A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

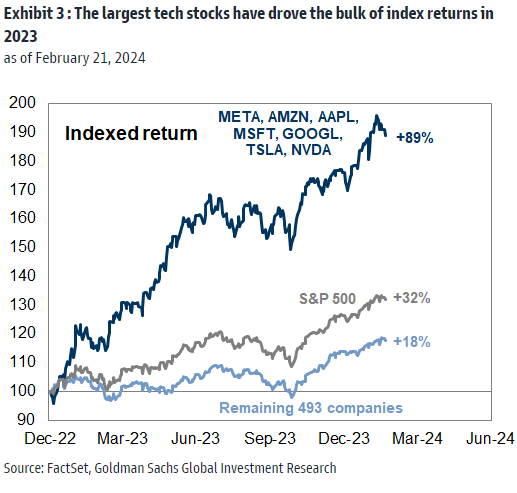

"There is no doubt [Nvidia] transformed the mood of the whole global risk market as well. Pretty much every global asset class is influenced by these seven stocks..." -Deutsche Bank, Jim Reid

"With global stocks at all-time highs, investors can’t shake off the fear factor...it looks very dangerous out there." -CNBC

"Mr. Biden is lucky that the AI revolution accelerated under his watch, just as Barack Obama was fortunate with the shale fracking boom....Nvidia’s nearly $2 trillion valuation is essentially a giant bet on U.S. private innovation." -WSJ, The Editorial Board

"Nvidia added $277bn to its market capitalisation, making this the biggest single session gain in value of all time, surpassing the $197bn gain by Meta earlier this month." -Deutsche Bank, Jim Reid

* source: CNBC

rate cut odds for June meeting getting pared back considerably...

* source: Piper Sandler

* source: CNBC

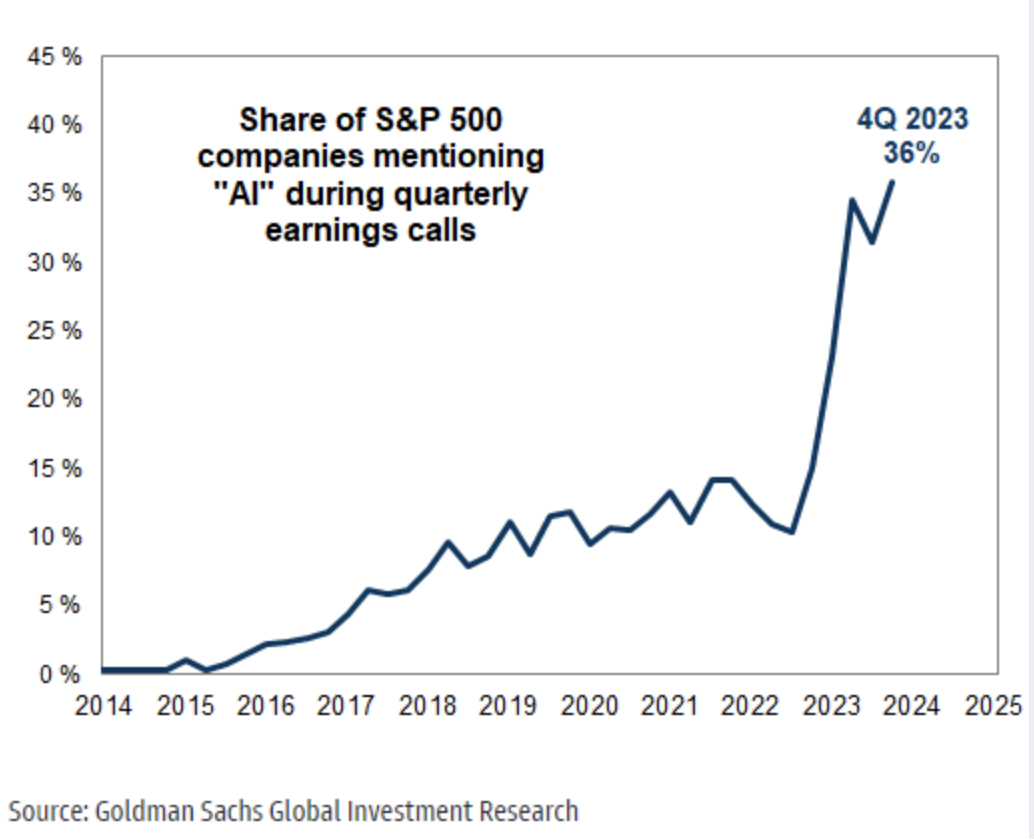

AI the new trend...

* source: Goldman Sachs Global Investment Research

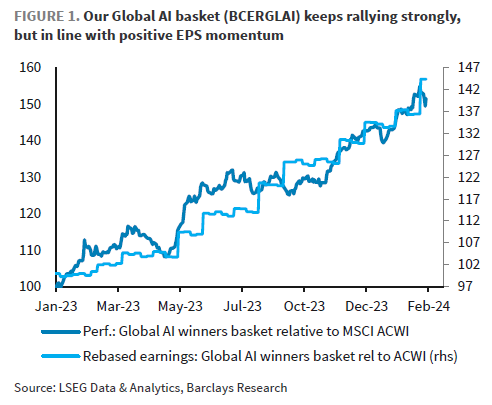

"Strong Nvidia results have again soothed market concerns of a bubble. Bullish price action in the hot AI space is tracking positive EPS momentum closely." -Barclays' Emmanuel Cau

* source: Barclays' Emmanuel Cau

* source: Goldman Sachs Global Investment Research

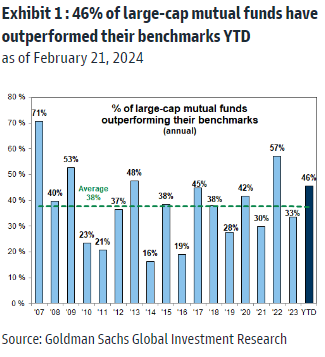

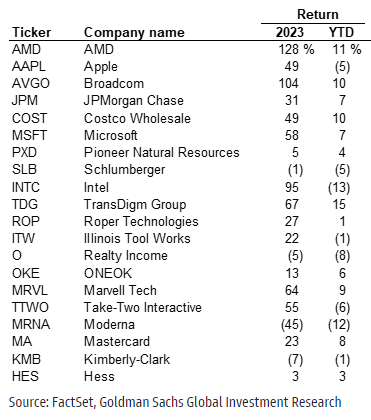

| active managers = poor performance? | On average, 38% of large cap mutual funds outperform their benchmarks...

* source: Goldman Sachs Global Investment Research

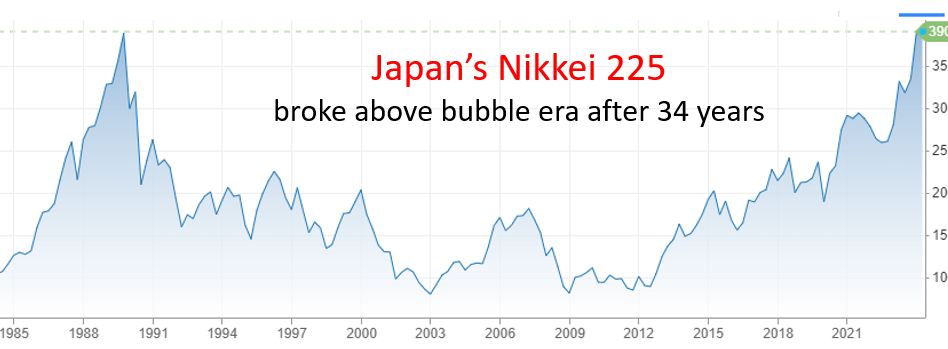

| getting bubbly with easy money policy?

* source: CNBC

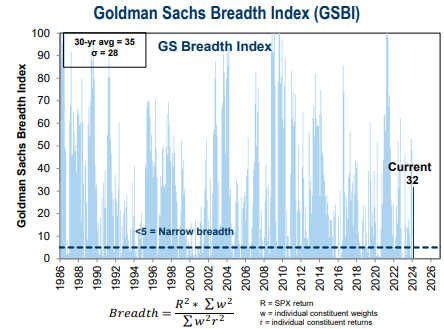

| "There are two ways that market breadth can broaden out from here: 1) a broad earnings recovery; or 2) lower bond yields." -Michael Kantrowitz, Piper Sandler

* source: Goldman Sachs Global Investment Research

1) KEY TAKEAWAYS

1) Equities MIXED / Dollar + TYields + Oil LOWER / Gold HIGHER

DJ +0.3% S&P500 +0.5% Nasdaq +0.5% R2K -0.2% Cdn TSX +0.1%

Stoxx Europe 600 +0.3% APAC stocks MIXED, 10YR TYield = 4.303%

Dollar LOWER, Gold $2,024, WTI -2%, $77; Brent -2%, $82, Bitcoin $50,822

2) Food for thought...

Goldman: stocks w/ LARGEST INCREASES in exposure in mutual funds (Dec End)

Goldman: stocks w/ LARGEST DECREASES in exposure in mutual funds (Dec End)

* source: Goldman Sachs Global Investment Research

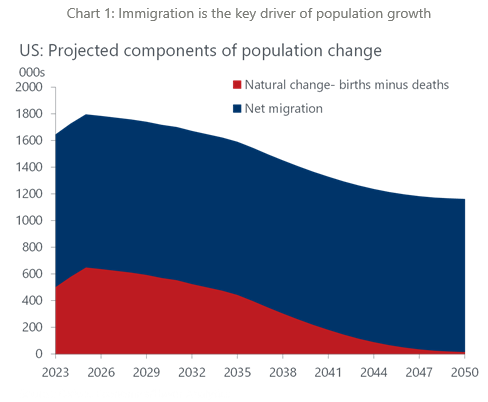

3) "As the native-born population ages, immigration will account for a rising share of population growth, making it crucial to growth in the labor force and the economy's long-term potential over the next several decades." -Oxford Economics

* source: Oxford Economics

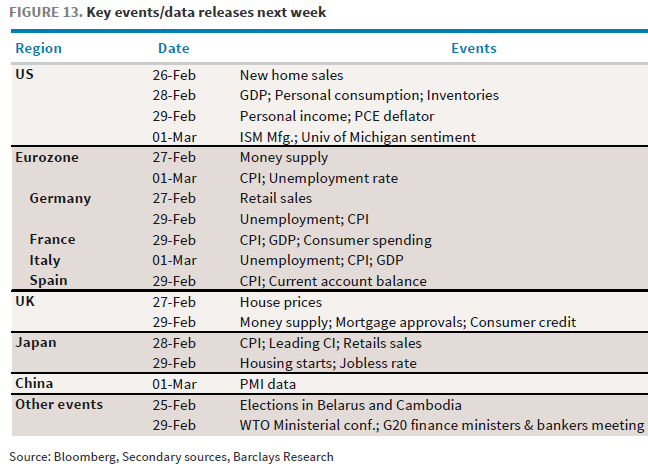

4) NEXT WEEK:

"focus will be on the US PCE inflation release, with other inflation reports also due in Europe and Japan. Otherwise, several economic activity indicators will be released for key economies, including PMI gauges in China.

Corporate earnings feature Berkshire Hathaway, Salesforce and Dell."

-Deutsche Bank

* source: Barclays' Emmanuel Cau

2) ESG, COMPILED BY NATHAN GREENE

Exclusive: US regulator drops some emissions disclosure requirements from draft climate rules - Reuters

The SEC has dropped a requirement for U.S.-listed companies to disclose so-called Scope 3 emissions, which was included in its original draft of the rules published in March 2022, the sources said.

The rules would deviate from the European Union's rules which make Scope 3 disclosures mandatory for large companies starting this year and potentially complicate compliance for some global corporations.

Ready for an 800-Volt Jolt? Carmakers Are Unveiling New Fast-Charging EVs - BBG

Today most EVs are based on 400-volt architectures — and for a standard vehicle like the VW ID.4 it can take about 20 minutes to add 200 kilometers (124 miles) of range. An 800-volt EV can do the same job in about 10 minutes.

Seven of the 10 largest automakers by revenue globally have announced 800-volt platforms that will bring new vehicles to the mass market over the next few years. For example, BMW will introduce six models from its Neue Klasse platform starting in 2025.

3) MARKETS, MACRO, CORPORATE NEWS

- Top Fed officials bolster case for patient stance on rate cuts-BBG

- Goldman pushes back bet on first Fed interest-rate cut to June-BBG

- China’s Central Bank tries to catch markets off guard with surprise easing-BBG

- ECB unlikely to cut interest rates before Fed, Holzmann says-BBG

- Majority on India's rate panel believe current policy appropriate-RTRS

- US money-market funds see second straight week of outflows-BBG

- Global stocks set for gains, not fireworks, in months ahead - Reuters poll-RTRS

- US commercial property foreclosures spike in January-BBG

- German business outlook inches higher but remains gloomy-BBG

- UK consumer confidence falls amid concern over persistent inflation-FT

- New Zealand retail sales drop for eighth straight quarter-BBG

- China’s property foreclosures surge as growth slows-BBG

- China regulator says stocks exchanges do not limit share selling-RTRS

- China recovery bets grow on Beijing’s moves to stem stock rout-BBG

- U.S. export curbs on China won't extend to legacy chips: official-NIKKEI

- Israel unveils plan for complete postwar control of Gaza-FT

- US plans biggest Russia sanction package of two-year war-BBG

- Adnoc’s $30bn chemicals deal with Austria’s OMV stalls-FT

- Nippon Steel’s China assets raise concerns over US deal-BBG

- Air China to sound out advisers on raising Cathay stake, sources say-BBG

- EQT taps banks for $15 billion exit of school chain Nord Anglia-BBG

- GM’s Cruise prepares to resume RoboTaxi testing after suspension-BBG

- Nvidia adds record $277 billion in stock market value-RTRS

- Nvidia pumps option bets in chipmakers as tech extends rally-BBG

- Capital One’s Discover deal includes $1.38 billion breakup fee-BBG

- Reddit's US IPO filing reveals $90.8 million losses, 21% rev growth 2023-RTRS

- AT&T outage caused by software update, company says-ABC

Oil/Energy Headlines: 1) US crude stockpiles rise, products draw on low refining rates – EIA-RTRS 2) Biden grants gasoline shift to boost ethanol in corn belt-BBG 3) Iraq reopens North Refinery in Baiji closed for a decade-RTRS 4) Oil prices rise as signs point to tightening global crude market-CNBC 5) India's Jan oil imports hit record high on Red Sea delays, trade data shows-RTRS 6) Asia's love for non-OPEC+ crudes set to deepen as output expands-PLATTS 7) Iraqi federal court ruling deals another blow to Kurdistan regional government's oil autonomy-PLATTS8) U.S. to impose sanctions on more than 500 Russian targets-NYT

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.