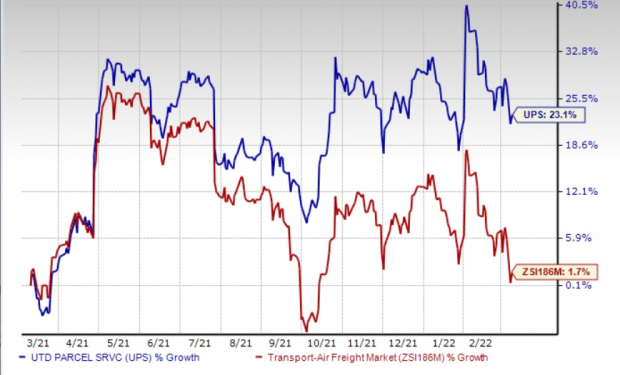

Shares of United Parcel Service UPS have displayed an uptrend on the bourses, gaining 23.1% in a year’s time, outperforming its industry’s 1.7% uptick.

Image Source: Zacks Investment Research

Let’s delve into the reasons for this double-digit price rise and examine if there is any scope for a further upside.

We are encouraged by UPS' solid free cash flow. Even in this coronavirus-hit scenario, UPS generated an impressive free cash flow of $5.1 billion in 2020. In 2021, the amount more than doubled to $10.9 billion. Robust free cash-flow generation by UPS is a major positive and is leading to an uptick in its shareholder-friendly activities. UPS paid out dividends worth $3,437 million in 2021, up 1.9% year over year. Last year, UPS repurchased shares worth $500 million, up 130% year over year. UPS aims to reward its shareholders with $6.2 billion in 2022 through dividends ($5,200 million) and share buybacks ($1,000 million).

Factors like higher shipping rates and upbeat e-commerce demand are also aiding UPS. E-commerce witnessed phenomenal growth in this coronavirus-scarred scenario, which served UPS very well.

We are also impressed with UPS' environmentally-friendly approach. Management aims to ensure that by 2035 all UPS facilities will be powered by renewable electricity. Moreover, 30% of the fuel used in its global air fleet should be sustainable aviation fuel by the same year.

With e-commerce expected to remain strong despite the ramp-up in economic activities, UPS should continue to flourish. UPS expects consolidated revenues of about $102 billion in 2022 (above $97.3 billion reported in 2021), an adjusted operating margin of 13.7% and an adjusted return on invested capital of above 30%. UPS expects to achieve its 2023 targets for consolidated revenues and operating margin in 2022 itself. That the future is bright for UPS is supported by the Zacks Consensus Estimate for 2022 earnings being revised 7.6% upward over the past 60 days.

Zacks Rank & Key Picks

UPS currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks within the broader Transportation sector are as follows:

ArcBest Corporation ARCB carries a Zacks Rank #2 (Buy) at present. ARCB has a stellar earnings surprise history, having outperformed the Zacks Consensus Estimate in each of the preceding four quarters, the average being 31.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Betterment in freight conditions represents a huge positive for ARCB. Shares of ArcBest have increased more than 17% in a year.

J.B. Hunt Transport Services JBHT currently carries a Zacks Rank of 2. JBHT’s earnings surpassed the Zacks Consensus Estimate in each of the preceding four quarters, the average being 10.2%.

BHT’s efforts to reward its shareholders even in the current challenging times are praiseworthy. Shares of J.B. Hunt have rallied more than 26% in a year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Parcel Service, Inc. (UPS): Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT): Free Stock Analysis Report

ArcBest Corporation (ARCB): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.