Veeva Systems Inc. VEEV, on Thursday, announced a product partnership with Zifo. The tie-up aims to help biopharmas modernize quality control (QC) operations.

Per Veeva Systems, companies can import data directly from any source document or other LIMS into Veeva LIMS by bringing together Veeva LIMS with Zifo's data integration and management platform, qcKen. This integration will likely simplify master data configuration during LIMS implementation and site deployment, making it easier for companies to advance beyond legacy QC systems.

As part of the partnership, Zifo is an official Veeva Product Partner, building on its existing relationship as a Veeva Services Partner.

It is worthwhile to mention that Zifo is a renowned enabler of artificial intelligence and data-driven enterprise informatics for science-driven organizations.

The latest tie-up is a significant stepping stone for Veeva Systems, enabling its customers to accelerate their QC modernization initiatives. Vault LIMS, a component of Veeva Vault Quality Suite of the broader Veeva Development Cloud solutions, is the life science industry’s unified suite of applications for managing quality content, processes, and training on a single cloud platform.

Likely Trend of VEEV Stock Following the News

Following the announcement, shares of the company lost nearly 2.3% till Friday’s closing.

Historically, the company has gained a high level of synergies from its partnerships. Although the latest announcement is likely to be beneficial for VEEV’s top-line growth going forward, the stock declined overall.

Veeva Systems currently has a market capitalization of $36.27 billion. It has an earnings yield of 2.9%, favorable than the industry’s negative yield. In the last reported quarter, VEEV delivered an earnings surprise of 10.8%.

Rationale Behind Veeva Systems’ Tie-Up

Per Veeva Systems, the integration between the two companies’ platforms will likely reduce the burden of master lab data configuration, lower costs and speed up Veeva LIMS implementation.

Management believes that partnering with Zifo will likely allow customers to implement Veeva LIMS and realize value much quicker, accelerating QC modernization initiatives.

Per Zifo’s management, the collaboration is expected to aid customers expedite their adoption of Veeva LIMS to streamline operations.

Industry Prospects in Favor of VEEV

Per a report by Grand View Research, the global quality management software market was estimated to be $10.18 billion in 2023 and is anticipated to witness a CAGR of 10.6% between 2023 and 2030. Factors like the rising demand for streamlining and centralizing business processes and the increasing adoption of new technologies like cloud computing are likely to drive the market.

Given the market potential, the latest partnership is expected to be a significant milestone for Veeva Systems and boost its business.

Veeva Systems’ Notable Development in Development Cloud

In December 2024, Veeva Systems announced its third-quarter fiscal 2025 results, wherein its Development Cloud suite recorded encouraging developments. The company witnessed continued strength in Veeva Vault Clinical, with a number of wins and significant go-lives, particularly with CTMS.

Veeva Vault Quality had another strong quarter, with 27 new customer additions. The company’s core applications — QualityDocs, QMS and Training — all continue to grow nicely, while Vault LIMS has also progressed well. Per management, VEEV continued to innovate in eTMF and CTMS by adding new functionality and improving existing functionality while at the same time working to avoid complexity.

VEEV’s Share Price Performance

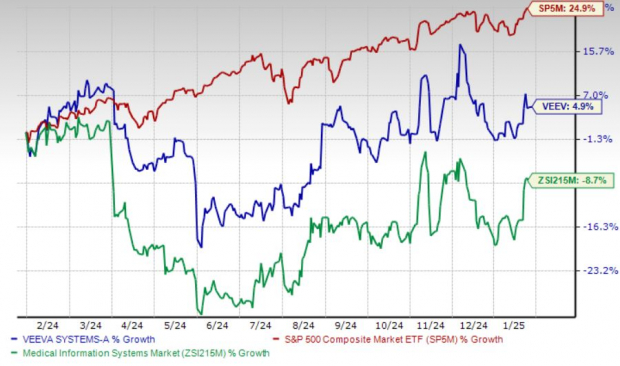

Shares of the company have gained 4.9% in the past year against the industry’s 8.7% decline. The S&P 500 has gained 24.8% in the same time frame.

Image Source: Zacks Investment Research

Veeva Systems’ Zacks Rank & Key Picks

Currently, VEEV carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Cardinal Health, Inc. CAH, ResMed Inc. RMD and DaVita Inc. DVA.

Cardinal Health, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 10.5%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 11.2%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cardinal Health’s shares have gained 21.7% compared with the industry’s 6.1% growth in the past year.

ResMed, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.8%. RMD’s earnings surpassed estimates in each of the trailing four quarters, with the average being 6.4%.

ResMed has gained 32.4% compared with the industry’s 16.5% growth in the past year.

DaVita, sporting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with the average surprise being 10.6%.

DaVita’s shares have rallied 59.3% compared with the industry’s 16.1% growth in the past year.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.