On March 7, 2023 at 13:15:56 ET an unusually large $5,347.89K block of Put contracts in Microsoft (MSFT) was bought, with a strike price of $260.00 / share, expiring in 17 days (on March 24, 2023). Fintel tracks all large options trades, and the premium spent on this trade was 3.16 sigmas above the mean, placing it in the 99.97 percentile of all recent large trades made in MSFT options.

This trade was first picked up on Fintel's real time Options Flow tool, where all large block option trades are tracked.

Analyst Price Forecast Suggests 13.52% Upside

As of March 7, 2023, the average one-year price target for Microsoft is $291.61. The forecasts range from a low of $214.12 to a high of $365.40. The average price target represents an increase of 13.52% from its latest reported closing price of $256.87.

What is the Fund Sentiment?

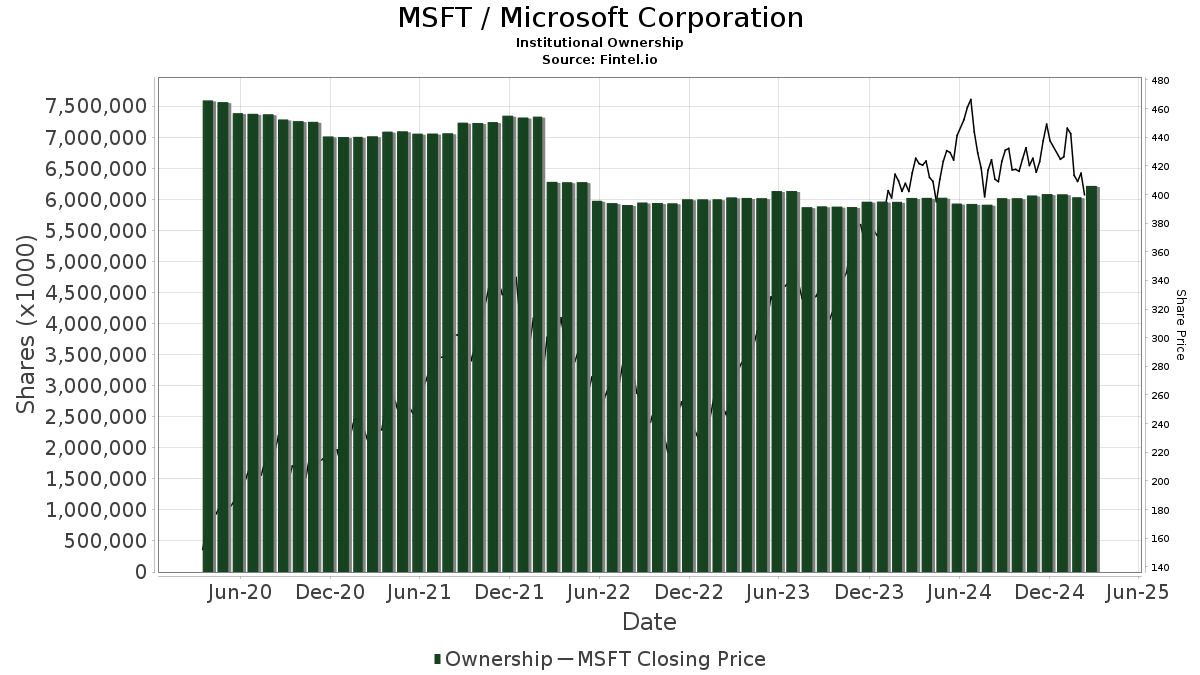

There are 6947 funds or institutions reporting positions in Microsoft. This is an increase of 171 owner(s) or 2.52% in the last quarter. Average portfolio weight of all funds dedicated to MSFT is 2.84%, a decrease of 16.12%. Total shares owned by institutions increased in the last three months by 0.50% to 6,029,037K shares. The put/call ratio of MSFT is 0.85, indicating a bullish outlook.

What are large shareholders doing?

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 226,595K shares representing 3.04% ownership of the company. In it's prior filing, the firm reported owning 222,314K shares, representing an increase of 1.89%. The firm decreased its portfolio allocation in MSFT by 3.08% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 172,327K shares representing 2.32% ownership of the company. In it's prior filing, the firm reported owning 169,063K shares, representing an increase of 1.89%. The firm decreased its portfolio allocation in MSFT by 3.31% over the last quarter.

Price T Rowe Associates holds 168,647K shares representing 2.27% ownership of the company. In it's prior filing, the firm reported owning 171,347K shares, representing a decrease of 1.60%. The firm decreased its portfolio allocation in MSFT by 0.93% over the last quarter.

Geode Capital Management holds 142,731K shares representing 1.92% ownership of the company. In it's prior filing, the firm reported owning 139,462K shares, representing an increase of 2.29%. The firm decreased its portfolio allocation in MSFT by 2.57% over the last quarter.

Jpmorgan Chase & holds 93,021K shares representing 1.25% ownership of the company. In it's prior filing, the firm reported owning 92,745K shares, representing an increase of 0.30%. The firm decreased its portfolio allocation in MSFT by 5.19% over the last quarter.

Microsoft Background Information

(This description is provided by the company.)

Microsoft enables digital transformation for the era of an intelligent cloud and an intelligent edge. Its mission is to empower every person and every organization on the planet to achieve more.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.