The last three months have been tough on Veritone, Inc. (NASDAQ:VERI) shareholders, who have seen the share price decline a rather worrying 63%. Despite this, the stock is a strong performer over the last year, no doubt about that. During that period, the share price soared a full 161%. So we think most shareholders won't be too upset about the recent fall. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

Given that Veritone didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, Veritone's revenue grew by 30%. We respect that sort of growth, no doubt. The revenue growth is decent but the share price had an even better year, gaining 161%. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

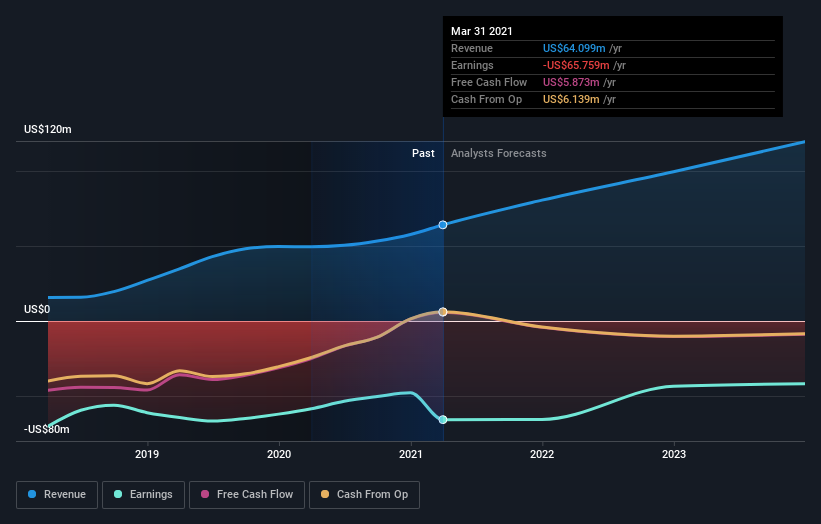

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Veritone stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Pleasingly, Veritone's total shareholder return last year was 161%. This recent result is much better than the 6% drop suffered by shareholders each year (on average) over the last three. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. It's always interesting to track share price performance over the longer term. But to understand Veritone better, we need to consider many other factors. Take risks, for example - Veritone has 3 warning signs we think you should be aware of.

Veritone is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.