More than 34 million Americans have diabetes and an additional 88 million are at risk of developing the disease, according to the American Diabetes Association. In this world of data, automation, and availability of information, it's hard to wrap your mind around the idea that roughly 10% of the U.S. population has diabetes and an additional 25% are at risk.

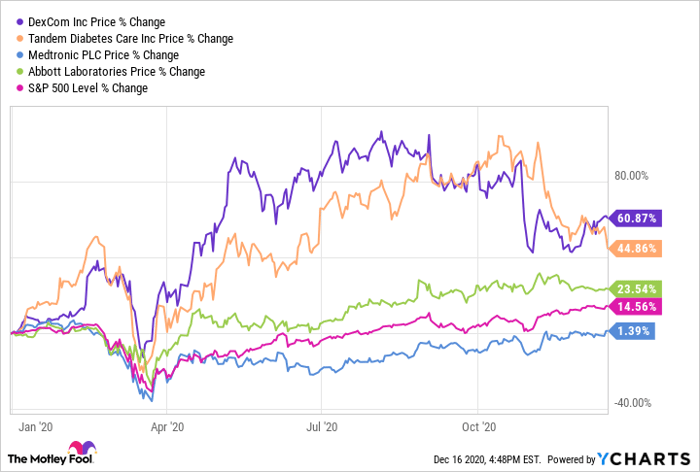

Diabetes is a chronic problem worldwide and there are many companies seeking to help diabetes patients. DexCom (NASDAQ: DXCM), a San Diego-based medical technology company is one that has been disrupting the industry. DexCom's continuous glucose monitoring (CGM) system allows diabetes patients to track their glucose levels via a wearable device that transmits biometrics to a smart device every five minutes. Its stock has risen more than 60% year to date, compared to the S&P 500's growth of nearly 15% over the same period. Over a five-year period, DexCom's stock has increased 344% compared to the broader market which rose 81%.

The question for investors heading into 2021 is whether the good times for DexCom will keep going and if it's a strong buy today.

Image source: Getty Images.

Convenience and comfort make CGMs ideal

Traditional glucose monitoring products are difficult to use and painful, requiring a finger stick from a pricking device. The patient has to carry the testing equipment with them. The convenience of the DexCom sensor is life-altering for patients because of convenience, elimination of pain, and most importantly, real-time glucose levels that can provide insights and analytics. CGM technology has made the finger-stick method obsolete for many patients and its popularity has propelled stocks like DexCom and its competitors higher in recent years.

DexCom is not the only company that sells a CGM system. Abbott Laboratories (NYSE: ABT), Medtronic (NYSE: MDT), and Roche (OTC: RHHBY) all have competing products in their diabetes management businesses. But DexCom's net promoter scores are significantly better than their competitors, meaning the patients utilizing the products prefer the freedom offered by the DexCom G6 CGM.

DexCom introduced the G6 in 2018 and since then, CGMs have become the standard of care for patients with diabetes. The company is actively working on its G7 version, which is in clinical trials. The new product is expected to launch in the second half of 2021. CEO Kevin Sayer said in the Q3 2020 earnings call that the "G7 will be more expensive in the early stages as we're ramping capacity, but at scale, it will be a lower cost profile for us than G6. So, I think there's still quite a bit of a good runway in front of us."

Partnership strategy and other advantages

Management has been astute by partnering with Apple (NASDAQ: AAPL), Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), as well as with Tandem Diabetes Care (NASDAQ: TNDM). Tandem utilizes DexCom's G6 CGM in its t:slim X2 insulin pump device which is widely used by diabetes patients. DexCom's CEO has an 87% approval rating on Glassdoor, showing employees have confidence in the company's leader.

DexCom's Q3 revenue was $501 million and revenue growth was 26% year over year, despite headwinds from the COVID-19 pandemic. The company has been disrupting the diabetes market for years and G7 should have a significantly positive impact as the company reduces manufacturing costs and drives penetration into the type 2 diabetes market. Most of DexCom's patients have type 1 diabetes but this is changing as the cost of sensors improves and insurance companies include CGM devices in their coverage. DexCom's market penetration in the U.S. for type 1 diabetes is 40% and just 15% for type 2 diabetes, which represents a large future opportunity for the company.

While DexCom continues to rapidly grow in the U.S., it has ample global opportunity. Management is working to develop a strategy for growth in international markets and believes that awareness and sharing CGM technology will help it win more patients.

The other advantage that DexCom has over its competitors is the ability to allocate higher research and development spend to innovate. Its larger and more diversified competitors have to allocate resources across a plethora of competing opportunities, hence R&D spending tends to be lacking.

Is DexCom a buy today?

With the disruptive technology of a small monitoring device, a diabetes patient has seamless monitoring of their glucose levels to their smart device. This technology will continue to drive growth for healthcare companies that recognize the way people want to live vs. traditional devices that are large and cumbersome. DexCom will be a company to watch for many years to come as it continues to innovate and drive smaller and smarter devices for patients.

DexCom thumped the market in 2020 and outpaced all its competitors. This is definitely a company deserving of future investment consideration for all kinds of investors. With continued innovation and new product introductions on the horizon, DexCom is a healthcare stock that should continue to beat the market for many years.

10 stocks we like better than DexCom

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and DexCom wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of November 20, 2020

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Jonathan Waldron owns shares of Apple and Tandem Diabetes Care. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), and Apple. The Motley Fool recommends DexCom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.