A Review of Unusual Options Activity in Under Armour, Inc. (UA)

Yesterday, February 23, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Under Armour (UA), which opened at $13.42.

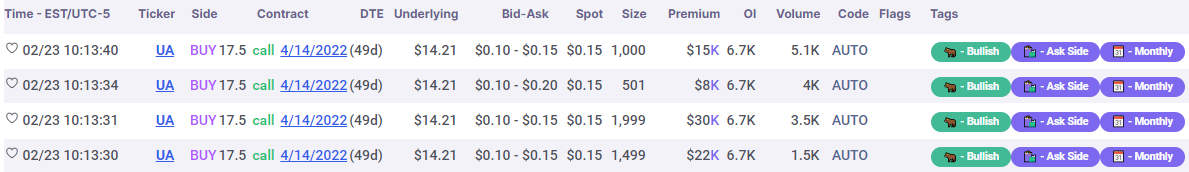

- There were a series of orders on the $17.5 call options dated for April 14, 2022; however, these orders were not sized above the open interest on the chain, which was 5,247 and the total volume yesterday was 5,247 contracts traded.

- Into today, the open interest increased to 11,819, implying the traders bought or sold to open these contracts yesterday, not closed.

- This is a shining example of when volume below open interest cannot reveal whether contacts were opened or closed, and the open interest into the next day always has to be investigated.

- Furthermore, these orders came prior to Under Armour authorizing a $500 million share repurchase program yesterday after the market closed.

Seen above are the noteworthy options in Under Armour from the Unusual Whales hottest chains page.

Additionally, these orders come after BNK Invest reported that Under Armour is now oversold.

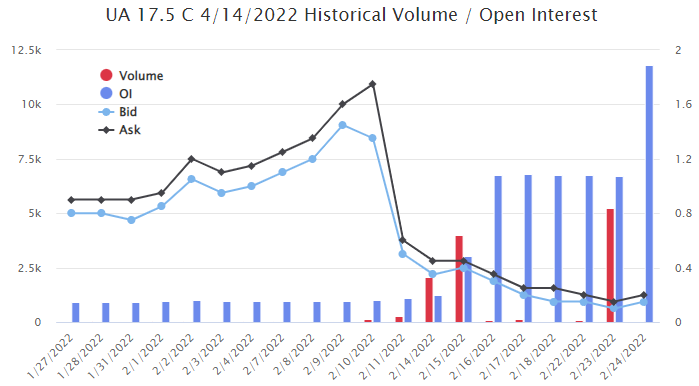

Seen above is the aforementioned chain’s historical volume, in red, and open interest, in blue, as bar charts behind the requisite bid and ask, in a light blue and darker shade, respectively.

As seen, the volume yesterday, in red, effectively added to the open interest, in blue; therefore, we can surmise that the traders yesterday opened these contracts into today, again ahead of the share repurchase program announcement.

To view more information about UA's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in PG&E Corporation (PCG)

Today, February 24, 2022, again in the NYSE, we saw unusual activity in PG&E Corporation (PCG), which opened today at $10.60.

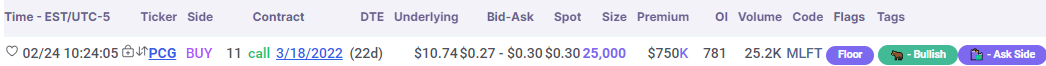

- There were 25,000 contracts traded on the $11 strike call option dated for March 18, 2022, bought to open at the ask of $0.30 with a bid-ask spread of $0.27 to $0.30.

- Additionally, these orders come after PG&E reported fourth-quarter 2021 adjusted earnings of 76 cents per share, which surpassed the Zacks Consensus Estimate of 70 cents by 8.6%.

Seen above are the noteworthy options in PG&E from the Unusual Whales flow.

A tip from the flow: Trades appended with the ↕ emoji are trades that have potentially came in together as a part of a strategy, and are coded accordingly as MLET or MLFT, under the codes column. Clicking on that emoji will open all of the trades that came in together so that the holistic strategy may be investigated.

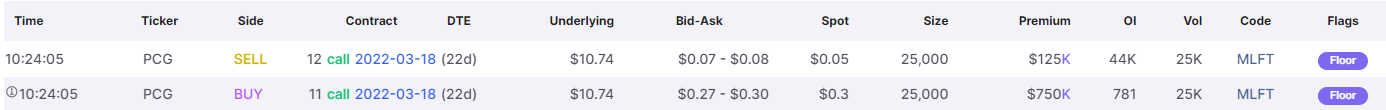

- By opening the possibly related trades, it can be seen that these orders came in with an additional 25,000 contracts traded on the $12 strike call option, for the same expiration of March 18, 2022, traded at a spot price of $0.05 with a bid-ask spread of $0.07 to $0.08.

- However, the open interest on this chain was approximately 44K as of this morning’s open, so it cannot be clarified until tomorrow as to whether this is a trader rolling down their $12 strike calls to $11s, or opening a call debit spread.

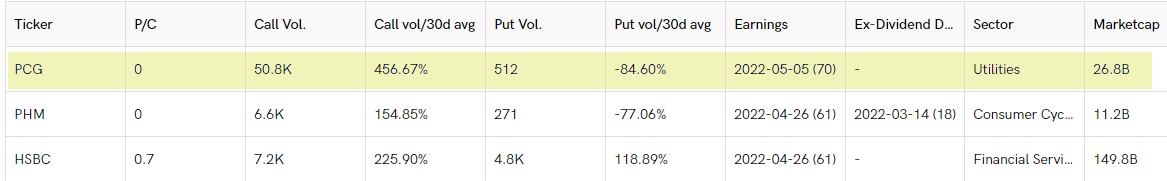

Seen above are the noteworthy options in PG&E from the NEW Unusual Whales tickers flow tool.

Furthermore, these options were detected using the NEW Unusual Whales tickers flow tool. As can be seen, calls are now 456.67% greater than their 30 day average.

To view more information about PCG's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Ford Motor Company (F)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Ford Motor Company (F), which opened today at $15.99.

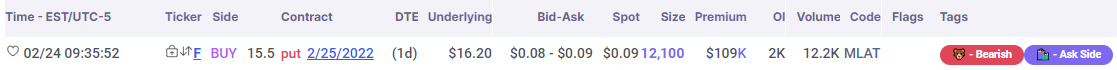

- There were 12,100 contracts traded on the $15.5 strike put option bought to open at the ask of $0.09 with a bid-ask spread of $0.08 to $0.09, amounting to approximately $109K in premium.

- These contracts are -4.32% out of the money from Ford’s current trading price.

- These orders come after Ford announced it had no plans to spin off EV or gasoline-powered vehicle businesses.

Seen above are the noteworthy options in Ford from the Unusual Whales flow.

As with the previous reported orders, these contracts were traded alongside others, visible by clicking the ↕ emoji:

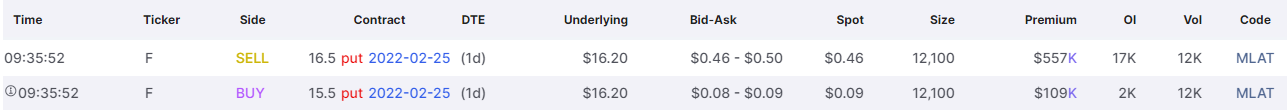

Seen above are the noteworthy options in Ford from the Unusual Whales flow.

- There were an additional 12,100 contracts traded on the $16.5 strike put options, for the same date, however the open interest on this chain was approximately 17K, so it cannot be known as to whether these were to open or to close.

- Given these contracts expire tomorrow and they are coupled with the out of the money positions, it cannot be clearly established whether they are a roll or a put credit spread.

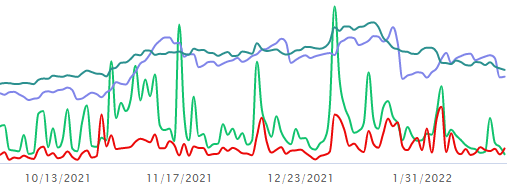

The chart above represents Ford’s historical price in cyan, call volume in green, put volume in red, and open interest in blue.

As of this writing, Ford has had 173,965 puts traded and has a put-call ratio of 1.66, which is bearish.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish.

To view more information about F's flow breakdown, click here to visit unusualwhales.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.