Unusual Options Activity in Kohl's Corporation (KSS)

Today, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Kohl's Corporation (KSS), which opened at $47.19.

There were three orders each sized at 7,750 contracts a piece, representing approximately 1,550,000 shares.

These orders were: $57.5 strike call options at the ask and $67.5 strike call options at the bid both dated for November 19th, 2021; these orders, if entered together, would be a vertical call debit spread costing approximately $0.74 at the time of entry.

Seen above are the noteworthy options orders in Kohl's Corporation from the Unusual Whales Flow.

These orders come after reports revealing that Bank of America, who was formerly bullish on the retailer, with a $75 price target and a buy rating on the stock, has slashed its price target on Kohl's to $48, and downgraded the stock to underperform.

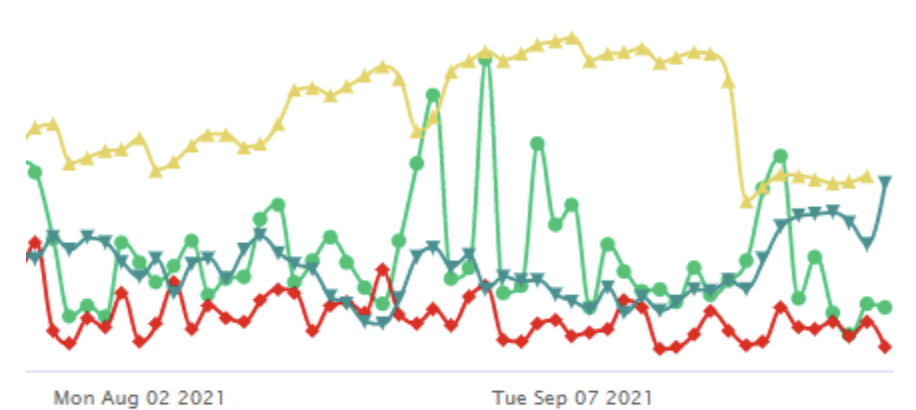

The charts above represent Kohl's Corporation’s historical price in blue, call volume in green, put volume in red, and open interest in yellow. Yesterday, KSS had a high of 26,822 call volume, and today it has reached 22,681 again at the time of this writing, and its price has rallied to $48.10.

To view more information about KSS's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Southwest Airlines Co. (LUV)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Southwest Airlines Co. (LUV), which opened today at $53.77.

There were 1,492 contracts bought at the ask on the $52.5 strike call option dated for November 19th, 2021, representing 149,200 shares.

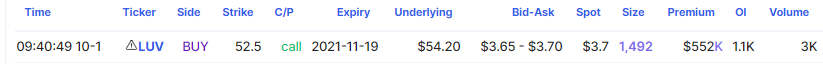

Seen above are the noteworthy options orders in Southwest Airlines Co. from the Unusual Whales Flow.

These orders come after reports from the Motley Fool regarding investors’ continued excitement on airline stocks in spite of lowered guidance: ”If you're invested in any of these stocks [$UAL, $DAL, $SAVE, $JBLU, $LUV] in particular, I'd say Delta or Southwest, I would definitely sit tight.”

The charts above represent Southwest Airlines Co. ’s historical price in blue, call volume in green, put volume in red, and open interest in yellow. Yesterday, LUV’s price had reached a local bottom at $51.43, with calls rising to 13,453; today, LUV is at $54.54 and, as of this writing, calls are at 12,930, with a continuation of the trend.

To view more information about LUV's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Merck & Co., Inc. (MRK)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Merck & Co., Inc. (MRK), which opened at $81.56.

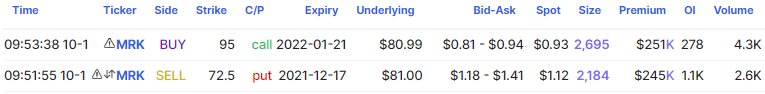

There were 2,695 contracts bought at the ask on the $95 strike call option dated for January 21st, 2022, representing 269,500 shares.

Additionally, there were 2,184 contracts sold at the bid on the $72.5 strike put option dated for December 17th, 2021, representing an additional 218,400 shares.

Seen above are the noteworthy options orders in Merck & Co., Inc. from the Unusual Whales Flow.

These order comes after reports from before market open today that the company announced that its oral antiviral medication molnupiravir -- developed in conjunction with Ridgeback Biotherapeutics -- cut the risk of hospitalization for COVID-19 by half.

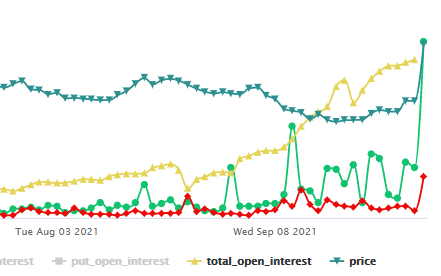

The charts above represent Merck & Co., Inc. ’s historical price in blue, call volume in green, put volume in red, and open interest in yellow. Yesterday, MRK’s price was $75.11, and today has climbed to $84.34, with calls rising to 215,244 from 61,953 yesterday; this increase in calls represents a 639% increase over MRK’s 30-day call volume average.

To view more information about MRK's flow breakdown, click here to visit unusualwhales.com.

For further information on the unusual options activity of KSS, LUV, and MRK visit unusualwhales.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.