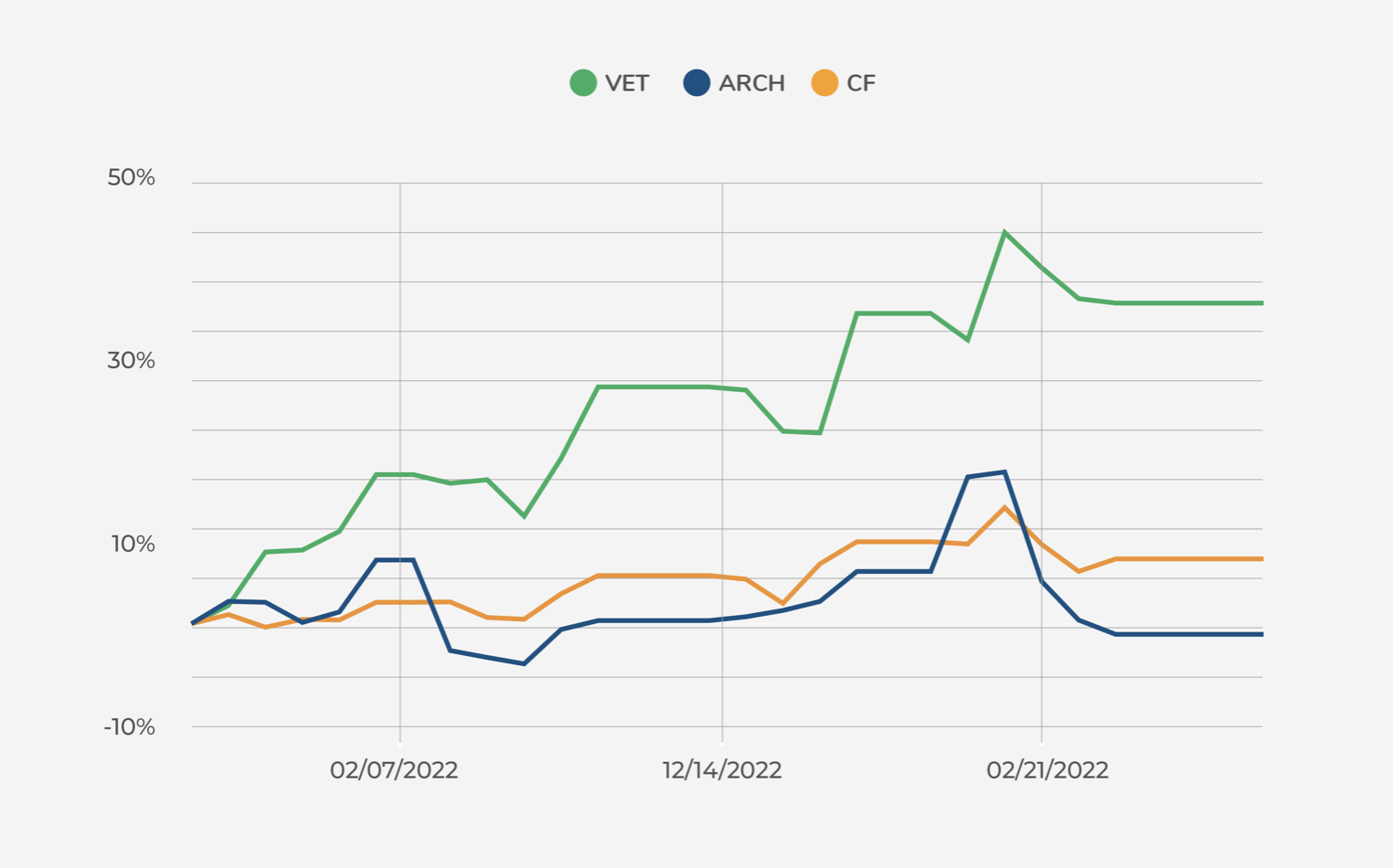

Trade of the Week for February

Vermilion Energy, Inc. (VET) (Triggered) has a strong chart that is coiled up around 52-week highs. Forget trying to pick bottoms and pullbacks, this week calls for something that has already shown strength.

Robinhood Markets, Inc. (HOOD) The chart of HOOD initially sold off after earnings then it reversed on strong volume while the rest of the market indexes were heading lower. The risk reward for setups like this can’t be beat. All of the bad sentiment has been priced into HOOD while giving us a clear selling point to get out if the stock price does not drift higher over the coming weeks.

CF Industries Holdings, Inc. (CF) (Triggered) The fertilizer and agricultural/chemical stocks have been quietly moving higher in response to the terrible supply chain issues and this is causing some concern. The charts of these companies confirm this concern with all the relative strength. The name we will focus on is CF Industries Holdings Inc. (CF).

ARCH Resources Inc. (ARCH) (Triggered) has only 15 million shares in circulation for trading and 33% of those shares are held by short sellers who will need to buy the stock back if it keeps going higher. This recipe for a short squeeze is going to be our Trade of the Week.

Trade Ideas’ Machine Learning AI: HOLLY, February 2022 Overall Performance

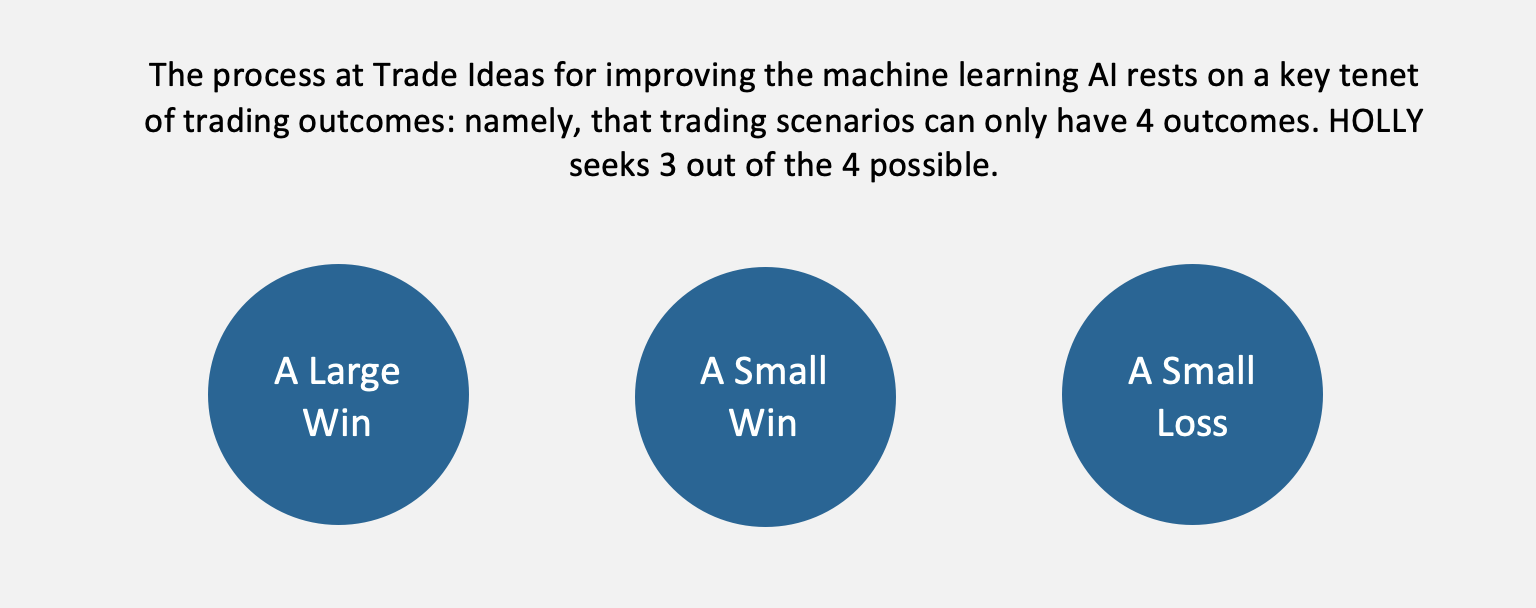

Over the course of February 2022 HOLLY strategized a total of 48 trades down from 226 in December. Overall performance was a decrease of -2.2%, compared to the SPY at -3.1%. Overall, HOLLY’s performance in a high volatility and event driven environment continues to fall within acceptable trading scenarios as described below.

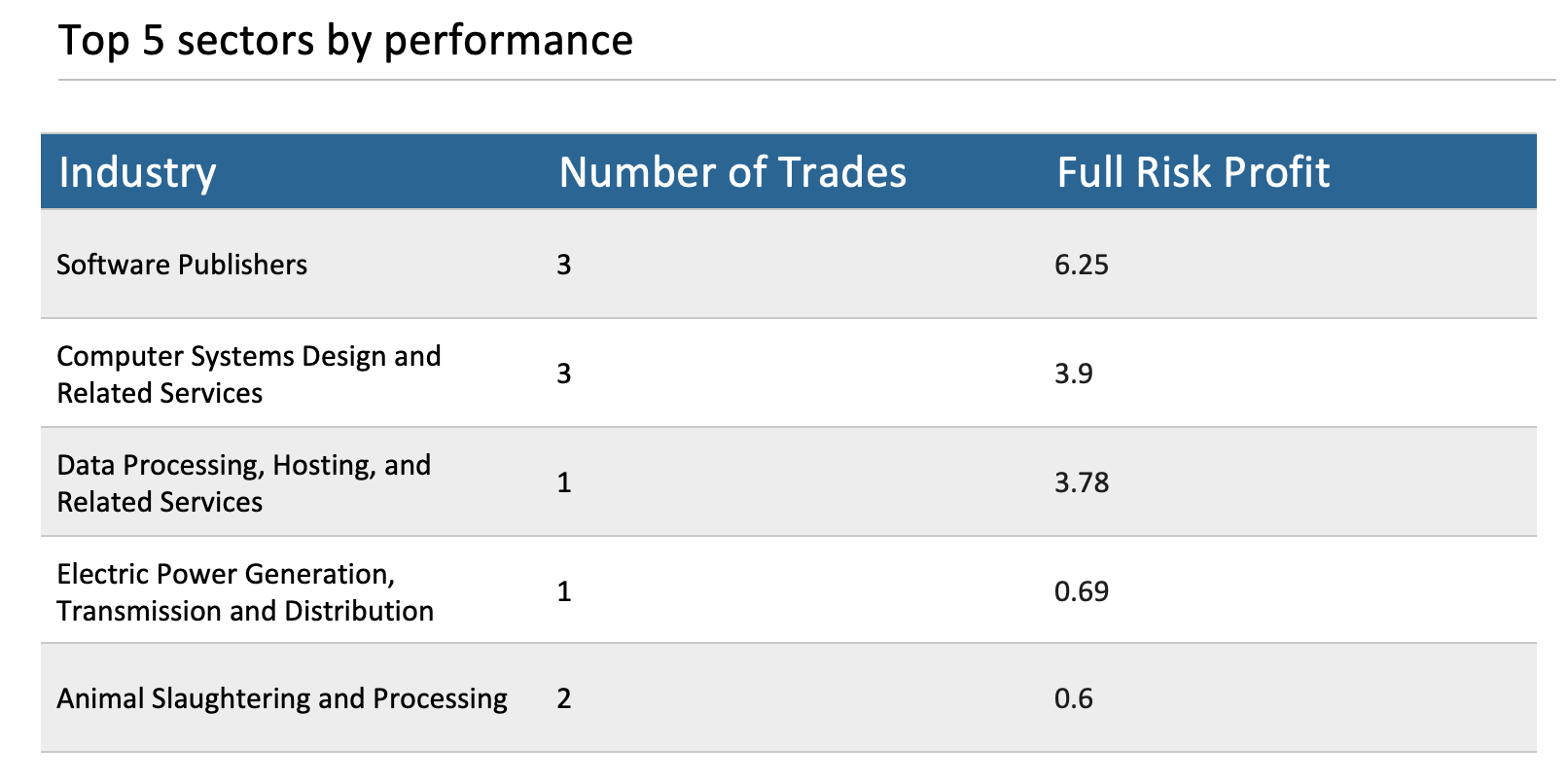

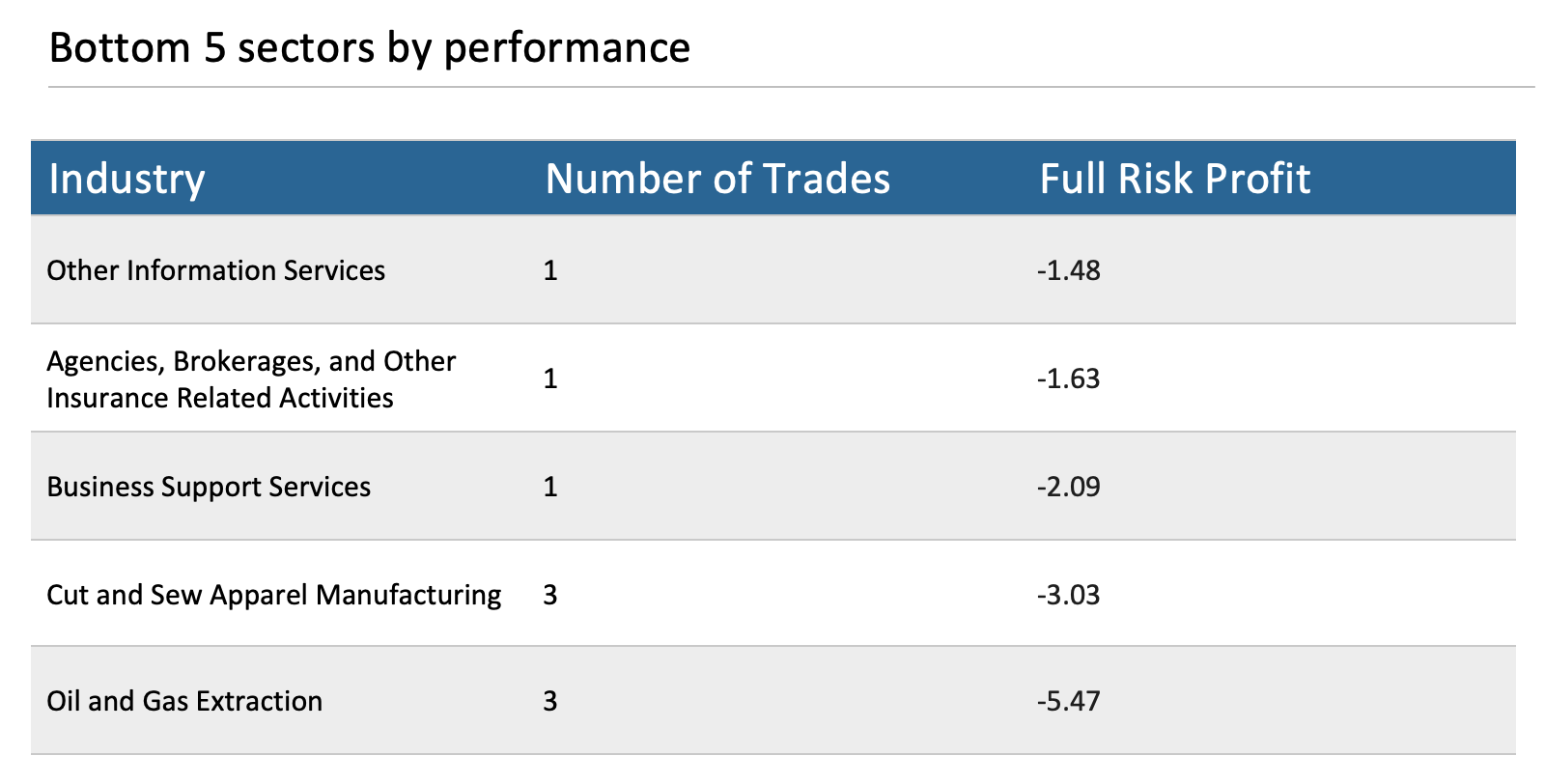

The table below details the Top 5 and Bottom 5 Sectors and the performance in each. The full risk profit is the profit per share of the trade using no stops and holding until just before the market close. Enterprise licensees and subscribers recognize that their hold times vary beyond end of day according to their risk management preferences. The total performance of HOLLY AI for February was -2.2%.

HOLLY Performance by Sector for February 2022

Conclusion

Portfolio Managers and Traders who avail themselves of HOLLY gain the ability to increase performance and mitigate risk. HOLLY has no emotional response to market conditions. As has been true since HOLLY’s inception, February 2022 proved out this principle of HOLLY’s effectiveness.

About Trade Ideas:

Trade Ideas is an artificial intelligence decision tool that enables portfolio managers and traders to make better decisions in the stock market.

Trade Ideas identifies opportunities to capture alpha before others and in sectors and places within the market where no one else is looking.

Overnight, Trade Ideas artificial intelligence capability, HOLLY, runs massive structured and unstructured data (market activity, news, social media, etc.) on all US equities across some 40 different trading strategies, each of which has multiple algorithms, effectively taking into account tens of millions of simulated trades.

The result is the reporting each trading day of 5-7 trading scenarios which February outperform the market. Risk guardrails are set against each strategy, so traders are alert when up or down limits are reached intraday.

Additionally, each week Trade Ideas publishes its free Trade of the Week. Visit the website to sign up.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.