If you have ever struggled with a dropped phone call, you might understand the frustration Verizon Communications (NYSE: VZ) has been for its shareholders. Despite the telecom giant being on track to end 2024 with a positive return, shares have deeply underperformed stock market benchmarks in recent years, losing about 15% of their value in the past five years compared to an 84% gain in the S&P 500 (SNPINDEX: ^GSPC) over the same period.

Nevertheless, encouraging signs in the company's core wireless services business, combined with a more positive outlook into 2025, provide a signal bar of hope that the stock could finally be on the cusp of a sustained rebound.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Is it time to dial in and buy Verizon stock now? Here's what you need to know.

An improved outlook for 2025

Verizon is navigating a significant transformation in the telecommunications industry. Traditional growth engines, such as mobile device sales, are facing a secular decline as consumers increasingly favor buying directly from brands like Apple. On the enterprise side, the company is selling less networking equipment due to the waning relevance of legacy wireline phone services. All this is in an intensely competitive landscape where peers like AT&T and T-Mobile have moved aggressively with pricing promotions.

For Verizon's last reported third quarter (for the period ended Sept. 30), total revenue was flat year over year, while adjusted earnings per share (EPS) was down 2.5% from the prior-year quarter. Even as these top- and bottom-line numbers don't inspire much confidence, investors focusing on them too much may be missing the bigger story.

A more favorable aspect was Verizon's 2.7% increase in wireless services revenue, underscoring its momentum in mobility and broadband through more premium offerings. The metric that stands out is the $139 in consumer wireless average revenue per account (ARPA), up 4.2% from Q3 2023. The increase reflects higher pricing and success in bundling several services, including accelerating demand for fixed wireless access (FWA). Verizon anticipates these trends to continue.

Image source: Getty Images.

A key development in the third quarter was Verizon's announced acquisition of Frontier Communications. The deal is seen as strengthening Verizon's position in the broadband market, by leveraging Frontier's substantial fiber optic infrastructure to drive up more robust long-term growth.

Management has reaffirmed its commitment to paying down debt and supporting its dividend, which saw its 18th consecutive annual rate increase this year to a new quarterly rate of $0.6675 per share. On this point, Verizon's leverage ratio has declined compared to 2023, while the $14.5 billion in free cash flow generated through the first nine months of the year more than covers the $8.4 billion in dividends paid. That's a great sign that fundamentals are solid and Verizon's shareholder distribution is sustainable.

Wall Street analysts predict Verizon's annual revenue will modestly increase by 0.4% this year, ahead of a more robust 1.9% growth rate in 2025. The company's adjusted EPS is projected to rebound from a -2.3% decline in 2024 with a 2.8% increase, reaching $4.73 in 2025.

| Metric | 2024 Estimate | 2025 Estimate |

|---|---|---|

| Revenue | $134.4 billion | $137 billion |

| Revenue change (YOY) | 0.4% | 1.9% |

| Adjusted EPS | $4.60 | $4.73 |

| Adjusted EPS change (YOY) | (2.3%) | 2.8% |

Data source: Yahoo Finance. YOY = year over year.

Compelling high-yield value

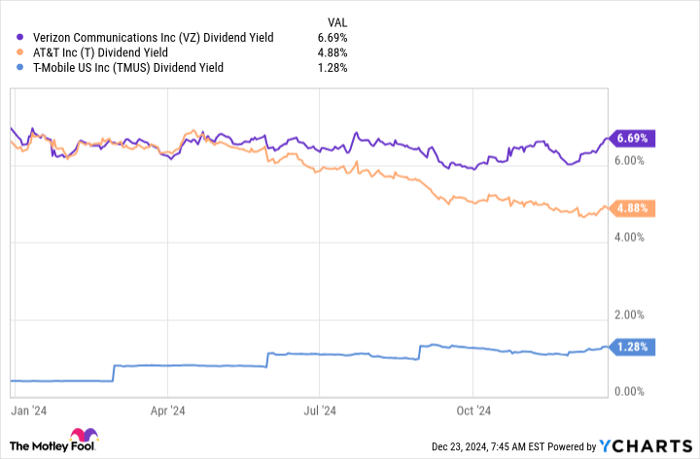

Verizon's outlook into 2025 won't win the company any growth accolades, but the main attraction here is on the side of value. What I like most about the stock is its 6.7% dividend yield, among the highest of the S&P 500 constituents and well above AT&T's 4.9% yield as an industry comparable.

It appears the market is still skeptical regarding Verizon's ability to jump-start growth and consolidate market share, a view that may be unfounded. That said, the high-yield opportunity means investors are getting paid a hefty income while waiting for the turnaround to materialize.

VZ Dividend Yield data by YCharts

The bullish case for Verizon is that its results over the next few quarters could outperform expectations, serving as a catalyst for the stock to rally higher.

Ultimately, I believe there are enough strong points in Verizon's fundamentals and its long-term potential to make it a good idea to buy the stock today in a diversified portfolio. While its chart likely won't be a straight line higher, I predict shares of Verizon will be at a higher price by this time next year.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $363,593!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,899!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $502,684!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 23, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.